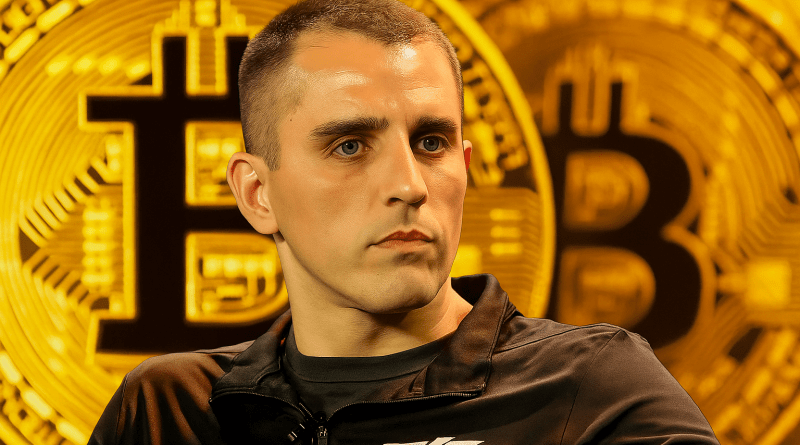

Anthony Pompliano’s ProCap Is Going Public in $1 Billion SPAC Deal

In a bold move to bridge Bitcoin and traditional finance, Anthony Pompliano is taking his bitcoin-native platform, ProCap BTC, public through a $1 billion merger with Columbus Circle Capital Corp. I (CCCM) — a SPAC backed by an affiliate of Cohen & Company.

Announced Monday, the deal will result in ProCap Financial, Inc., which is being billed as one of the largest public bitcoin treasury entities ever launched. And it’s not just for show — the firm has already raised $550 million in preferred equity and secured $225 million in convertible notes, making this the largest initial raise for any bitcoin treasury company going public.

Instant Bitcoin Exposure for Public Market Investors

What makes this deal especially intriguing is its structure: investors in ProCap will get near-immediate exposure to Bitcoin even before the transaction officially closes. ProCap is already acquiring BTC, and the coins will be securely custodied until the merger finalizes — likely by end of 2025, pending the usual SEC review and shareholder vote.

For Wall Street players who have been itching for more direct access to Bitcoin without the complexity of self-custody or private funds, this could be a game-changer.

Pompliano’s Vision: Bitcoin Meets Yield Strategies

Pompliano, a longtime Bitcoin evangelist and investor, won’t just let the company’s BTC holdings sit idly. ProCap is designed to go beyond a passive treasury model. The plan? Put its Bitcoin to work through yield-generating strategies built around the growing crypto-financial infrastructure — all while keeping risk in check.

“The legacy financial system is being disrupted by Bitcoin,” Pompliano said in the announcement. “ProCap Financial represents our solution to the increasing demand for bitcoin-native financial services among sophisticated investors.”

In other words, ProCap wants to be part asset manager, part fintech, and entirely Bitcoin-forward.

A Public Bitcoin Treasury on a Billion-Dollar Scale

While many firms have tiptoed into the crypto space, ProCap is going full throttle. At a potential valuation of up to $1 billion, depending on Bitcoin’s price at the time of closing, the company is positioning itself as a first-of-its-kind hybrid between a Bitcoin fund and a financial service provider.

The Financial Times previously reported that ProCap was looking to raise $750 million for BTC purchases. With this new announcement, that figure appears to have been surpassed — reinforcing market appetite for innovative Bitcoin-native investment vehicles.

What Comes Next for ProCap?

If the deal goes through as planned, Pompliano will become CEO of ProCap Financial. The company’s hybrid approach of active BTC deployment and public market accessibility could reshape how institutional and retail investors access Bitcoin-based strategies.

Whether you’re a die-hard Bitcoiner or a curious investor from the TradFi world, one thing’s clear: Bitcoin just found another serious seat at the Wall Street table.