Polymarket Whales Cash In: Big Bets on Trump’s Victory Yield Millions in Profits

Polymarket whales have yielded millions of dollars betting on a Trump victory in the US election.

More than 50% of the “Yes” shares for Trump are held by just five major players on Polymarket.

As of Nov. 4, one day before election day, over half of Donald Trump’s “Yes” shares on Polymarket were in the hands of five enigmatic whales.

In comparison, shares for Vice President Kamala Harris are more evenly spread, with the top five shareholders owning only 18% of her “Yes” votes. The largest shareholder of Harris holds just 4.4%, while Trump’s leading shareholder commands 29.1%, Domer pointed out.

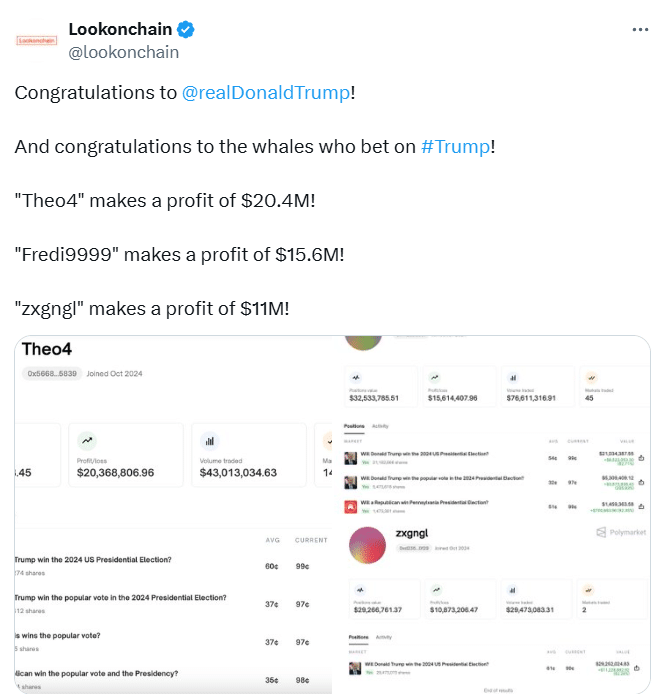

The largest Trump-related betting account on Polymarket, referred to as “Theo4,” reportedly made over $20.4 million in profit from his pro-Trump wagers, based on information released by Lookonchain on Nov. 6.

Another enigmatic Polymarket whale referred to as “Fredi9999” earned a profit exceeding $15.6 million, while a third whale, “zxgngl,” garnered more than $11 million, as reported in a Lookonchain post on Nov. 6.

Understanding Crypto Whales

Crypto whales are individuals or entities that hold a substantial amount of cryptocurrency, often enough to influence market prices. Their actions are closely watched by other investors, as their trades can lead to significant market shifts. In this case, these whales are making headlines by placing large bets on the outcome of the U.S. presidential election.

Also read: Trump Victory: What His Presidency Could Mean for the Future of Crypto

The Trump Bet: A High-Stakes Gamble

The allure of political betting is not new, but the scale at which crypto whales invested in Trump’s victory is unprecedented. With over $81 million wagered, these investors are banking on the volatility of the political landscape to generate massive returns. The decentralized nature of cryptocurrency allows them to place these bets with relative anonymity and speed, making it an attractive option for high-risk, high-reward scenarios.

Polymarket Whales’ Profits and Market Impact

Now that the gamble has paid off, the profits could be astronomical. The $81 million wagered will turn into even more substantial sums, significantly impacting the crypto market. Such large transactions can lead to price fluctuations, affecting not only the whales but also smaller investors who may be caught in the ripple effect.

Also read: Crypto Surge: $2.2 Billion Inflows Amid US Election Euphoria

What This Means for Everyday Investors

For everyday investors, the actions of Polymarket whales can serve as both a cautionary tale and an opportunity for learning. Observing the strategies and outcomes of these large-scale bets can provide insights into market trends and potential future movements. However, it’s crucial to approach such investments with caution and an understanding of the risks involved.

In conclusion, while the prospect of $81 million in profits is enticing, it’s a reminder of the high-risk nature of both political betting and cryptocurrency investments. For those looking to navigate this complex landscape, staying informed and considering the broader market implications is essential.