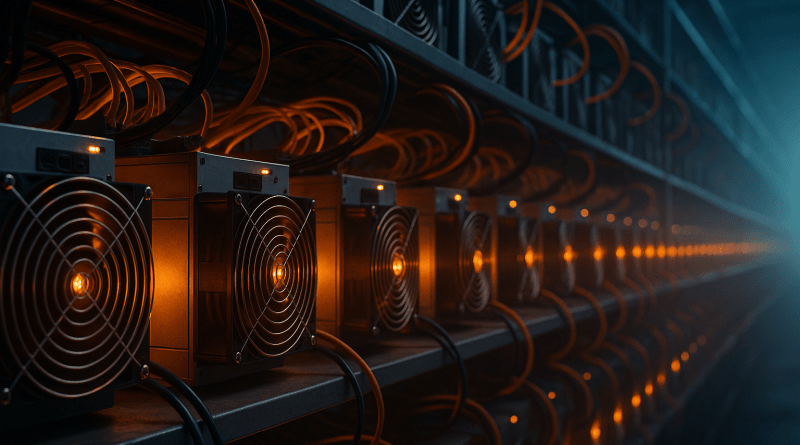

Underdog Bitcoin Miner Iren Destroys Industry Giant – Here’s How

Iren Limited (NASDAQ: IREN), an Australia-based Bitcoin mining firm, outperformed Marathon Digital Holdings (MARA) in both Bitcoin production and use of fleet in July 2025.

The company mined 728 Bitcoin during July, compared to MARA’s 703, a major achievement for the smaller miner. It also achieved a fleet utilization rate above 90%, exceeding MARA’s 74.59%, a testament to the Iren’s operational efficiency.

Record-Breaking Month for Iren Mining Operations

Iren’s average hashrate reached 45.4 EH/s, using 91% of its 50 EH/s deployed capacity, compared to MARA’s 43.94 EH/s, or 74.59% of its 58.9 EH/s capacity. MARA’s July production declined from its June 2025 output of 950 Bitcoin, probably due to operational issues.

The Australian mining giant reported record financial results for July as well, with $86 million in revenue, including $66 million in hardware profits and $2.3 million from its AI Cloud services. Its revenue per Bitcoin mined was $114,891, in line with the company’s efficient operation.

Its reliance on 100% renewable energy has contributed positively to its cost lately. The company’s stock price increased by 11.4% to $18.32, ahead of MARA’s 2% gain to $15.91, showing strong investor confidence in Iren’s growth.

IREN Stock Chart (Source: Yahoo Finance)

Green Energy and AI Boost Iren’s Mining Might

Iren’s July performance shows its operational strength, with over 90% utilization of its fleet, while MARA’s was under 75%.

With a mining efficiency of 15 J/TH, the company maximized output despite a smaller deployed hashrate. Its renewable energy focus reduces costs and is in line with sustainability demands.

Its AI Cloud services generated $2.3 million in July and are different from MARA, which focuses majorly on Bitcoin mining. The company bought 2.4k NVIDIA B200/B300 GPUs to support its 50 MW Horizon 1 AI data center, scheduled for completion in Q4 2025, positioning it to capture growth in high-performance computing.

MARA, despite its larger 58.9 EH/s capacity, faced recent challenges in July, possibly due to operational downtime. However, its Q2 2025 revenue of $238 million, up 64% year-over-year, and a 50,000 BTC treasury show its financial resilience.

MARA Bitcoin Holdings (Source: BitcoinTreasuries)

Iren’s diversified revenue stream gives it a hedge against Bitcoin price volatility, a risk MARA faces more directly, though its substantial treasury provides high financial resilience.

The New Battle for Bitcoin Mining Dominance

With the Bitcoin network hashrate exceeding 900 EH/s in July 2025, the need for diversification and efficiency are becoming increasingly important in the mining sector.

Iren’s $4.11 billion market capitalization, second only to MARA among public miners, shows its rising visibility. Its renewable energy and AI programs position it for growth in both crypto and computing markets, potentially addressing Bitcoin’s volatility risks.

MARA, a leader in hashrate and treasury size, remains a strong contender, though its July performance shows the need for operational and efficiency improvements to maintain its position.