Gold Rally May Fizzle as Bitcoin Eyes Next Rotation, Says Coin Bureau Co-Founder

Gold’s stunning rally in 2025 — now up more than 50% year-to-date — may be showing signs of overheating, according to Nic Puckrin, investment analyst and co-founder of The Coin Bureau. He warns that the precious metal’s meteoric rise is beginning to resemble a momentum-driven trade rather than a fundamentally supported one.

Gold price (Source: TradingView)

“Gold’s record run is fuelling fresh price projections, with Goldman Sachs now expecting the shiny metal to reach $4,900 by next December,” Puckrin said in a statement to Ecoinimist.

“But investors should remember that this is what often happens when a trade gets overheated. Gold’s surge is now as much a momentum trade as anything else, and momentum trades have a tendency to fizzle out.”

While Puckrin acknowledged that gold could continue outperforming for a while, he cautioned that the market is becoming “a crowded trade,” increasing the risks of entering new positions at current levels.

Bitcoin and Tokenized Real Assets Seen as Undervalued

As investors search for alternative hedges against inflation and currency debasement, Puckrin pointed to other assets that may offer better long-term opportunities.

“These include other metals and commodities, tokenized real assets, and Bitcoin, which remain undervalued against gold,” he said.

“These alternative assets can all play a similar role in portfolios – a hedge against future inflation and political intervention, and an alternative to the US dollar and other debasing currencies.”

The Coin Bureau co-founder believes Bitcoin’s scarcity, liquidity, and decentralization make it a particularly attractive option as gold’s rally matures. In his view, the rotation toward digital assets could define the next phase of capital movement through the remainder of 2025.

“Even if gold’s rally does continue unabated to Goldman Sachs’ 2026 year-end target, other assets are already playing catch-up,” Puckrin added.

“This shift may well become the dominant narrative for the remainder of 2025 as gold takes a breather.”

Also read: Wall Street Blesses Bitcoin in Major Morgan Stanley Update

Crypto Investment Products Hit Record $48.67 Billion in 2025

Puckrin’s comments come as institutional demand for Bitcoin and crypto-linked products continues to surge.

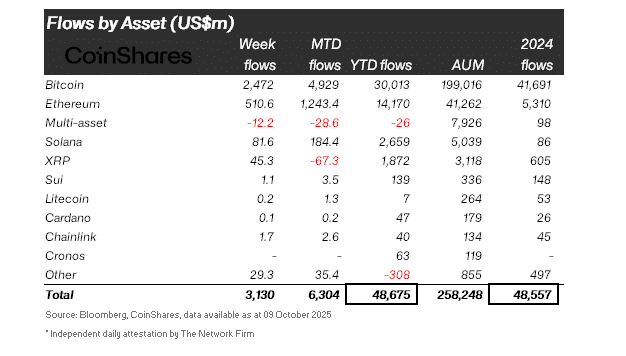

According to CoinShares head of research James Butterfill, global crypto exchange-traded products (ETPs) have attracted $48.67 billion in inflows year-to-date, surpassing the total for all of 2024.

Crypto ETP flows by asset YTD versus 2024 inflows (Source: X)

Bitcoin remains the dominant asset in this landscape, accounting for roughly 62% of all ETP inflows — about $30 billion so far in 2025. However, this marks a decline from its 86% dominance in 2024, as Ethereum, Solana, and XRP funds gain traction among investors seeking diversification.

Ether-based products have surged ahead this year, amassing $14.1 billion in inflows, nearly tripling 2024’s totals. Solana and XRP have also seen significant gains, with YTD inflows of $2.7 billion and $1.9 billion, respectively.

This institutional appetite reflects the broader narrative of digital asset maturity, with investors increasingly viewing Bitcoin as “digital gold” — a scarce, non-sovereign asset that can complement or even outperform traditional safe havens like bullion.

Bitcoin’s “Digital Gold” Narrative Strengthens

The record-breaking inflows into Bitcoin ETPs and Puckrin’s comments together show a potential shift in market psychology. As gold’s momentum begins to cool, Bitcoin could emerge as the preferred inflation hedge for a new generation of investors.

The rise of tokenized real assets — from on-chain gold to U.S. Treasuries — also reinforces this transition, allowing investors to access traditionally illiquid stores of value through blockchain rails. Combined, these trends point to a broad rotation from physical to digital alternatives.

If Puckrin’s thesis proves correct, the closing months of 2025 could mark a critical turning point: one where Bitcoin reclaims center stage as global investors seek the next asymmetric trade in the face of monetary debasement, regulatory uncertainty, and shifting macro dynamics.