S&P Global and Chainlink Team Up to Bring Stablecoin Risk Data to DeFi

S&P Global Ratings is entering the blockchain era by bringing its stablecoin stability assessments directly onchain through a new partnership with Chainlink, the leading decentralized oracle network.

The collaboration aims to make S&P’s risk evaluations for stablecoins instantly accessible to DeFi protocols, smart contracts, and digital financial platforms.

According to a press release, the integration allows decentralized systems to reference S&P’s ratings in real time — marking a major step toward bridging traditional finance with onchain transparency and automation.

S&P Global Ratings Go Onchain

S&P’s stablecoin stability assessments assign scores from 1 to 5, gauging a token’s ability to maintain parity with fiat currencies such as the U.S. dollar. The evaluations consider asset quality, liquidity, redemption mechanisms, regulatory compliance, and governance structure.

Also read: Sergey Nazarov Says Chainlink Talks With Trump Agencies Go Beyond Commerce

Currently, S&P analyzes 10 major stablecoins, including market leaders USDT, USDC, and Sky Protocol’s USDS/DAI. These assessments differ from credit ratings — focusing not on issuer creditworthiness, but rather on the operational and structural soundness of the stablecoin itself.

By placing these evaluations onchain, S&P enables instant and trustless access to risk data, removing the need for intermediaries or manual data feeds. DeFi protocols can now automatically integrate the latest stability assessments into lending, trading, and collateralization mechanisms.

Powered by Chainlink’s DataLink Infrastructure

The onchain deployment is facilitated by Chainlink’s DataLink, a secure infrastructure that allows traditional data providers to publish verified information directly to blockchains. This innovation eliminates the need for S&P to build new blockchain systems from scratch.

The service will first launch on Base, Coinbase’s Ethereum Layer-2 network, with expansions to other blockchains planned based on user demand.

Also read: Chainlink Growth Spikes With 14 Integrations — Can LINK Price Follow?

A Sign of Crypto’s Growing Institutional Integration

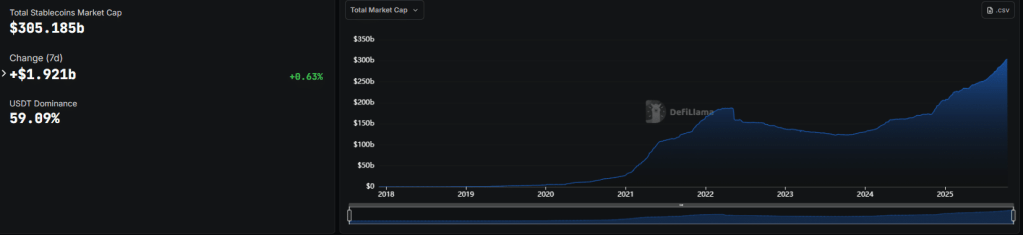

The move comes amid a resurgence in the stablecoin sector, which has swelled to $305 billion in market capitalization, more than doubling from $130 billion a year ago, according to DeFiLlama.

Stablecoin market cap (Source: DefiLlama)

S&P Global has been steadily deepening its involvement in digital assets since 2021 — launching crypto indices, issuing risk assessments for tokenized funds, and, most recently, providing credit ratings for DeFi protocols. Its first-ever DeFi credit rating was assigned in August, signaling growing institutional confidence in blockchain-based finance.

This latest integration demonstrates how traditional financial intelligence providers are converging with blockchain infrastructure, making real-time, verifiable data a native component of decentralized markets.