Solana Corporate Treasuries Surge Past $4 Billion

Solana corporate treasuries have quietly become one of the fastest-growing pockets of institutional crypto adoption, with reserves surpassing $4 billion, according to fresh data from the Strategic Solana Reserve.

$4.03 Billion Locked in Solana Corporate Treasuries

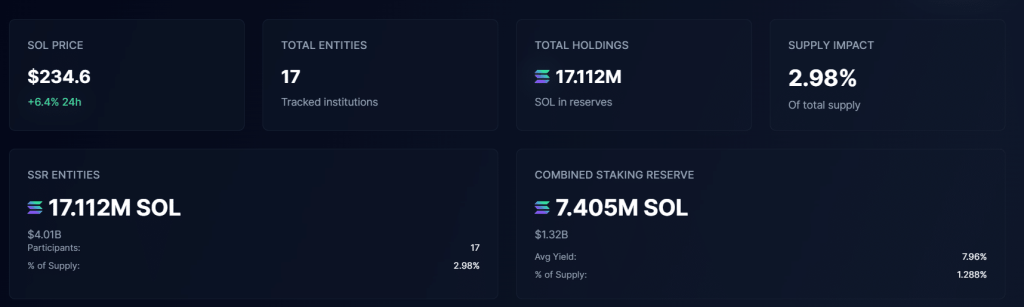

On Tuesday, the tracker revealed that Solana-based reserves climbed to 17.11 million SOL, valued at $4.03 billion at current market prices. This represents almost 3% of Solana’s circulating supply of more than 600 million tokens, signaling deepening institutional conviction in the blockchain often touted for its speed and scalability.

Solana corporate treasuries overview (Source: Strategic SOL reserve)

The largest single participant is Forward Industries, which holds 6.8 million SOL worth $1.61 billion. Other notable corporate holders include Sharps Technology, DeFi Development Corp., and Upexi, each with allocations of roughly 2 million SOL, valued at more than $400 million apiece.

Institutions Fueling the Solana Corporate Treasuries Movement

Forward Industries announced its Solana reserve formation on Sept. 8, with backing from Galaxy Digital, Multicoin Capital, and Jump Crypto. The launch sparked a Solana buying spree, including a single-day purchase of $306 million in SOL by Galaxy.

This week, Helius Medical Technologies added fuel to the fire with the creation of a $500 million Solana treasury reserve. The initiative was spearheaded by Pantera Capital and Summer Capital, underscoring growing hedge fund and venture firm involvement in Solana’s corporate treasury wave.

Speaking to CNBC on Monday, Pantera Capital CEO Dan Morehead described Solana as the “fastest, cheapest, most-performing blockchain” and disclosed that Pantera itself holds a massive $1.1 billion Solana position.

Solana vs. Bitcoin and Ethereum Treasuries

While Solana’s $4 billion milestone is impressive, it still lags far behind corporate reserves tied to Bitcoin (BTC) and Ethereum (ETH).

- Bitcoin Treasuries: Data from BitcoinTreasuries.NET shows 3.71 million BTC are held by companies, worth $428 billion—approximately 17% of the total Bitcoin supply.

- Ethereum Reserves: Corporate entities hold nearly 5 million ETH, worth over $22 billion, while Ethereum ETFs add another 6.77 million ETH ($30 billion) to institutional holdings.

The comparison highlights both the room for growth and the increasing credibility of Solana as a treasury asset.

Outlook: Solana Joins the Big Leagues

The rapid growth of Solana corporate treasuries signals that institutions are no longer just experimenting with the network—they’re committing capital at scale. With influential firms like Galaxy Digital, Pantera Capital, and Jump Crypto publicly backing Solana reserves, the blockchain is carving out a seat at the same table as Bitcoin and Ethereum in the evolving digital treasury landscape.

If adoption trends continue, Solana could become the third pillar of institutional crypto reserves, offering diversification beyond Bitcoin’s store-of-value appeal and Ethereum’s smart contract dominance.