Best Meme Coins to Buy Now: BONK, WIF and PEPE Trading Around Key Levels and Could Surge

In the ever-evolving world of cryptocurrency, meme coins have carved out a unique niche. They have also managed to captivate investors with their viral potential and community-driven momentum. Meme coins like BONK, Dogwifhat (WIF), and Pepe Coin (PEPE) are making waves in the market.

These digital assets, often inspired by internet culture and humor, offer not only speculative opportunities but also a vibrant community spirit. In this article, we will explore why BONK, WIF, and PEPE stand out as the best meme coins to buy now. We will also delve into their recent performances, key technical indicators, and what makes them intriguing options for both new and seasoned crypto enthusiasts. Whether you’re looking for the next big thing in crypto or just a fun addition to your portfolio, these meme coins might be worth a closer look.

Could BONK Be Set for a Major Rally? Key Resistance Break Might Spark Huge Gains!

BONK has shown some interesting technical movements on the 4-hour chart. The closing prices have experienced minor fluctuations. These movements suggest a slight volatility in the market, with prices testing both the resistance and support levels.

The 9 Exponential Moving Average (EMA) has been declining from $0.00002591 to $0.00002558, indicating a bearish momentum as the prices have consistently closed below this moving average. Similarly, the 20 EMA shows a slight decline from $0.00002543 to $0.00002541. This aligns with a short-term bearish sentiment as the price remains below both the 9 and 20 EMA.

The Moving Average Convergence Divergence (MACD) further supports this bearish outlook. The MACD line has been trending downwards, from 0.00000056 to 0.00000032, while the signal line has shown a sharper decrease, indicating an increase in bearish momentum. Notably, the histogram has moved from a positive 0.00000002 to a more pronounced negative 0.00000014, signifying growing bearish strength.

The Relative Strength Index (RSI), another critical indicator, suggests neutrality leaning towards bearishness. Values have slightly declined from 53.89 to 49.35. This indicates that the market is neither overbought nor oversold but is trending towards potential bearish conditions.

Key Levels to Watch

Current resistance and support levels are key to determining future movements. Resistance levels are set at $0.00002548 and $0.00002519, while support levels are crucial at $0.00002448 and $0.00002410. A break above the resistance could signal a bullish reversal, whereas breaking below support could intensify bearish trends.

Related: Meme Coins: Understanding the Hype and Investment Potential

Given the current bearish indicators, traders might consider entering short positions if the price fails to break the immediate resistance level and shows signs of heading towards the first support level. Conversely, a bullish scenario could be considered if the price breaches the resistance at $0.00002548, potentially targeting higher resistance.

BONK presents a predominantly bearish outlook with potential for reversal if key resistance levels are broken. Traders should consider both entry and exit points carefully. They should watch for any significant changes in volume that could alter the expected trends.

Dogwifhat Bull Run in Jeopardy? Watch This Critical Level to Avoid Major Losses!

The Dogwifhat price has shown significant price movement. Starting from a closing price of $2.5311, the cryptocurrency has seen a steady increase. It reached a high of $2.7067 before slightly retracing to $2.6854. This upward trend indicates a positive momentum, though it faces significant resistance levels ahead.

The 9 Exponential Moving Average (EMA) shows an ascending trend, moving from $2.5821 to $2.6356. This suggests that the short-term sentiment remains bullish. However, the 20 EMA has been relatively flat, hovering around the $2.675 mark. This stagnation at a crucial resistance level of $2.7703, alongside the 20 EMA’s placement slightly above the recent closing price, could indicate potential resistance in the upward movement of WIF.

The Moving Average Convergence Divergence (MACD) provides a deeper insight. The MACD line, despite being below the signal line initially, is closing the gap, showing decreasing negative values, which could be a sign of weakening bearish momentum. Furthermore, the MACD histogram moving from negative to positive values supports this potential shift towards a bullish sentiment. The Relative Strength Index (RSI) has risen from a low of 34.74 to a more neutral zone around 48.09, suggesting a reduction in the previously oversold conditions but still offering room for upward movement before reaching overbought territory.

Related: Arthur Hayes Says Dogwifhat Eyes $10 Milestone Amid Viral Rally

Considering the current technical setup, WIF might test the immediate resistance at $2.7703 again. If the price can sustain above this level, the next targets for bulls would be at $2.7941 and potentially at the more ambitious $3.0356 level. For traders looking to enter long positions, a sustained move above the 9 EMA with increased volume could serve as a good entry point. However, should the price fail to break above the $2.7703 resistance, it might retest support levels at $2.6725 and further down at $2.605. Short positions could be considered if the price consistently closes below the 20 EMA with increasing volume, indicating strong selling pressure.

Potential Entry and Exit Points

– Long Entry: Consider entering a long position if WIF breaks and holds above $2.7703 with substantial volume.

– Long Exit: Consider taking profits or reducing positions at resistance levels of $2.7941 or $3.0356.

– Short Entry: A break below $2.6725 could be a potential entry for a short, especially if followed by high selling volume.

– Short Exit: Short positions might be covered near the support levels of $2.605 or $2.5541 to avoid potential reversals.

Pepe Coin Ready for a Breakout? Key Resistance Level Could Trigger Massive Gains!

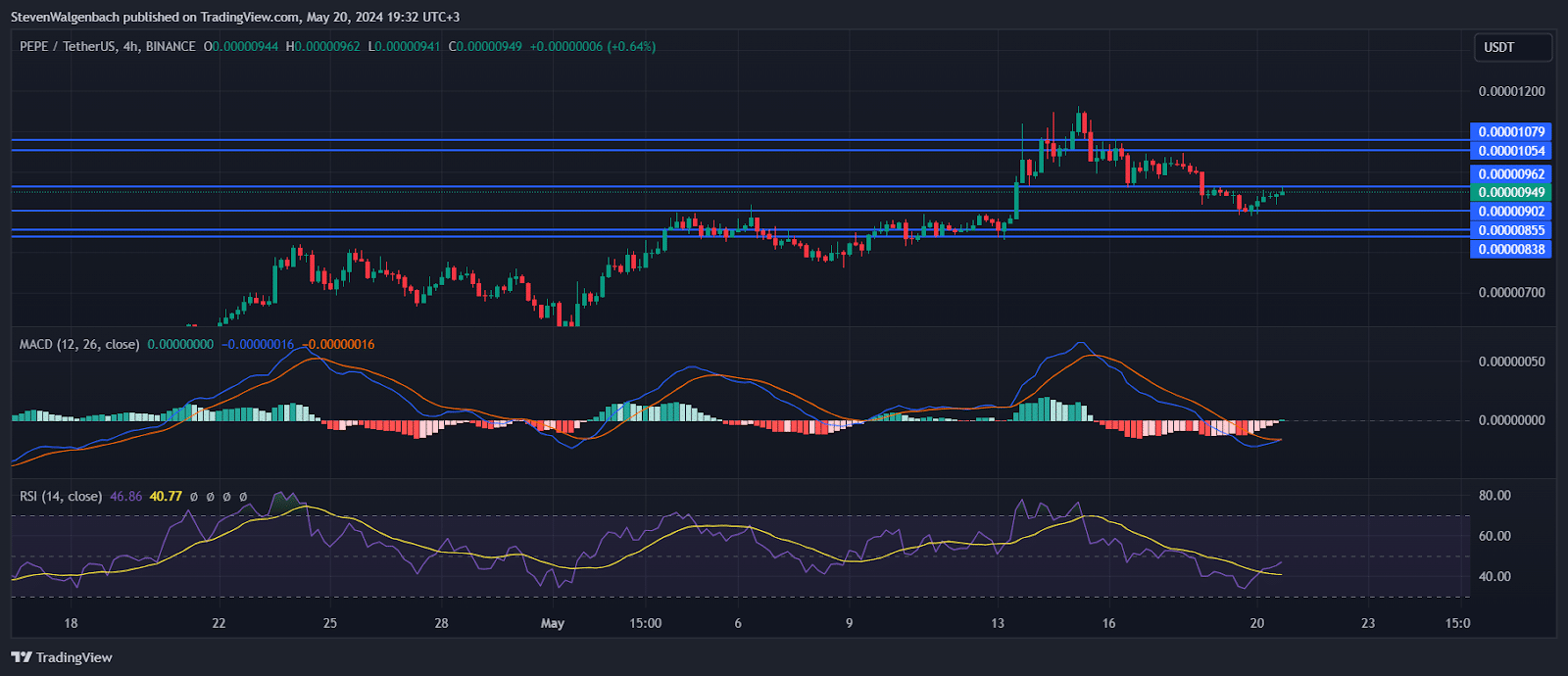

The Pepe coin price has shown a subtle but noticeable fluctuation within the micro-cent range on its 4-hour chart. As of the latest data points, the closing prices have marginally ascended from $0.00000916 to $0.00000939, before slightly retracting to $0.00000934. This indicates a tentative bullish behavior but within a very confined range.

The moving averages provide further insight into the market’s demeanor. The 9 Exponential Moving Average (EMA) has seen a gradual decrease from $0.00000937 to $0.00000936, which is nearly convergent with the recent closing prices, suggesting a lack of strong bullish momentum. The 20 EMA, on the other hand, reflects a more pronounced bearish trend as it declines from $0.00000963 to $0.00000954, significantly higher than the recent closings.

The MACD (Moving Average Convergence Divergence) values have shown decreasing negative values, from -0.00000022 to -0.00000019, which indicates a decreasing bearish momentum. However, the histogram, which measures the difference between the MACD and its signal line, is also shrinking. This typically suggests that while bearish momentum is reducing, bullish momentum has not yet taken firm control, indicating potential consolidation in the market.

Trading in Neutral Territory

Relative Strength Index (RSI), another key indicator, oscillates between 37.76 and 43.98 in recent periods. This suggests that PEPE is neither oversold nor overbought. This aligns with the consolidation narrative, as the market is not showing extreme sentiment in either direction.

Considering potential support and resistance levels, the immediate resistance to watch is at $0.00000962. A break above this level could open the door to further gains towards $0.00001054 and possibly $0.00001079. On the downside, support at $0.00000902 holds the key. A breach below this could see the pair testing $0.00000855, followed by $0.00000838.

Also read: Meme Coins: Understanding the Hype and Investment Potential

Traders might consider entry points for long positions if PEPE breaks above the $0.00000962 resistance with significant volume, targeting exits near higher resistance levels. Conversely, a break below the $0.00000902 support could be a viable entry for short positions, with potential exits planned near lower support levels. Due to the near convergence of the 9 EMA with the price and the narrowing MACD histogram, traders should remain vigilant for any signs of increasing volatility or confirmation of trend direction through additional indicators or volume changes.

Start trading meme coins and other cryptos on the most liquid and active exchange, Binance. Get started now, by signing up to Binance here. Alternatively, explore more technical analyses by professional traders on TradingView.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Ecoinimist is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.