Best Crypto to Buy Now as Flash Crash Shakes the Market

The crypto market just lived through one of those days that will be remembered for years.

On Oct. 10, 2025, everything fell apart in minutes. President Trump’s announcement of new 100% tariffs on Chinese imports sent shockwaves through global markets, and crypto was hit hardest.

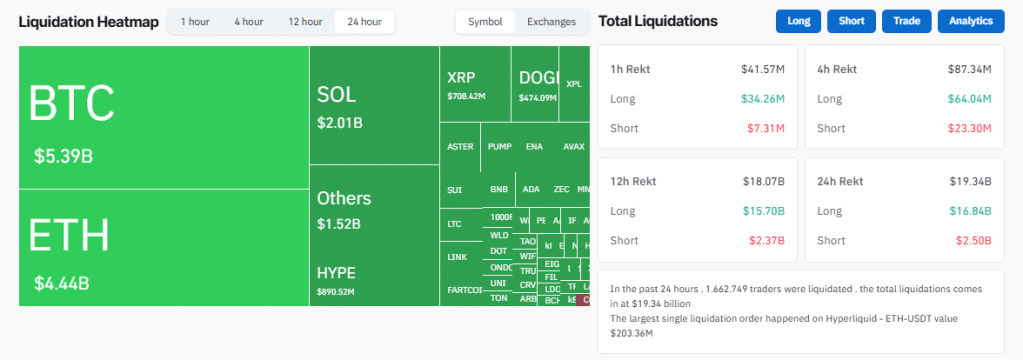

In under an hour, over $6 billion in leveraged positions were liquidated, wiping out close to $1 trillion in market value. Bitcoin plunged from around $122,000 to below $110,000, while Ethereum, Solana, and XRP collapsed between 15% and 30%.

Crypto liquidations (Source: Coinglass)

Some smaller tokens saw catastrophic 90% drops intraday as well.

It was the kind of chaos that only crypto can deliver — cascading liquidations, thin liquidity, and algorithms feeding panic. Yet, amid the wreckage, a familiar narrative began to emerge: buy the dip. As such, we turned to Grok to find the best crypto to buy now.

Grok Calls It a Market “Reset,” Not a Collapse

While many traders were licking their wounds, Grok offered a surprisingly optimistic take.

The AI described the crash not as the end of the bull market, but as a “reset” — a necessary purge of over-leveraged positions that could actually make the next leg of the rally more sustainable.

“More dips are possible if uncertainty persists,” Grok said, “but strong hands are already accumulating.”

It wasn’t blind optimism, though. Grok warned that volatility might stick around as macro tensions — tariffs, inflation, and interest-rate anxiety — continue to shape sentiment. But beneath that caution was a clear message: this sell-off could mark the kind of clean-up event that precedes powerful rebounds.

The Best Crypto to Buy After the Crash

When it came to the best crypto to buy, Grok’s guidance was surprisingly old-school. It wasn’t about chasing the flashiest tokens or memecoins — it was about returning to strength and fundamentals.

Bitcoin (BTC)

According to Grok, Bitcoin remains the “core anchor” of the market. It’s where institutional inflows are most likely to return once the fear fades.

Every past leverage purge, Grok noted, has eventually been followed by a BTC-led recovery — and this one might be no different.

Ethereum (ETH)

Ethereum came in as the second pillar of the post-crash playbook.

Grok highlighted ETH’s strong DeFi foundations and the continued momentum from its ETF approvals, suggesting it could lead the next altcoin rally once volatility cools off.

Solana (SOL) and XRP

Two names that stood out in Grok’s commentary were Solana and XRP.

Solana has been one of the few layer-1s showing “relative strength” even during heavy selling, thanks to its thriving memecoin and NFT ecosystems. XRP, meanwhile, remains a contrarian bet — regulatory clarity, cross-border utility, and growing ETF speculation make it one of the more undervalued large-caps on the board.

Grok’s Take on Altcoins and the “Smart Risk” Zone

Beyond the top players, Grok identified a few mid-to-large caps that could outperform if the market stabilizes.

Avalanche (AVAX) and Chainlink (LINK) topped that list — the first for its expanding ecosystem and scalability narrative, the second for its oracle dominance and DeFi integration.

Other mentions included Injective (INJ), Stellar (XLM), and Sui (SUI) — all showing signs of undervaluation and active accumulation by traders who survived the crash. These are, in Grok’s view, “smart risk” plays — assets with strong fundamentals that could deliver asymmetric returns once confidence returns.

Also read: Top Altcoins for 2025: Best Cryptos To Watch

The Wild Card: Memecoins and Momentum Trades

Of course, it wouldn’t be crypto without the high-risk side of the spectrum.

Grok acknowledged the renewed interest in Solana-based memecoins like Michi, Popcat, and Pepe. Some traders see them as prime rebound candidates, capable of 10x moves in short bursts once liquidity returns.

But Grok’s warning was clear: these are not investments; they’re trades. They thrive on volatility, sentiment, and community hype. Anyone buying them should do so with money they can afford to lose — and without expecting stability anytime soon.

Grok’s Playbook: Accumulate, Don’t Overleverage

Perhaps Grok’s most important message wasn’t about which coins to buy, but how to buy them.

The AI urged traders to avoid leverage for now, focus on spot accumulation, and wait for confirmation of market stabilization. “The field has been cleared,” Grok observed, “and now the next leg belongs to those who didn’t get liquidated.”

It’s the same philosophy that separates experienced investors from emotional traders. Grok framed the current environment as an opportunity to accumulate strength, not chase volatility — to focus on coins that can survive another crash rather than those that need perfect timing to profit.

Final Thoughts: Survive First, Then Thrive

So, what’s the best crypto to buy right now?

If you follow Grok’s logic, it’s the one you believe in enough to hold through the next storm. Bitcoin and Ethereum remain the foundation of any solid strategy.

Solana and XRP offer growth potential with proven ecosystems. And for those with a taste for risk, selective exposure to strong altcoins or memecoins could amplify returns — if timed carefully.

The October flash crash was brutal, but it wasn’t the end.

Every major crypto rally has started from the same place: fear, forced selling, and disbelief. Grok’s message cuts through the chaos with calm precision — this isn’t the apocalypse; it’s the reset before the next run.

Disclaimer: The information in this article is provided for educational and informational purposes only and should not be considered financial or investment advice. Cryptocurrency markets are highly volatile and involve significant risk. Always conduct your own research before making investment decisions. Ecoinimist and its contributors are not responsible for any financial losses resulting from actions taken based on this content.