“Solana Is the New Wall Street” — Price Tests $233 Resistance

Solana has rallied strongly in recent sessions, climbing back toward the $233 level and sparking renewed debate over its role in the crypto ecosystem.

The momentum comes as Bitwise CIO Matt Hougan labeled Solana “the new Wall Street,” highlighting its fast settlement speeds and growing role in financial infrastructure.

Hougan’s statement adds fuel to the bullish narrative surrounding Solana. By comparing the blockchain to Wall Street itself, he underscored its potential to serve as a global financial hub, particularly for high-frequency trading and tokenized assets. This public endorsement has given traders fresh conviction as SOL approaches a key resistance cluster.

Solana Price Technical Overview

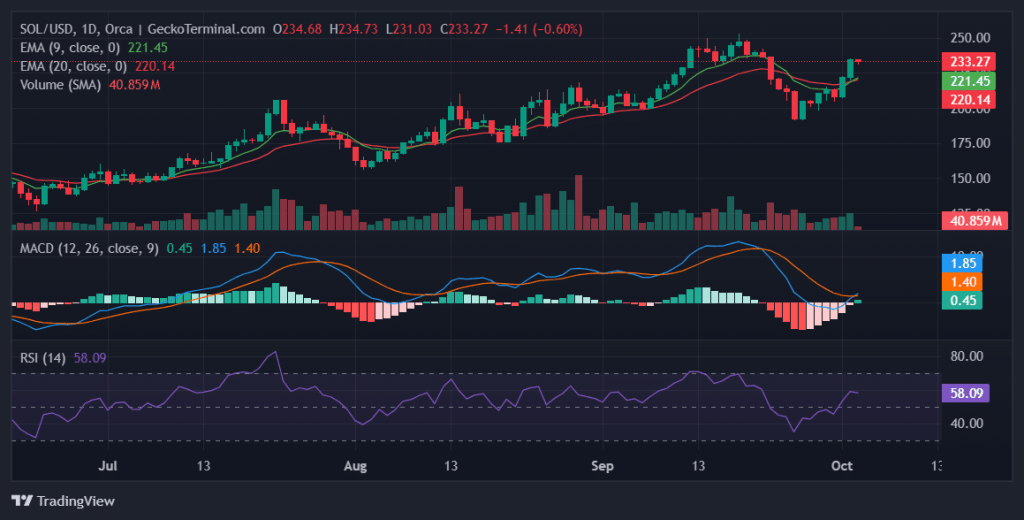

On the charts, Solana has shifted into a more constructive phase. The 9-day EMA has crossed above the 20-day EMA, showing that short-term momentum is back in the hands of buyers. Meanwhile, the MACD has flipped into bullish territory after weeks of negative readings, reinforcing the idea that selling pressure has faded. The RSI, now in the high 50s, suggests improving strength without overheating conditions.

Daily chart for SOL/USD (Source: GeckoTerminal)

This technical setup leaves room for further upside if Solana can overcome near-term resistance.

Resistance and Support Levels

Price action is converging on critical resistance at $238. Beyond that, the next ceilings sit at $247 and $256, levels that would cement Solana’s bullish breakout if cleared. Support lies close by at $230, followed by $225 and $213, which will be important to watch if momentum falters.

Meanwhile, the order book shows heavy ask walls standing in the way of immediate upside. At $235, $236, and especially $240, there are thick clusters of sell orders. Clearing the $240 wall — over 11,000 units valued above $2.7 million — could trigger a swift rally toward $247. On the flip side, bid walls near $225–$227 provide strong buyer defense. If these were to break, however, SOL could see a sharp retracement of 3–4%.

Solana Trading Outlook

The combination of bullish momentum, strong support below, and influential commentary from Bitwise is creating a favorable backdrop for Solana. Long traders may look to enter on dips toward $226–$230, with targets near $238 and $247. Bears may attempt to fade rallies into the $236–$240 zone, but a breakout above $240 would invalidate that thesis and open the door to higher levels.

Hougan’s “new Wall Street” remark underscores a bigger picture: Solana is no longer just a high-speed blockchain but increasingly viewed as a core piece of future financial infrastructure. This narrative could provide the fundamental tailwind needed to propel SOL past its near-term technical hurdles.

Disclaimer: The information presented in this article is for informational and educational purposes only. It does not constitute financial advice. Ecoinimist is not responsible for any losses incurred. Readers should exercise caution before acting on this content.