Crypto Trends to Watch in 2026, According to Grok AI

If there’s one thing we’ve learned about the digital asset space, it’s that the only constant is change.

Every cycle brings new narratives, new technologies, and new ways for investors to capture upside. Heading into 2026, crypto trends are already shaping up to be some of the most exciting in years.

Recently, Grok AI shared its own perspective on what’s next, saying: “Based on current market analyses, macroeconomic shifts, and ecosystem developments as of mid-2025, here are five crypto trends I anticipate will deliveral significant growth and adoption in 2026.”

Let’s unpack those predictions and explore why they matter for traders, investors, and everyday crypto users.

Tokenization of Real-World Assets (RWAs)

Grok AI expects tokenized real-world assets to explode in adoption.

“RWAs—bringing assets like real estate, bonds, and treasuries on-chain—will see explosive growth, potentially reaching $30 billion in tokenized value by year-end,” the AI noted.

Why does this matter? Because RWAs bridge traditional finance with crypto, letting people own fractions of assets that were once out of reach. Think tokenized U.S. Treasuries, real estate, or even art.

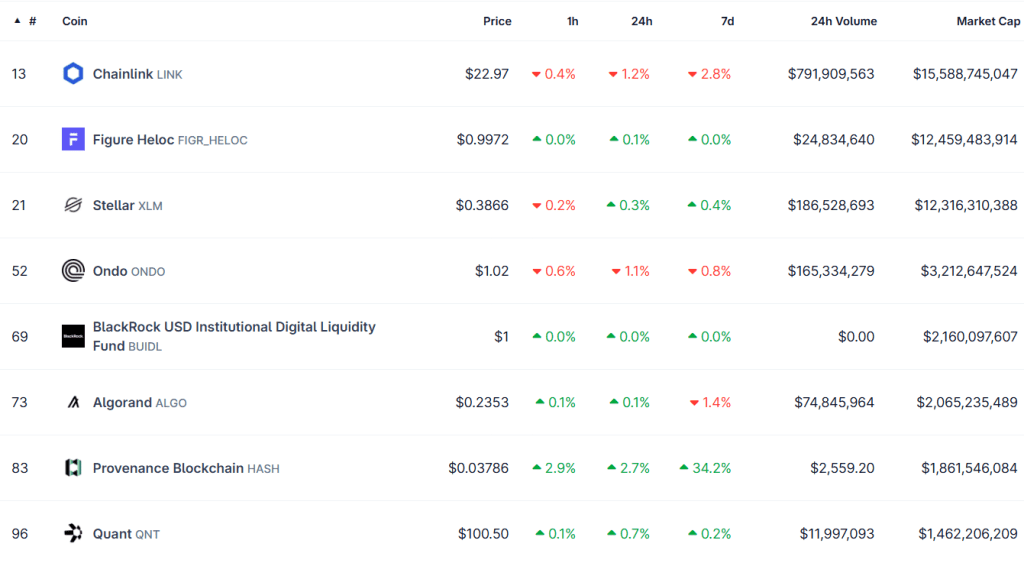

Top RWA cryptos by market cap (Source: CoinGecko)

As regulations like the CLARITY Act provide more legal certainty, institutions are expected to pour in. This could make RWAs one of the most lucrative crypto trends of 2026.

DeFi Meets AI and CeFi

DeFi has already proven its worth, but Grok AI believes the next phase is full-blown integration with AI and traditional finance.

“DeFi protocols will evolve from niche tools to everyday financial services, with total value locked (TVL) potentially hitting $1 trillion, driven by AI-enhanced risk management and seamless TradFi bridges,” it projected.

That means smarter lending, borrowing, and yield opportunities—all powered by AI. And as central banks ease rates, DeFi becomes even more attractive for both retail and institutional investors. If this plays out, Ethereum and its ecosystem could see massive demand.

Scalability with Layer 2s and High-Speed Chains

Another big theme Grok highlighted is scalability.

“Solutions like zero-knowledge rollups, optimistic rollups, and monolithic chains (e.g., Solana, Sui) will dominate, slashing fees and boosting throughput to support mass adoption,” it said.

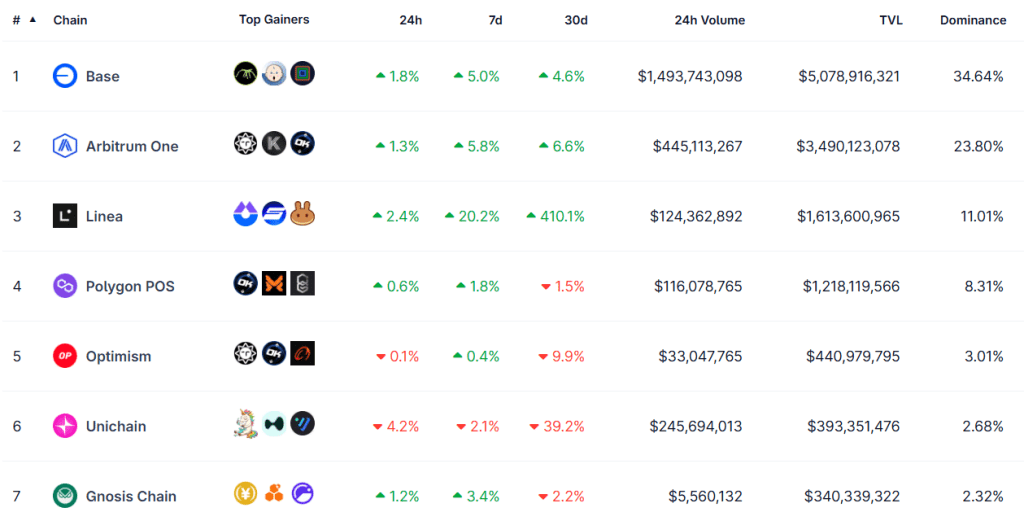

This matters because crypto adoption can’t grow if networks remain slow and expensive. With Layer 2s scaling Ethereum and high-speed chains like Solana and Sui breaking new ground, expect 2026 to be the year blockchain finally feels instant for gaming, payments, and enterprise adoption.

Top layer-2 chains by TVL (Source: CoinGecko)

AI-Blockchain Convergence

It’s no surprise that AI and blockchain are converging, and Grok flagged this as a major driver.

“AI integration into crypto—via decentralized compute, analytics, and autonomous agents—will surge, fueled by GPU demand and projects like Fetch.ai or Bittensor,” the AI explained.

This trend isn’t just about hype. It’s about practical AI-driven tools making DeFi more efficient, more predictive, and more accessible. As global demand for GPUs continues to climb, projects powering decentralized compute could be some of the top performers in the next bull cycle.

Regulatory Clarity and Institutional Adoption

Finally, Grok emphasized the role of regulation: “Clearer U.S. frameworks and global tax reforms will unlock institutional inflows, sparking an altcoin boom with mid-caps up 6x and low-caps 10x,” it predicted.

With countries like Japan slashing crypto taxes and the U.S. moving toward broader frameworks, institutional investors are expected to finally step in at scale. That could mean an altcoin season like no other in 2026.

Final Thoughts on Crypto Trends in 2026

If Grok AI is right, crypto trends in 2026 will be defined by real-world integration, scalability, AI synergy, and institutional adoption. For investors, it’s not just about following the hype—it’s about positioning early for where the market is heading.

To quote Grok one last time: “These are derived from projections around regulatory evolution, technological maturation, and capital flows.”

Whether you’re a seasoned trader or just starting out, keeping an eye on these five themes could make all the difference in 2026.Disclaimer: The information presented in this article is for educational and informational purposes only and should not be considered financial or investment advice. Ecoinimist does not provide recommendations to buy, sell, or hold any cryptocurrency, token, or financial asset. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions. Ecoinimist is not responsible for any financial losses incurred as a result of the information provided.