Ethereum Foundation Confirms $43M ETH Sale for Growth Plans

The Ethereum Foundation (EF) has announced another planned sale of 10,000 ETH, valued at roughly $43 million, as part of its ongoing efforts to support ecosystem growth through research, development, grants, and donations.

In a post on X on Tuesday, the foundation said the Ether would be sold via centralized exchanges “over several weeks,” with the proceeds earmarked for operational and community initiatives.

To limit any impact on market liquidity, EF confirmed that conversions would be executed through multiple smaller orders rather than one large transaction.

Ethereum Foundation Grants and Treasury Restructuring

The move comes just days after the foundation temporarily paused open grant applications while it works to overhaul its funding process.

As of the first quarter of 2025, EF reported distributing more than $32 million in grants, with a significant portion allocated to education and community projects.

Earlier in June, the foundation unveiled a new treasury policy that set strict parameters on ETH sales. Under the framework, EF will periodically assess the deviation of its fiat-denominated reserves and decide whether asset sales are necessary over the next three months. The policy caps annual operational spending at 15% of its reserves and aims to build a sustainable multi-year buffer while gradually tightening spending over time.

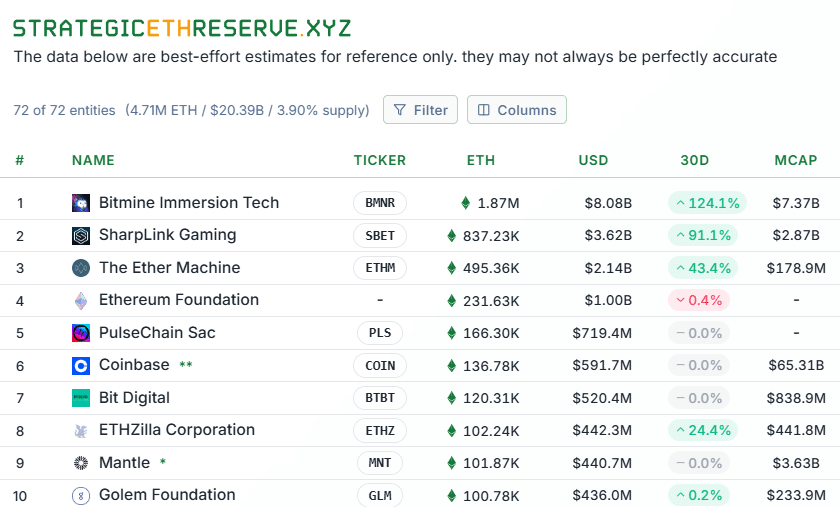

Since the policy’s introduction, the Ethereum Foundation has already liquidated around $25 million in ETH directly to SharpLink Gaming, marking the first instance of a publicly traded company acquiring Ether directly from the foundation. In addition, EF sold 2,795 ETH—worth about $12.7 million at the time—in two separate transactions.

The Ethereum Foundation has a long history of strategic treasury management. One of its most notable sales occurred in December 2020, when it offloaded 100,000 ETH. That move preceded a significant rally that drove ETH prices to then-record highs in the months that followed.

Market Context and Institutional Moves

At the time of writing ETH remains below the all-time high of $4,870 reached in August but has stayed resilient amid increased volatility across the broader crypto market.

Other major market players have also been making moves. Hong Kong-based Yunfeng Financial Group disclosed on Tuesday that it had purchased 10,000 ETH on the open market, though the acquisition appeared unrelated to the foundation’s sales.

Top 10 largest corporate ETH holders (Source: StrategicETHReserve)

Meanwhile, Ether Machine announced it had secured 150,000 ETH as part of a long-term strategy to build a corporate treasury ahead of an anticipated Nasdaq listing. Following the purchase, the company’s ETH holdings will surpass 345,000 ETH, worth around $1.5 billion.

These institutional entries come as Ethereum continues to gain momentum on Wall Street. Over the weekend, Ethereum co-founder Joseph Lubin suggested that ETH could one day surpass Bitcoin as the world’s leading “monetary base” as adoption deepens among traditional financial institutions.

His comments followed remarks from Federal Reserve Chair Jerome Powell in late August, signaling a potential shift in U.S. monetary policy that helped propel ETH to new highs.

The Ethereum Foundation’s latest sale shows the delicate balance between funding ecosystem growth and managing potential market volatility. While some traders remain wary of large-scale ETH disposals, EF’s structured and transparent approach aims to minimize disruptions.

Combined with growing institutional interest and favorable macroeconomic signals, Ethereum appears positioned to remain a focal point in both crypto-native and traditional finance circles in the months ahead.