PayPal Expands Stablecoin PYUSD to Nine More Blockchains via LayerZero

Payments giant PayPal (NASDAQ: PYPL) is significantly widening the reach of its U.S. dollar stablecoin, PayPal USD (PYUSD).

Through an integration with interoperability protocol LayerZero (ZRO), the token is now being introduced to nine additional blockchains, extending its presence well beyond the four networks where it is currently natively issued.

LayerZero Expansion and PYUSD0 Launch

LayerZero has integrated PYUSD—originally issued by Paxos in 2023—into its Hydra Stargate system. This integration has created a new permissionless version of the token called PYUSD0, which is fully interchangeable one-to-one with the underlying stablecoin.

The expansion brings PYUSD to Abstract, Aptos, Avalanche, Ink, Sei, Stable, and Tron, while community-issued versions on Berachain and Flow will automatically convert into the new model. Until now, PayPal’s stablecoin has been limited to Ethereum, Solana, Arbitrum, and Stellar, where it is issued natively.

Growing Adoption and Market Position

The broader rollout signals PayPal’s ambition to position its stablecoin as a core instrument in the crypto economy, reaching more ecosystems and developers quickly. As one of the first stablecoins launched by a major payments company, PYUSD has steadily gained traction among traders, DeFi protocols, and exchanges.

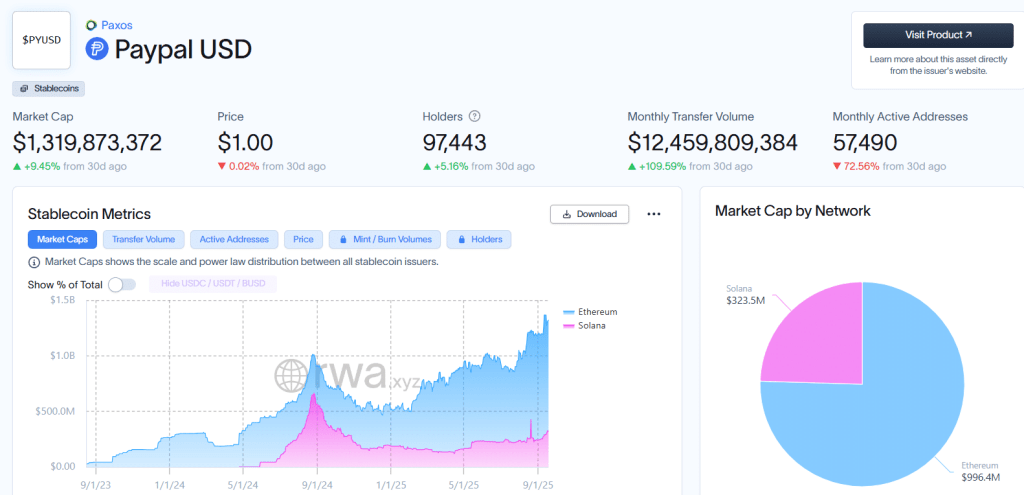

Data from RWA.xyz shows that PYUSD’s supply has grown to $1.3 billion, more than doubling from around $520 million at the beginning of 2025. This rapid growth comes amid increasing demand for dollar-pegged stablecoins.

PYUSD market cap (Source: RWA.xyz)

Industry Significance

The expansion highlights how traditional fintech companies like PayPal are increasingly embracing blockchain interoperability. By leveraging LayerZero, PYUSD gains exposure across both established chains like Avalanche and fast-growing ecosystems like Sei and Aptos.

For PayPal, this move not only strengthens its foothold in the digital asset space but also underscores its vision of embedding a trusted, dollar-backed stablecoin within decentralized markets. As cross-chain activity continues to grow, PayPal’s presence in multiple ecosystems may accelerate adoption of PYUSD in payments, trading, and DeFi applications.