Wall Street Bets on Ethereum: Sharplink Profits $500M While BitMine Buys $827M More ETH

Even after one of the sharpest weekend drawdowns in months, SharpLink said its Ethereum (ETH) position remains up by more than $500 million since launching its onchain treasury strategy in June.

“Our approach is built on discipline, transparency, and yield-bearing productivity,†the company said in an X post on Monday, adding that this is “what institutional-grade, onchain treasury management looks like.â€

The tweet ended with a firm declaration of conviction: “The asset is $ETH, the ticker is $SBET.â€

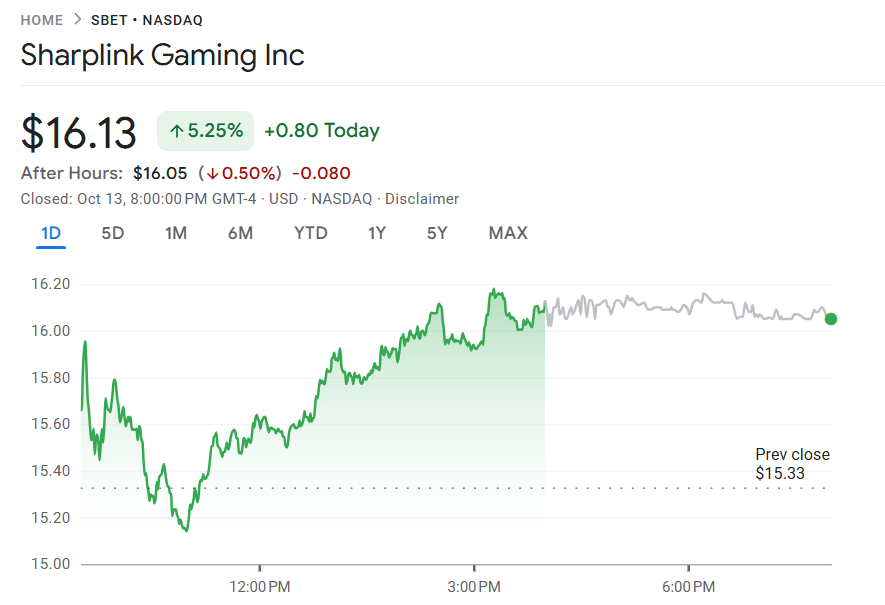

SharpLink Gaming share price (Source: Google Finance)

That confidence — echoed by BitMine’s massive Ether accumulation during the crash — paints a clear picture of how institutional players are reshaping Ethereum’s role in corporate finance.

Sharplink’s $500M Ethereum Treasury Strategy

SharpLink’s public statement reflects a growing shift among institutional players embracing Ethereum as a yield-generating, transparent treasury asset rather than a purely speculative investment.

Since June, the company’s ETH position has not only withstood major market fluctuations but has also generated over half a billion dollars in unrealized gains.

The strategy, according to SharpLink, is rooted in onchain discipline — emphasizing real-time transparency, productivity through staking and yield-bearing protocols, and risk-adjusted exposure that can weather market downturns.

For institutional investors, that approach is rapidly becoming a model for modern crypto treasury management.

Ethereum’s liquid staking ecosystem, combined with Layer-2 scaling and onchain credit markets, allows corporates to hold ETH productively — a stark contrast to the static treasuries seen in the early days of corporate crypto adoption.

SharpLink’s performance also demonstrates that Ethereum’s financial utility extends beyond speculation. By anchoring its balance sheet in ETH, the company is showing how tokenized assets and smart contracts can deliver measurable, real-world productivity for institutional portfolios.

BitMine “Buys the Dip†With $827M in Ether Accumulation

While SharpLink’s gains highlighted Ethereum’s resilience, BitMine — the world’s largest corporate Ether holder — made an even bolder statement.

The firm used the weekend’s crash to buy the dip, adding 202,037 ETH worth roughly $827 million, according to an X post shared on Monday.

BitMine said it acted “more aggressively†amid the market turmoil, pushing its total holdings past 3 million ETH, or around 2.5% of the cryptocurrency’s total circulating supply. The company’s average purchase price was $4,154 per token, signaling strong conviction in Ethereum’s long-term value.

In total, BitMine now controls $13.4 billion in assets, including $12.9 billion in crypto and moonshot investments, 192 Bitcoin (BTC), $104 million in cash, and a $135 million stake in Nasdaq-listed Eightco Holdings.

Chairman Tom Lee, who also serves as head of research at Fundstrat Global Advisors, said the firm is now “more than halfway†toward its treasury goal of owning 5% of Ethereum’s total supply.

“The crypto liquidation over the past few days created a price decline in ETH, which BitMine took advantage of,†Lee said.

“Volatility creates deleveraging, and this can cause assets to trade at substantial discounts to fundamentals — or as we say, ‘substantial discount to the future.’â€

Lee’s comments underscore a crucial insight: volatility in crypto markets, far from being a deterrent, is increasingly viewed by institutional treasuries as a buying opportunity. For disciplined actors like BitMine, these sharp corrections are moments of accumulation, not panic.

Ethereum as the Backbone of Institutional-Grade Onchain Finance

The contrasting yet complementary moves by SharpLink and BitMine point to a broader institutional narrative — one that sees Ethereum as the foundation of a new, productive financial layer.

Ethereum’s transition to proof-of-stake and its ecosystem of yield-bearing assets have made it an attractive choice for corporations looking to deploy idle capital efficiently. Instead of holding nonproductive cash or volatile equities, companies can now earn real onchain yield while maintaining transparency through verifiable blockchain transactions.

This transformation is accelerating the institutionalization of decentralized finance (DeFi). Where early adopters like Tesla and Strategy once leaned heavily on Bitcoin as a treasury reserve asset, the next wave of corporate accumulation is increasingly focused on Ethereum — not just as a store of value, but as an income-generating digital infrastructure asset.

BitMine’s Stock Activity Reflects Growing Market Interest

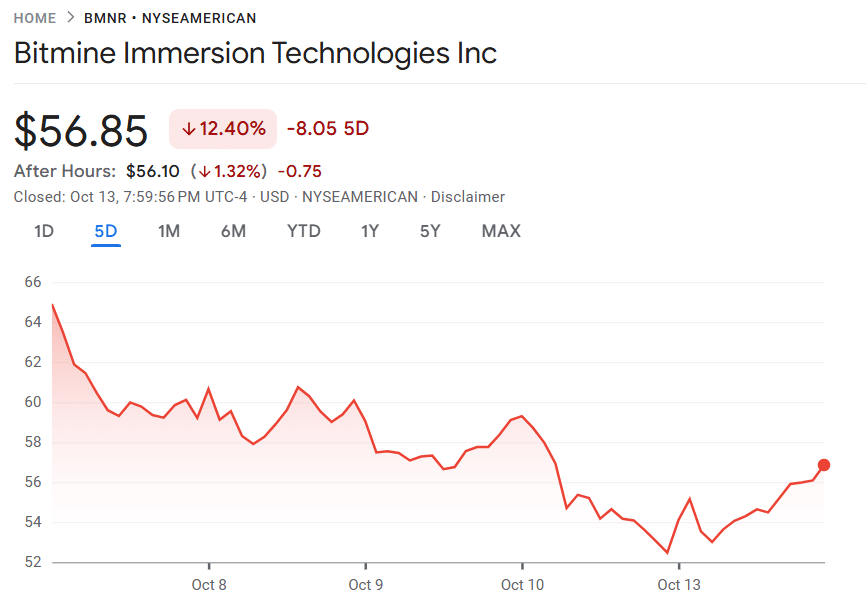

Beyond its crypto holdings, BitMine’s stock (BMNR) has become one of the most widely traded equities in the U.S. market. The company ranked 22nd in average five-day trading volume at over $3.5 billion, reflecting heightened investor attention to corporate entities with deep crypto exposure.

However, BMNR’s share price has seen volatility of its own, dropping 12% over the past week after Kerrisdale Capital announced a short position, criticizing BitMine’s business model as being “on its way to extinction.†Despite the short-term pressure, analysts suggest that institutional buying during market corrections could strengthen the firm’s long-term fundamentals.

BitMine share price (Source: Google Finance)

As Lee put it, volatility creates opportunity, and BitMine’s actions suggest that institutional players are prepared to endure near-term pain for future positioning.

Institutional Confidence in Ethereum Grows

Together, SharpLink’s profitable treasury management and BitMine’s aggressive accumulation illustrate a resounding vote of confidence in Ethereum’s future.

While the broader crypto market endured nearly $19 billion in liquidations over the weekend, Ethereum’s role as a productive, yield-generating, and institutionally credible asset remains stronger than ever.

Ethereum’s ability to maintain liquidity, support onchain yield strategies, and power tokenized financial systems continues to position it as the backbone of digital finance. The message from both companies is clear: volatility may shake out traders, but disciplined institutional treasuries are here to accumulate — and to build.