Corporate Bitcoin Holdings Surpass 1 Million BTC as Market Cools

Publicly traded companies have officially crossed a major milestone in Bitcoin adoption. According to BTC Treasuries, firms now collectively hold 1,000,698 BTC—worth roughly $110 billion—highlighting the expanding role of corporations in the market.

BTC corporate holdings breakdown (Source: Bitcoin Treasuries)

Strategy Leads With Dominant Position

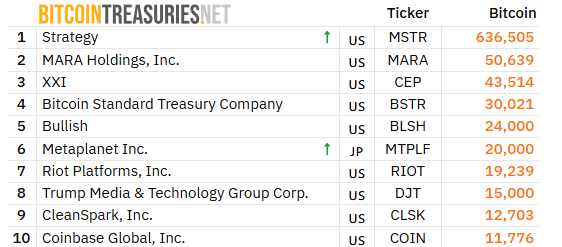

The lion’s share of those holdings belongs to Strategy (MSTR), which alone controls 636,505 BTC, accounting for more than 63% of the total. Strategy’s aggressive accumulation strategy since 2020 has cemented its place as the dominant corporate Bitcoin holder, far outpacing peers.

The concentration is striking: the top 10 companies hold 863,397 BTC, nearly 86% of all corporate holdings.

Top 10 corporate BTC holders (Source: Bitcoin Treasuries)

Other Major Corporate Holders

While Strategy grabs the headlines, several other firms have made significant allocations to the leading crypto:

- MARA Holdings (MARA, US): 50,639 BTC

- XXI (CEP, US): 43,514 BTC

- Bitcoin Standard Treasury (BSTR, US): 30,021 BTC

- Bullish (BLSH, US): 24,000 BTC

- Metaplanet Inc. (MTPLF, Japan): 20,000 BTC

- Riot Platforms (RIOT, US): 19,239 BTC

- Trump Media & Technology Group (DJT, US): 15,000 BTC

- CleanSpark (CLSK, US): 12,703 BTC

- Coinbase Global (COIN, US): 11,776 BTC

This wave of adoption accelerated in this year with Japanese investment firm Metaplanet following Strategy’s lead, sparking a broader rush among corporates to add BTC to balance sheets.

Market Pullback After Frenzied Accumulation

The frenzy appears to have cooled in 2025. BTC dominance has slipped to just above 58%, while the asset itself retreated below $110,000 after hitting a record high of $124,000 earlier this year.

Corporate stocks tied to Bitcoin are also feeling the pressure. Strategy shares are down 30% since peaking in mid-July, while Metaplanet has shed nearly two-thirds of its value since its late-May high.

The fact that public companies now hold more than 1 million BTC shows how deeply Bitcoin has become embedded in global finance. While price volatility and market corrections remain part of the story, the institutionalization of Bitcoin through corporate treasuries is unlikely to reverse.

Instead, the cooling period may set the stage for the next wave of accumulation—particularly as ETFs and regulatory frameworks bring more traditional investors into the fold.