FET Crypto Price Soars 13% as AI Crypto Coins TAO, NEAR, RNDR and GRT All Pump

The FET crypto price surged over 13% in the past 24 hours to trade at $2.30 at press time.

FET’s strong performance comes after investors poured a substantial amount of capital into AI crypto coins. CoinMarketCap shows the market cap for the AI crypto sector has risen more than 11% over the past 24 hours.

The top 4 biggest AI crypto coins all achieved substantial gains throughout the past day of trading. NEAR Protocol (NEAR) and Render (RNDR) increased over 13% and 4%, respectively. Similarly, The Graph (GRT) surged more than 15%, while Bittensor (TAO) recorded a price increase of more than 12%.

FET Crypto Technical Overview

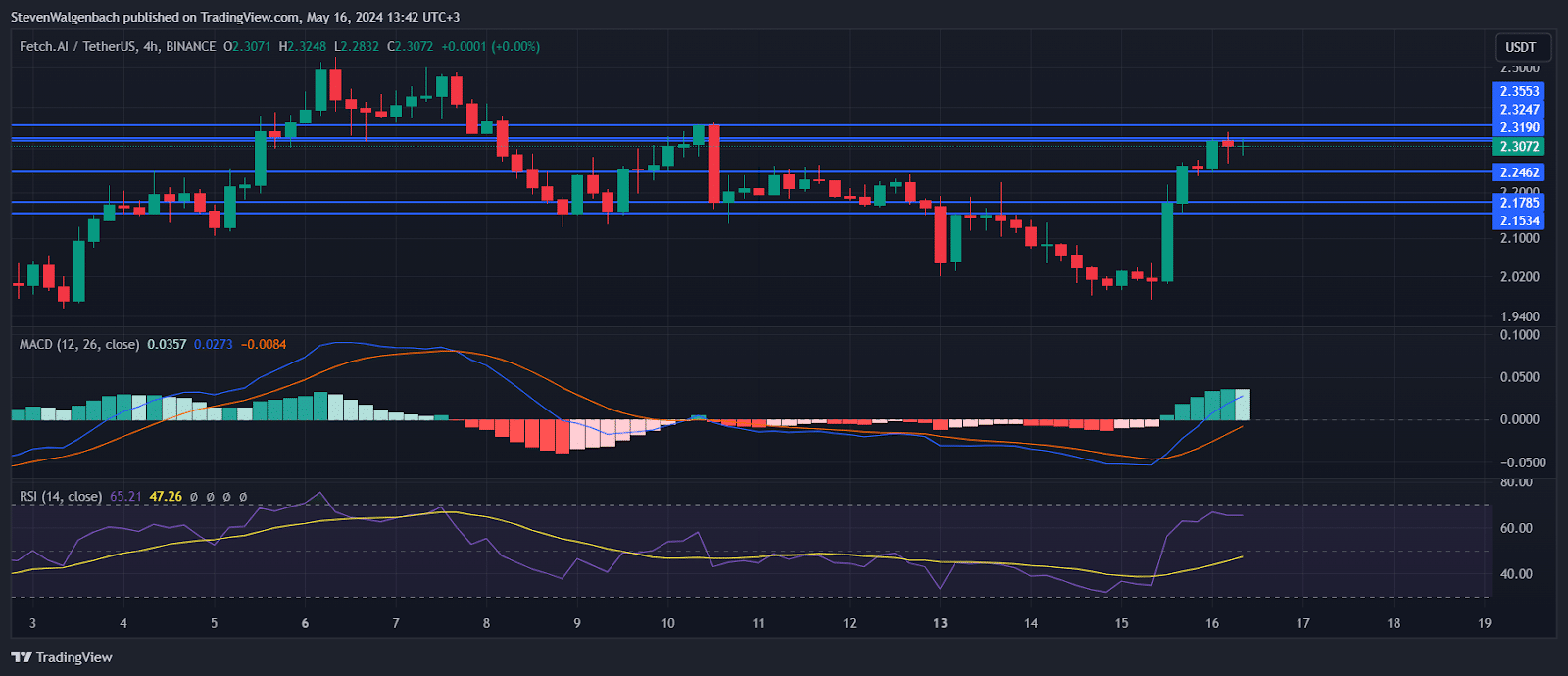

The latest technical data on the 4-hour chart for the FET crypto price indicates an emerging bullish trend as key indicators align. Over recent trading sessions, FET has shown increased activity and upward price movement. The closing prices suggest a strengthening position close to significant resistance levels.

The 9 Exponential Moving Average (EMA) has exhibited a continuous upward trajectory, moving from $2.1075 to $2.2228 over the past 24 hours. This increase is mirrored by the 20 EMA, advancing from $2.1147 to $2.1761, reinforcing a positive trend as the shorter EMA remains above the longer EMA, typically a bullish market indicator.

The Moving Average Convergence Divergence (MACD) further supports this bullish outlook. The latest figures show the MACD line at 0.0278, progressing positively above the signal line at -0.0083. The expanding histogram, now at 0.0360, suggests growing bullish momentum. The Relative Strength Index (RSI) remains in the mid-60s, currently at 65.63, indicating strong buying interest without veering into overbought territory.

Resistance and Support Levels

The FET crypto price is currently testing a crucial resistance at $2.319, with further resistance observed at $2.3247 and $2.3553. A decisive break above these levels could confirm the continuation of the upward trend. On the downside, support levels at $2.2462, followed by stronger floors at $2.1785 and $2.1534, should provide substantial safety nets in case of price retractions.

Considering the bullish indicators, traders might consider entering long positions if FET successfully breaches the $2.319 resistance with substantial volume. A conservative approach would involve setting stop losses just below the immediate support level at $2.2462. For those looking at potential short opportunities, a failure to break the current resistance could be exploited, especially if accompanied by a high selling volume, targeting the next support levels for exit points.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Ecoinimist is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.