Cardano Price Prediction: Is a Big Move Coming for ADA?

This Cardano price prediction comes after ADA has shown a subtle but crucial pattern in its price movements. Over the past 24 hours, the closing prices for ADA have fluctuated. They also suggest a mild consolidation phase as the market searches for direction.

Cardano Price Technical Overview

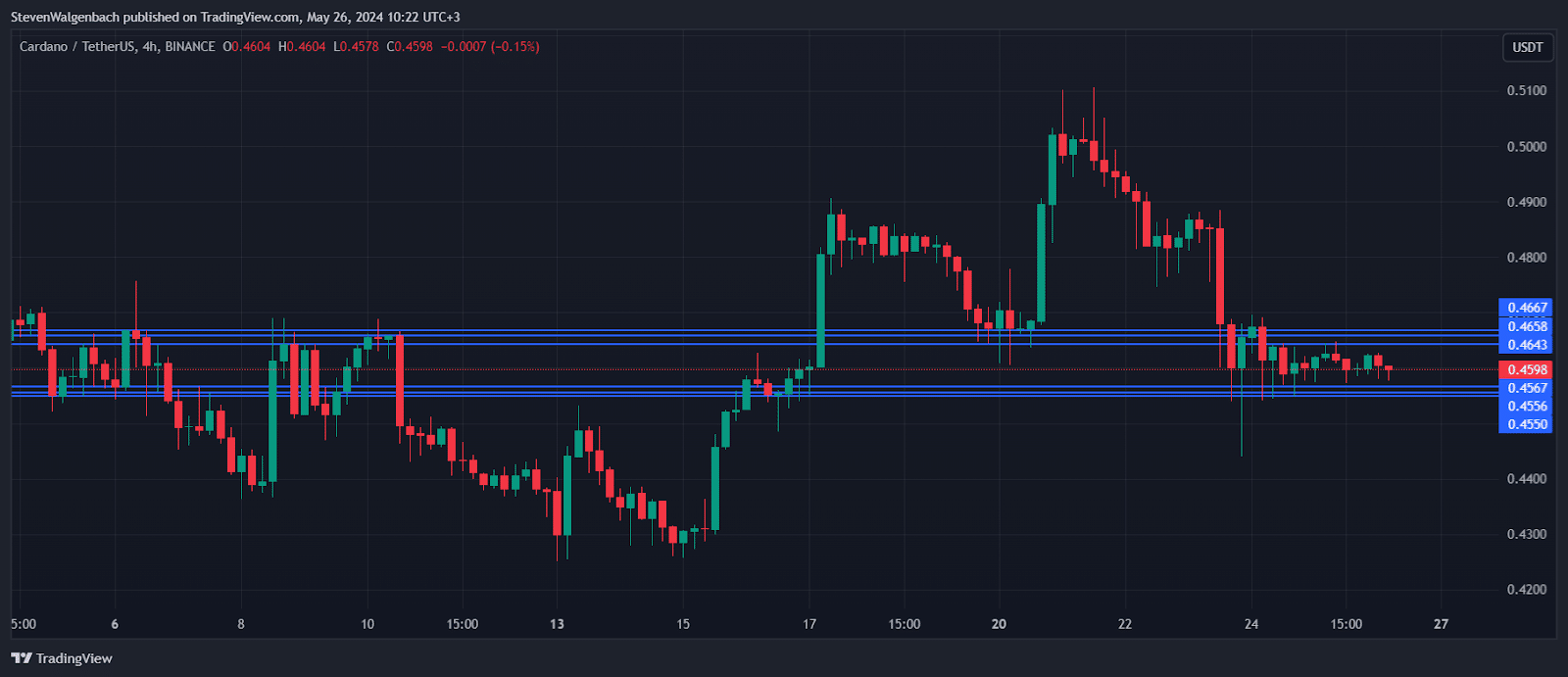

ADA’s 9 Exponential Moving Average (EMA) on the 4-hour chart has gently decreased from $0.4628 to $0.4613, indicating a bearish tone as it trades below the 20 EMA, which similarly declined from $0.4683 to $0.4657. This gap between the 9 EMA and the 20 EMA further supports a bearish outlook in the short term.

The Moving Average Convergence Divergence (MACD) analysis reveals a consistent negative histogram, meaning the MACD line remains below the signal line. Recent values include a MACD of -0.00507 compared to a signal of -0.00497, reinforcing the bearish sentiment. This indicator suggests that the downward momentum, although slowing, persists.

Meanwhile, the Relative Strength Index (RSI) for ADA has been below the 50 mark, predominantly indicating a bearish momentum with recent readings showing a slight uptick from 37.36 to 41.28 before settling back to 37.71.

Key Levels to Watch for This Cardano Price Prediction

Looking at potential support and resistance levels, ADA is currently testing key support at $0.4567. A break below this could see the price move towards the next support at $0.4556 and potentially $0.455. On the upside, resistance levels are observed at $0.4643, $0.4658, and $0.4667. A push above these could indicate a shift to a bullish scenario, providing an opportunity for buyers.

Also read: Alaya AI: Revolutionizing Technology with Advanced Machine Learning

Given the bearish indicators, traders might consider short positions if ADA breaks below the $0.4567 support, with an eye on further declines towards $0.455. Conversely, a reversal above the $0.4643 resistance could be used as a potential entry point for a long position, targeting subsequent resistance levels at $0.4658 and $0.4667.

While the technical indicators largely suggest a bearish outlook for ADA in the near term, traders should watch for potential reversals or breaks above resistance levels as indicators of a changing trend. Entry and exit points should be carefully considered based on these technical levels.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Ecoinimist is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.