MANA Price Might Drop as Indicators Flag Bearish

The MANA price fell over 1% in the last 24 hours to trade at $0.4146 at press time.

MANA Technical Overview

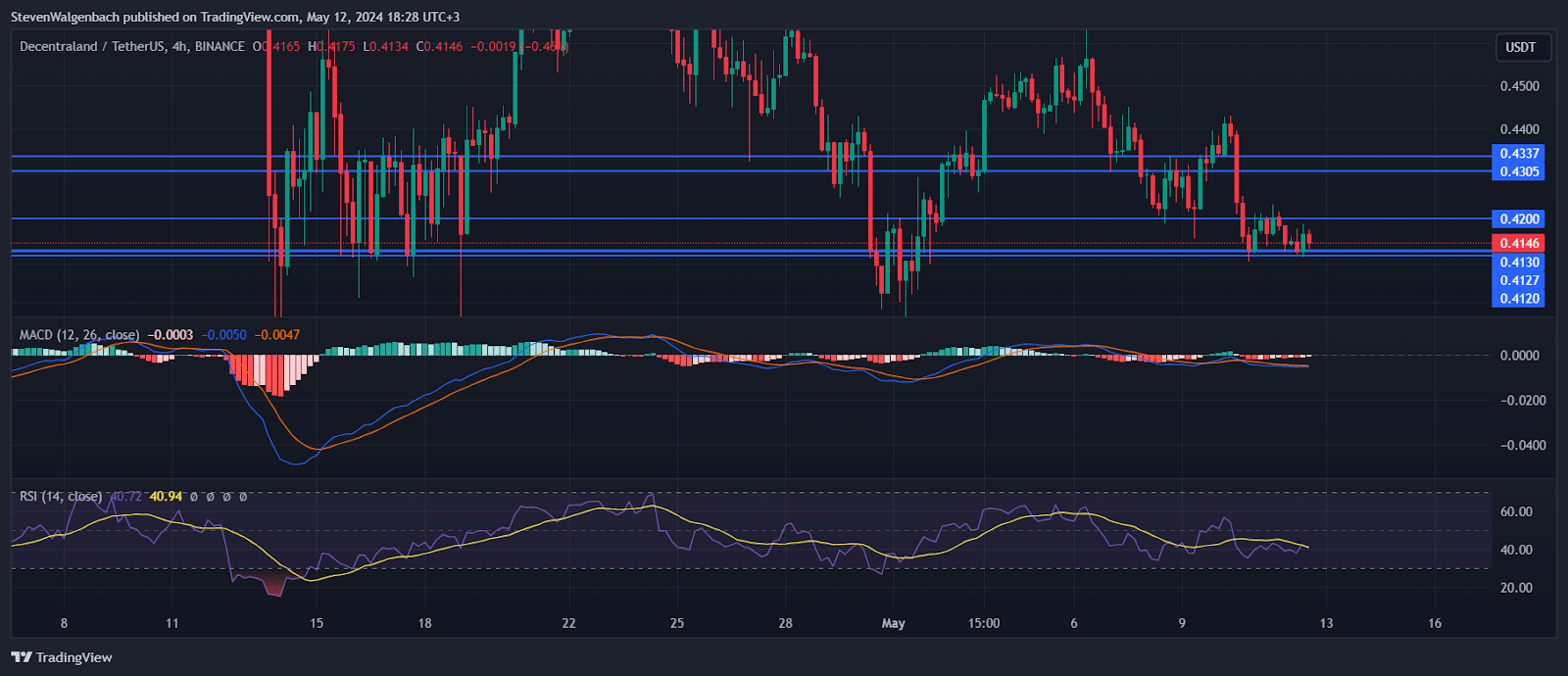

The MANA price has demonstrated moderate fluctuations in the recent sessions, according to the latest trading data on the 4-hour chart. Closing prices for the last five sessions were as follows: $0.4144, $0.4150, $0.4128, $0.4165, and $0.4147. These figures indicate a relatively tight price range, suggesting consolidation within the market.

The 9 EMA and 20 EMA provide key insights into market sentiment. Recent values for the 9 EMA show a gradual downtrend. Meanwhile, the 20 EMA values also show a downward trajectory. The price remaining below both the 9 EMA and 20 EMA suggests bearish pressure in the near term.

The Moving Average Convergence Divergence (MACD) values continue to show bearish momentum, with the MACD line remaining below the signal line over the recent periods. Notably, the histograms, indicating the difference between the MACD line and its signal line, are negative and have not shown significant recovery, further confirming bearish sentiment.

Still In a Bearish Zone

The RSI has remained below the neutral 50 mark, oscillating between 38.92 and 42.31 in the observed periods. This indicates that the market could still be in the bearish zone, with no immediate signs of a strong bullish reversal.

Looking at critical support and resistance levels, the immediate resistance is at $0.42, followed by more substantial barriers at $0.4305 and $0.4337. The support levels to watch are $0.413 and $0.4127, with $0.412 being a crucial psychological and technical point.

For traders considering entering positions, a break above $0.42 could offer a long opportunity targeting subsequent resistance levels. Conversely, a breach below $0.4127 might validate short positions aiming for lower support levels. Both strategies should consider stop-loss orders to manage risk effectively.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Ecoinimist is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.