IBIT ETF Overview: What Investors Need to Know About BlackRock’s Bitcoin Fund

BlackRock’s IBIT ETF (iShares Bitcoin Trust ETF) is a U.S.-listed, physically-backed spot Bitcoin ETF launched on Jan. 5, 2024.

Its stated goal is “to reflect generally the performance of the price of bitcoin”. In practice, IBIT holds actual Bitcoin in custody (via a third-party custodian) and issues shares that trade on the NASDAQ under ticker IBIT (CUSIP 46438F101).

This structure lets U.S. investors gain exposure to Bitcoin within regular brokerage or retirement accounts, rather than buying crypto directly. The fund charges a 0.25% management fee and has no dividend distributions (it simply accumulates Bitcoin’s price changes). By mid-2025, the IBIT ETF had become the largest Bitcoin ETF: as of July 9, 2025 it held about $77.5 billion in assets under management.

IBIT tracks the CME CF Bitcoin Reference Rate (New York) to mirror the Bitcoin spot price. Its key facts (as of July 2025) include: Net Assets ≈$77.49 B, single holding (100% Bitcoin), and a 30-day median bid/ask spread of ~0.02%. With about 1.234 billion shares outstanding and an “indicative basket” of ~22.72 BTC per share, IBIT’s total Bitcoin holdings exceed 700,000 BTC. In fact, this represents over 3.33% of all Bitcoin in existence. In June–July 2025 IBIT traded around the low $60s: for example, it closed at $61.82 on July 8, 2025 and hit an all-time high price of $63.58 on July 9, 2025. As news outlets reported, that day Bitcoin briefly topped $112,000 and IBIT rose to its new high.

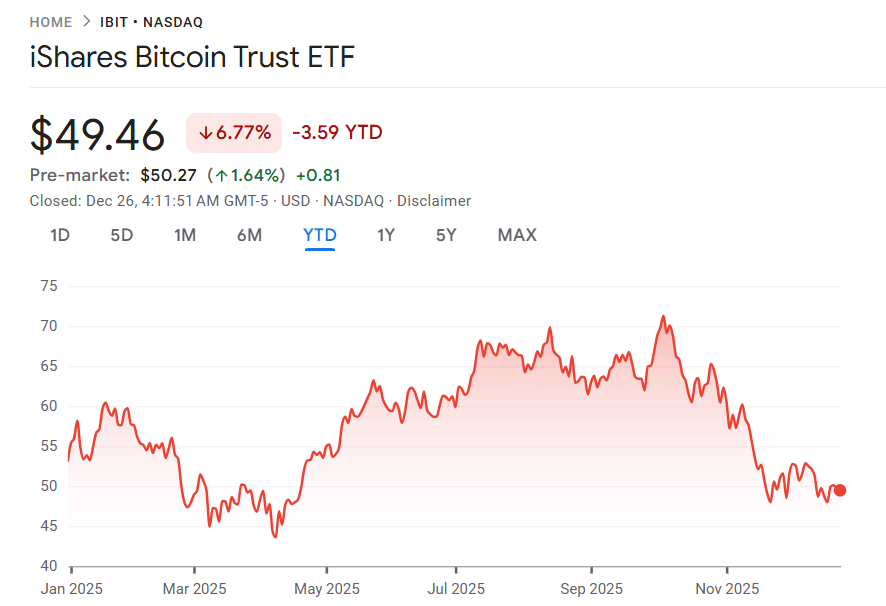

IBIT share price (Source: Google Finance)

How the IBIT ETF Works

The IBIT fund is legally structured as a trust that holds Bitccoin. Its investment objective is straightforward: match Bitcoin’s performance.

It achieves this by buying and storing actual bitcoin (via custodian institutions, e.g. Coinbase) and adjusting the supply of shares through authorized participants.

The IBIT ETF does not invest in Bitcoin futures or stocks; it only holds Bitcoin itself. Because of this direct backing, the fund’s share price generally tracks the Bitcoin price (minus fees), and it trades very close to its net asset value.

For example, as of July 8, 2025 the fund was trading at a tiny –0.07% discount to NAV, meaning it closely reflected the Bitcoin price. The fund charges no performance fee beyond its fixed 0.25% expense ratio, and it distributes no income to shareholders (no dividends or periodic payouts). Tax treatment is similar to any other ETF: gains are taxed as capital gains. In short, IBIT lets investors “own” Bitcoin via an ETF wrapper.

IBIT overview (Source: BlackRock)

Key highlights of IBIT include:

- Launch and Size: Started Jan 5, 2024; as of July 9, 2025 held ~$77.5B AUM, far outpacing any other spot Bitcoin ETF.

- Fee: 0.25% annual expense ratio, waived on small AUM tiers for only $2.5B (no waiver on IBIT). (By comparison, peer funds range 0.20–0.25%.)

- Holdings: 100% Bitcoin (1 holding); ~22.72 BTC per share. Total IBIT holdings >700,000 BTC.

- Trading: NASDAQ-listed; very high liquidity (30-day avg. volume ~40 million shares), on par with major equity ETFs.

- Custody: Bitcoin held by institutional custodians; the fund is not a commodity pool. BlackRock discloses it’s not a SEC-registered investment company.

- Tracking: Tied to CME CF Bitcoin Reference Rate – a composite spot price – ensuring IBIT closely tracks spot Bitcoin.

- Performance: Through June 2025, IBIT’s cumulative total return since inception was ~82.7%, reflecting a similar rise in Bitcoin (net of fees). Its 1-year return (ending 6/30/25) was ~77.7%. (Market price returns were slightly higher, ~79.3% for 1 year.)

In sum, IBIT essentially rises and falls with Bitcoin’s price. For US investors this means a familiar brokerage ticker “IBIT” (NASDAQ) that they can buy/sell like a stock or bond, but with Bitcoin exposure. Its official fund name “iShares Bitcoin Trust ETF (IBIT)” and objectives are clearly stated on BlackRock’s site.

Recent Performance and News

IBIT’s growth has been nothing short of spectacular. In less than 18 months it attracted unprecedented inflows. Industry analysts report that since launch IBIT alone has drawn roughly $52 billion in investor inflows, dominating the spot-ETF market. By mid-2025 it crossed $70 billion in AUM in just 341 trading days – the fastest any U.S. ETF (of any kind) has reached that size. Over the first year of trading, IBIT’s net inflows were about $38 billion (roughly three times the next-largest spot Bitcoin fund). In fact, U.S. spot bitcoin ETFs collectively saw around $55–60 billion of net inflows since their January 2024 debut, and the IBIT ETF led the way.

Bitcoin inflows as of July 9 (Source: Farside Investors)

These massive inflows translated to record-breaking performance. For example, in July 2025 Bitcoin’s price surged to new all-time highs (topping $112,000), and IBIT followed suit.

On July 9, 2025 the fund closed at $63.58, its highest ever, coinciding with Bitcoin’s $112K peak. The fund also set milestones: it was the fastest ETF ever to reach $50 billion in AUM (just 227 trading days, shattering the previous record). As a result of its size and fee revenue, BlackRock’s own reporting shows IBIT now generates more annual fee income than BlackRock’s flagship S&P 500 ETF (IVV). (IBIT’s ~$75B AUM at 0.25% equates to roughly $186–187 million/year in fees, edging out IVV’s revenue.)

The market narrative is clear: BlackRock’s IBIT has become the dominant U.S. spot Bitcoin fund. As one analyst put it, “IBIT attracts the lion’s share of new investments and shows minimal outflows compared to competitors”. CoinDesk notes IBIT’s holdings (700k BTC) and $76 billion AUM now surpass even large equity ETF benchmarks like the iShares S&P 500 ETF (IVV). In short, IBIT has capitalized on Bitcoin’s rally and institutional demand to become an all-time success story in ETF history.

For US investors, these headlines mean IBIT offers a proven way to ride Bitcoin’s ups and downs. Its popularity means excellent liquidity (tens of millions of shares traded daily). Retail investors can check “IBIT” on Yahoo Finance or Nasdaq websites for IBIT stock price charts, and even follow social chatter (e.g. on StockTwits). As of July 2025, a search for “IBIT share price” or “IBIT ETF price today” would show it trading in the low $60s (just below its July high). Historical data on sites like Yahoo Finance confirm IBIT’s recent price action in line with Bitcoin’s new peaks.

IBIT vs. Other Bitcoin ETFs

IBIT is one of a dozen or so spot Bitcoin ETFs approved in early 2024. Its main peers include:

- Fidelity Wise Origin Bitcoin Fund (FBTC): Fidelity’s spot BTC ETF (ticker FBTC), with ~22.1 B AUM and a 0.25% fee.

- ARK 21Shares Bitcoin ETF (ARKB): ARK Invest/21Shares fund, with ~$5.21 B AUM and 0.21% fee.

- Bitwise Bitcoin ETF Trust (BITB): Bitwise fund, ~$4.33 B AUM, 0.20% fee.

- VanEck Bitcoin Trust (HODL): $1.73 B AUM, 0.25% fee.

- WisdomTree Bitcoin Fund (BTCW): Smaller ~ $0.17 B AUM, 0.25% fee.

Compared to these, IBIT’s strengths are clear: it vastly larger in size and market share, and it charges a competitive fee. For example, Bitwise’s BITB is slightly cheaper (0.20%) and ARKB is 0.21%, while Fidelity’s FBTC matches IBIT at 0.25%. (Grayscale’s legacy Bitcoin Trust (GBTC), now an ETF, still has a steep 1.50% fee.) In terms of returns, all these funds have moved in lockstep with Bitcoin: for instance in 2025 YTD each was up roughly +16–17%, reflecting Bitcoin’s rise.

The table below compares key stats of major spot Bitcoin ETFs for U.S. investors:

| Fund (Ticker) | Issuer | AUM (USD) | Fee | YTD 2025 |

| iShares Bitcoin Trust (IBIT) | BlackRock/iShares | $75.8 B | 0.25% | +16.5% |

| Fidelity Wise Origin (FBTC) | Fidelity | $22.1 B | 0.25% | +16.4% |

| ARK 21Shares Bitcoin (ARKB) | ARK/21Shares | $5.21 B | 0.21% | +16.4% |

| Bitwise Bitcoin Trust (BITB) | Bitwise | $4.33 B | 0.20% | +16.4% |

| VanEck Bitcoin ETF (HODL) | VanEck | $1.73 B | 0.25% | +16.5% |

| WisdomTree Bitcoin (BTCW) | WisdomTree | $0.17 B | 0.25% | +16.9% |

All these ETFs hold Bitcoin 1-for-1, but the IBIT ETF dominates in scale. It accounts for roughly 70–80% of all spot Bitcoin ETF assets. (For context, the converted Grayscale Bitcoin Trust (GBTC) still holds ~$19.9 B and charges 1.50%, but its flows have been declining.)

What Investors Should Know

For U.S. investors considering IBIT, here are some takeaways:

- Access & Convenience: IBIT trades like any stock or ETF. You can buy it on the NASDAQ through brokers (Robinhood, Fidelity, Schwab, etc.) or include it in IRAs. There is no need to manage a crypto wallet. As a regulated ETF, IBIT’s price quotes are available on platforms like Yahoo Finance and Bloomberg under ticker “IBIT”. (Indeed, searches like “IBIT stock price” or “IBIT Yahoo Finance” will show its data.)

- Fees & Costs: At 0.25%, IBIT’s fee is relatively low for a actively traded crypto fund. However, there are also trading commissions or spreads to consider (many brokers now offer commission-free trading). Because IBIT is physically backed, there are no hidden futures roll costs or crypto lending fees – you simply pay the expense ratio.

- Liquidity & Premium/Discount: IBIT is extremely liquid, so in practice its market price stays very close to its Bitcoin NAV. The BlackRock site reported a –0.07% discount to NAV as of July 8, 2025. Unlike the old GBTC trust (which often traded at large discounts/premiums), IBIT typically has minimal deviation, making it an effective tracker.

- Volatility: Remember that IBIT’s share price directly mirrors Bitcoin. If Bitcoin falls 10%, IBIT will fall ~10% (after fees). This means high volatility: while Bitcoin’s rise has driven the fund up ~80% since inception, it can also suffer sharp declines if crypto markets turn. Investors should be prepared for this risk.

- No Yield: IBIT pays no interest, dividends, or staking rewards. Its return comes solely from Bitcoin price changes. (The fund does not distribute any rewards; it simply holds the Bitcoin.)

- Tax Treatment: Capital gains from selling IBIT are taxed at the usual rates (short/long term). Unlike holding crypto directly, there is no crypto-to-fiat event until you sell your shares (so no 1099-B for crypto transactions, just your usual stock basis tracking). However, IBIT shares are subject to wash sale rules (as they are stock instruments), whereas crypto holdings might not be.

- Custodial Security: The fund’s Bitcoin is custodied by a major entity (BlackRock cites an affiliated custodian with ~$171B assets under custody). This means individual investors do not bear the risk of self-custody, but must rely on the custodian’s security and insurance.

- Regulatory Risk: As a U.S.-approved ETF, IBIT has cleared the SEC’s initial approval. However, the crypto industry remains subject to regulatory shifts. ETF investors should stay informed (recently there have been favorable signals but nothing is guaranteed long-term).

Summary

In summary, the IBIT ETF is BlackRock’s flagship spot Bitcoin ETF, designed to give U.S. investors direct Bitcoin exposure without handling crypto themselves. Launched in January 2024, it has quickly become the largest Bitcoin fund – surpassing $75B in AUM and breaking ETF records. The fund holds real Bitcoin (~700k BTC total) and charges a 0.25% fee. In mid-2025 it hit a new all-time closing high of $63.58 as Bitcoin itself climbed to ~$112K. Compared to its peers (Fidelity’s FBTC, ARK’s ARKB, etc.), IBIT stands out for its scale and liquidity.

For U.S. investors, IBIT provides an easy way to “own” Bitcoin – you can simply buy IBIT shares in a brokerage account. The fund’s performance, volatility, and recent news (e.g. record-high closes and inflow dominance) all stem from the underlying Bitcoin market. By including IBIT in one’s research, an investor can follow Bitcoin’s price via a well-regulated vehicle.

Frequently Asked Questions

What is the IBIT ETF?

The IBIT ETF, officially known as the iShares Bitcoin Trust ETF, is a U.S.-listed spot Bitcoin ETF launched by BlackRock. It allows investors to gain exposure to the price of Bitcoin without owning or managing the cryptocurrency directly. IBIT holds actual Bitcoin in custody and trades under the ticker IBIT on the NASDAQ.

How does IBIT work?

IBIT is a trust that buys and holds real Bitcoin. Investors purchase shares of the trust, which reflect the price of Bitcoin. The value of IBIT shares rises and falls in line with the market price of Bitcoin, minus a small management fee.

How is IBIT different from Bitcoin futures ETFs?

Unlike futures-based ETFs, which track derivatives contracts and may have performance slippage, IBIT directly holds Bitcoin. This allows it to more accurately track the spot price of Bitcoin and eliminates costs associated with rolling futures contracts.

What is the management fee for IBIT?

The IBIT ETF charges an annual expense ratio of 0.25%. This is competitive with other spot Bitcoin ETFs, although some rivals like BITB and ARKB offer slightly lower fees.

Does IBIT pay dividends or interest?

No. IBIT does not pay dividends, yield, or staking rewards. Since it only holds Bitcoin, returns are solely based on Bitcoin price appreciation or depreciation.

Where can I buy the IBIT ETF?

IBIT is listed on the NASDAQ stock exchange and can be purchased through any standard U.S. brokerage account, such as Fidelity, Charles Schwab, Robinhood, or E*TRADE.

Is IBIT available in retirement accounts like IRAs?

Yes. Since IBIT is a publicly traded ETF, it can be included in retirement accounts such as Traditional IRAs, Roth IRAs, and 401(k) plans (depending on your provider).

What is the current price of IBIT?

IBIT’s price fluctuates daily with the price of Bitcoin. As of July 9, 2025, IBIT closed at a new all-time high of $63.58, reflecting a Bitcoin price of over $112,000.

How much Bitcoin does IBIT hold?

As of July 2025, IBIT holds over 700,000 BTC, representing more than 3.3% of Bitcoin’s total supply, making it the largest institutional holder among ETFs.

How does IBIT compare to other Bitcoin ETFs?

IBIT is the largest spot Bitcoin ETF by a wide margin, with over $75 billion in AUM. Its closest competitor is Fidelity’s FBTC (~$22 billion AUM), followed by ARKB and BITB. IBIT also leads in daily trading volume and investor inflows.

Is IBIT a safe way to invest in Bitcoin?

IBIT provides regulated, custodial exposure to Bitcoin with the security and oversight of BlackRock and its partners. While it eliminates the technical risks of self-custody, it still carries the volatility and risk of Bitcoin itself.

Are there tax implications when buying or selling IBIT?

Yes. IBIT is subject to capital gains taxes just like any other ETF. There are no special crypto tax forms (like 1099-B for crypto exchanges), but you should report capital gains or losses when selling IBIT shares.

Does IBIT trade at a premium or discount?

IBIT typically trades very close to its net asset value (NAV) thanks to its high liquidity. As of July 8, 2025, IBIT traded at only a –0.07% discount to NAV.

Who is the custodian for IBIT’s Bitcoin?

BlackRock partners with Coinbase Custody to securely store IBIT’s Bitcoin holdings. All Bitcoin is held in cold storage with strict institutional security standards.