Robert Kiyosaki: “Losers” Sold Bitcoin, Trump Will Buy It

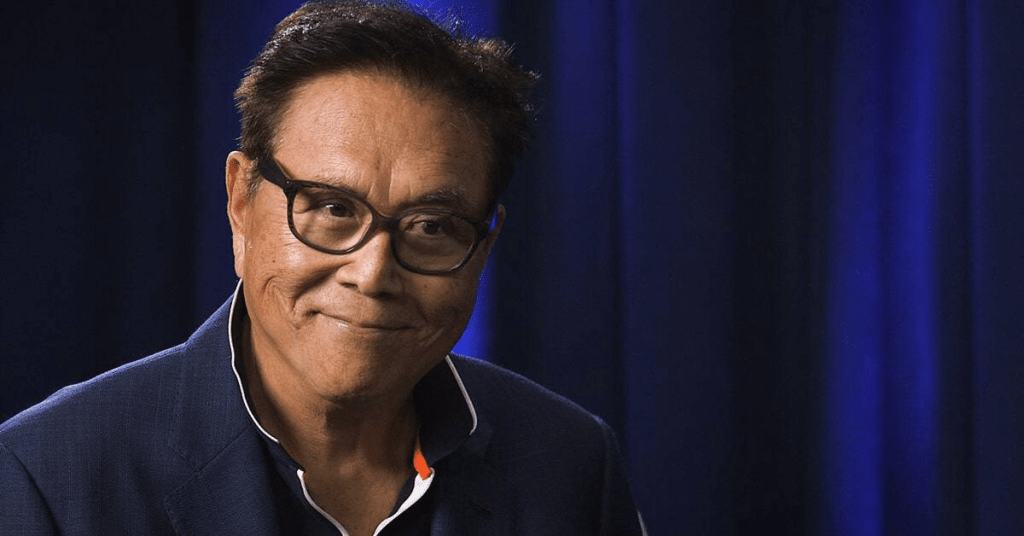

The popular financial commentator Robert Kiyosaki, author of the bestseller Rich Dad, Poor Dad, has continued to advocate for Bitcoin (BTC).

In a March 5 X post, Kiyosaki stated that President Donald Trump may use Bitcoin as a strategic asset to save and fix America’s economic challenges, while describing those who sold the digital currency when its price recently crashed as “losers.”

At the time of writing, Bitcoin is trading at $90,980, rising by 3.06% in the last 24 hours. This price rebound follows a volatile week where BTC briefly dropped to $80,000 on Feb. 28, 2025, amid global market fluctuations.

Robert Kiyosaki Makes Bold Forecast

In his X post, Robert Kiyosaki emphasized his trust in President Trump’s deep understanding of crypto’s potential. “President Trump… the right President at the right time… gets the power of Bitcoin,” he wrote. “When he begins buying BITCOIN to help solve America’s economic insanity… those who bought Bitcoin in the last crash will be the winners… and those who sold will be the biggest LOSERS.”

Also read: Robert Kiyosaki Backs BTC Amid Gold Surge & Mining Record

He further declared that he personally bought more Bitcoin, as he bets on a huge price increase during Trump’s administration.

Kiyosaki’s stand aligns with President Trump’s early presidency and campaign promises to make the US a “crypto capital.” The administration has also recently announced they are looking into a Crypto Strategic Reserve, with Bitcoin being one of the top assets considered. With America’s national debt around $36.4 trillion and concerns of inflation, Kiyosaki considers Bitcoin to be a safe haven for a falling dollar, which he believes is a “scam” compared to decentralized assets.

Market Context and Reactions

The price of Bitcoin has rise consistently since its February low, surging by 5.76% over the last week. Experts attribute this recent price surge to increased investor confidence, which was partly driven by Trump’s pro-crypto stance. The overall cryptocurrency market capitalization currently stands at approximately $2.98 trillion, 2.5% higher compared to the previous day, according to the Ecoinimist Markets page.

Also read: What Does BTC Mean? A Clear Explanation of the Cryptocurrency Abbreviation

Robert Kiyosaki’s provocative labeling of Bitcoin sellers as “losers” has sparked mixed reactions. Supporters on X echo his optimism, with one user noting, “Trump buying BTC could push it past $100K by year-end.” Meanwhile, critics argue his comments oversimplify the crypto market trends, highlighting external factors like regulatory uncertainty and global economic pressures.