Ethereum Outlook: Citi Sees $4,300 as Base Case, Warns of $2,200 Downside

Wall Street giant Citigroup (Citi) has released a fresh Ethereum price forecast that suggests both the promise and the uncertainty surrounding the world’s second-largest cryptocurrency.

The bank’s analysts believe Ethereum (ETH) will likely settle around $4,300 by year-end, but the range of outcomes is strikingly wide, with a bull case of $6,400 and a bear case of $2,200.

Citi’s Forecast: A Wide Band of Outcomes

Citi’s base case rests on the assumption that Ethereum will capture only a fraction of the activity on layer-2 networks, which have become increasingly dominant in recent years.

The report suggests that just 30 percent of this usage translates into direct value for Ethereum’s base layer, creating a gap between growing adoption and price performance.

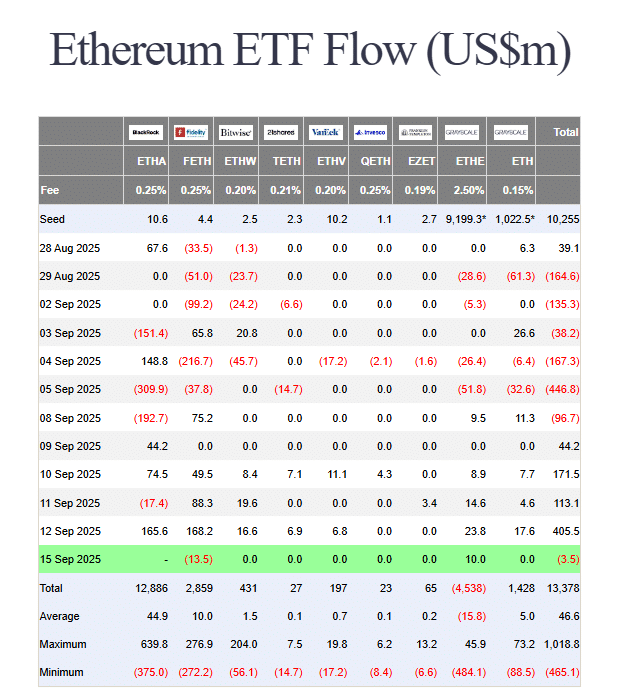

The bank also noted that while ETFs and institutional demand are providing support, ETH’s smaller market profile compared to Bitcoin limits the size of inflows. On top of that, Citi highlighted broader macroeconomic conditions—such as equities already nearing its S&P 500 target of 6,600—as factors that could restrict risk appetite.

Base, Bear, and Bull Cases

In this framework, the $4,300 base case reflects steady but measured growth, while the bear case of $2,200 imagines a scenario where regulation tightens, risk assets sell off, or value from layer-2 scaling fails to accrue to ETH itself.

Ethereum price chart (Source: CoinMarketCap)

By contrast, the bull case of $6,400 would require stronger ETF participation, friendlier policy environments, and more direct economic benefits flowing from Ethereum’s scaling ecosystem into its core token.

US ETH ETF flows (Source: Farside Investors)

Other Institutional Ethereum Predictions

Citi’s stance appears more cautious than some of its peers.

Standard Chartered recently raised its year-end target for ETH to $7,500, pointing to increasing institutional involvement and regulatory clarity as reasons for optimism. The bank even went as far as to project that Ethereum could climb as high as $25,000 by 2028 if long-term trends play out.

Meanwhile, Fundstrat has suggested that Ethereum could trade in the $10,000 to $15,000 range by the end of 2025 under favorable conditions, emphasizing tokenization and institutional inflows as the biggest drivers. Independent analysts, including those at Token Metrics, have taken a middle path, with models suggesting ETH could reach between $5,000 and $10,000 depending on DeFi adoption and network growth.

Comparing Citi to the Broader Market

The spread among those forecasts highlights just how divergent institutional views on ETH remain.

Citi’s more conservative outlook underscores risks that others may be overlooking, particularly the uncertain value capture from layer-2 networks.

Yet, even its cautious base case points to Ethereum ending the year below its current level, reflecting the difficulty of pricing an asset that sits at the center of both technological change and financial speculation.

For investors, the message is clear: Ethereum’s future is still highly contested. While some of Wall Street’s biggest players see dramatic upside ahead, others urge caution and emphasize the risks of overestimating how much activity on Ethereum’s scaling layers will actually benefit ETH itself.