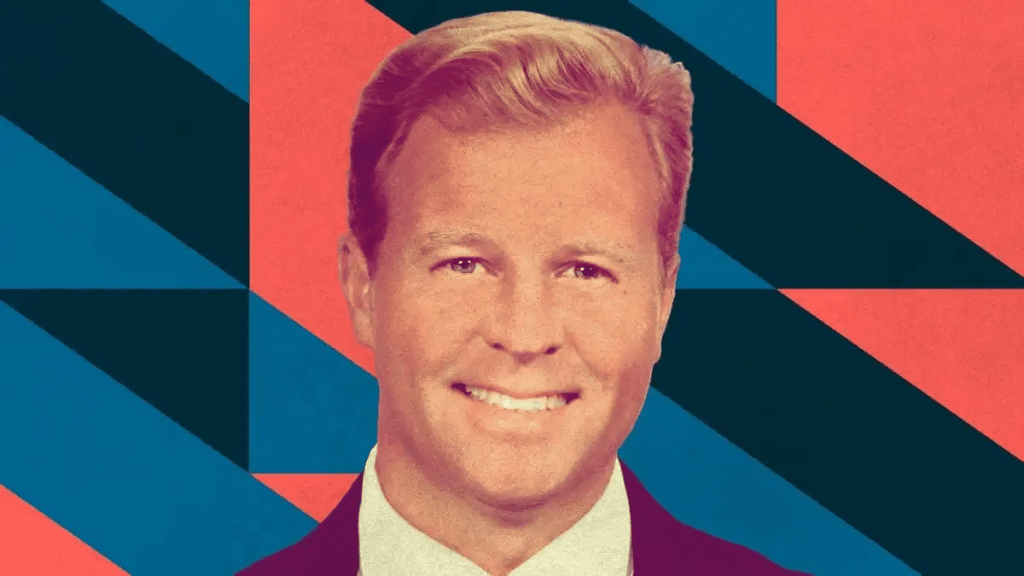

Brian Quintenz Poised to Shape Crypto Policy—But Is He Too Involved?

President Donald Trump’s nominee for chair of the Commodity Futures Trading Commission (CFTC), Brian Quintenz, has disclosed assets worth at least $3.4 million, with major cryptocurrency ties.

The asset disclosure has raised concerns about a potential conflict of interest ahead of his potential Senate confirmation.

Quintenz, who previously served as CFTC commissioner from 2017 to 2021, has proposed measures to address those asset concerns, but his deep crypto industry ties remain a major issue.

Quintenz’s $3.4M In Assets and Financial Ties to Crypto Revealed

His financial filings, submitted on May 27 and 28, 2025, reveal assets valued at a minimum of $3.4 million, which includes substantial crypto-related investments.

Some of these investments include stakes in Andreessen Horowitz (a16z)-managed funds—CNK Fund III, CNK Seed 1 Fund, and CNK IV Fund—along with capital commitments to related general partners.

He also holds stock and unvested options in Kalshi, a prediction markets platform, and shares with vested options in Next Level Derivatives, both based on crypto activities. The disclosures, filed with the Office of Government Ethics, include Quintenz’s financial links to the crypto sector.

Can Quintenz Stay Neutral with Deep Crypto Ties?

Presently, Quintenz serves as global head of crypto policy at a16z, a venture capital firm with major crypto investments, and is a board member at Kalshi, which has faced regulatory challenges from gaming authorities.

His current roles have raised questions about his impartiality, given the CFTC’s oversight of digital asset derivatives and prediction markets.

The crypto community remains divided regarding his nomination, as some have flagged his connections and questions about his objectives, while others suggest his background and experience could lead pro-crypto regulation. The increasing influence of the CFTC in regulating derivatives of digital assets is expected to be an added advantage to Quintenz’s nomination.

Trump announced the nomination in February 2025, and his appointment puts him in a position to influence crypto policy, but his industry connections have raised concerns regarding bias.

Quintenz’s Plan to Ease Conflict-of-Interest Fears

To address conflict-of-interest matters, Quintenz’s ethics agreement provides specific actions.

If he’s confirmed, he will resign from a16z and Kalshi, divest conflicting assets within 90 days, recuse himself from a16z-related matters for two years and Kalshi matters for one year, and forfeit unvested stock options, as well as comply with conflict-of-interest policies, including ethics briefings. He will retain unpaid trustee seats for two family trusts free of conflicts, as confirmed by the Office of Government Ethics.

Senate confirmation hearings, which are likely to intensify in summer 2025 based on WilmerHale’s analysis of past CFTC chair timelines, will most probably focus on these disclosures.

Meanwhile, Commissioner Christy Goldsmith Romero plans to resign upon Quintenz’s confirmation. Aside from the ongoing scrutiny, Quintenz’s experience and ethics plan are expected to strengthen his candidacy.