XRP Slips 15% After Multi-Year Highs — What’s Next for Ripple’s Core Token?

XRP is having a bit of a reality check.

The token, which only weeks ago was riding high on multi-year peaks, has slipped about 15% from those lofty levels.

For longtime XRP watchers, this dip feels familiar — Ripple’s token has always been one part promise, one part drama. But with most of its old baggage finally cleared, investors are asking: what’s next for XRP?

Also read: Trump-Era Comeback: Can $25K in XRP Make You a Millionaire?

From Cross-Border Hopeful to Courtroom Survivor

XRP’s story has always been tied closely to RippleNet, a global payments network designed to make cross-border money transfers faster and cheaper than the old guard — systems like SWIFT or services like MoneyGram.

For a while, RippleNet looked like the future of remittances: low fees, instant conversions between currencies, and a growing roster of banking partners worldwide.

But Ripple’s early start in 2012, long before crypto regulations had any real structure, landed it in hot water. In 2020, the U.S. Securities and Exchange Commission (SEC) came after Ripple, arguing the XRP launch broke securities laws.

The fallout was brutal. U.S. exchanges like Coinbase, Kraken, and Robinhood pulled the altcoin from their platforms, cutting the token off from the world’s biggest market for outbound remittances.

The lawsuit dragged on for years, creating a stop-start cycle of “this is the end” headlines that often fizzled into nothing. Investors grew numb to the legal noise, and rivals like Ethereum, Solana, Stellar, and even emerging stablecoins began circling XRP’s territory.

Also read: How to Buy XRP Safely

A Fresh Start — With Political Tailwinds

Fast forward to late summer 2025, and the clouds have finally cleared. The SEC lawsuit is officially settled and dismissed, removing the biggest weight on XRP’s shoulders. U.S. traders can now freely buy and sell the token again, and RippleNet is running at full speed.

Still, the lawsuit’s resolution didn’t send the crypto to the moon. Most of the optimism was already priced in months ago, especially after last year’s U.S. presidential election, when a crypto-friendly administration under Donald Trump signaled a lighter regulatory hand.

Now, XRP investors are looking for the next big catalyst: ETFs. While Bitcoin and Ethereum already have their spot ETFs, the crypto’s chance may come later this year. The SEC has several XRP ETF applications under review, with October shaping up as a key month.

The XRP Valuation Puzzle

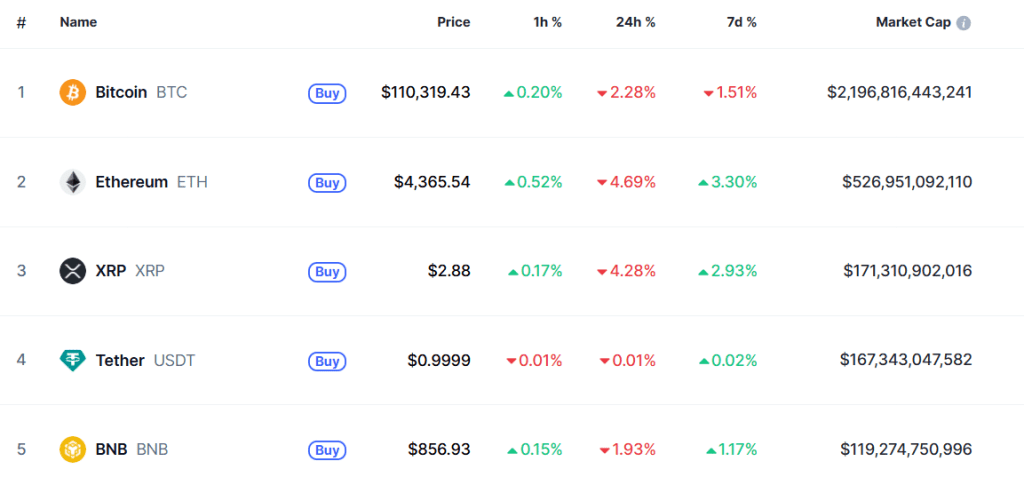

But here’s the catch: even after a 15% pullback, XRP isn’t exactly cheap. With a market cap of $171 billion, it’s currently the third-largest cryptocurrency in the world. That’s a huge price tag for a project still fighting to carve out its share of the global payments business.

Top 5 biggest cryptos by market cap (Source: CoinMarketCap)

The international remittance market is massive — measured in the trillions — but XRP’s low-fee structure means profits are slim, even at scale. In other words, RippleNet could dominate its niche without necessarily delivering windfall earnings to XRP holders.

The coin’s price action over the past year tells the story: swings from as low as $1.79 to as high as $3.56, often tied to political or regulatory headlines. That volatility suggests one thing — the market is still figuring out what the crypto is really worth in this new, lawsuit-free era.

Patience Over FOMO

So, is now the time to buy XRP? Maybe — but only in moderation. If you’re looking to take part in RippleNet’s comeback story, a small position makes sense. But for larger investments, patience might pay off. A deeper dip, particularly if the altcoin slides below $2 again, could be the better entry point.

Crypto markets reward patience as much as they punish impatience. For now, XRP’s comeback story is still being written — and the next few months, with ETF decisions looming, could decide how exciting that story really becomes.

Disclaimer: The information presented in this article is for educational and informational purposes only. It should not be considered financial or investment advice. Cryptocurrency markets are highly volatile, and you should never invest more than you can afford to lose. Ecoinimist is not responsible for any losses incurred as a result of trading or investing based on the information provided here.