The SHIB Price Jumps 3%, Is the Meme Coin on the Verge of a Breakout?

The SHIB price jumped over 3% in the past 24 hours to trade at $0.00002339 at press time.

SHIB Price Overview

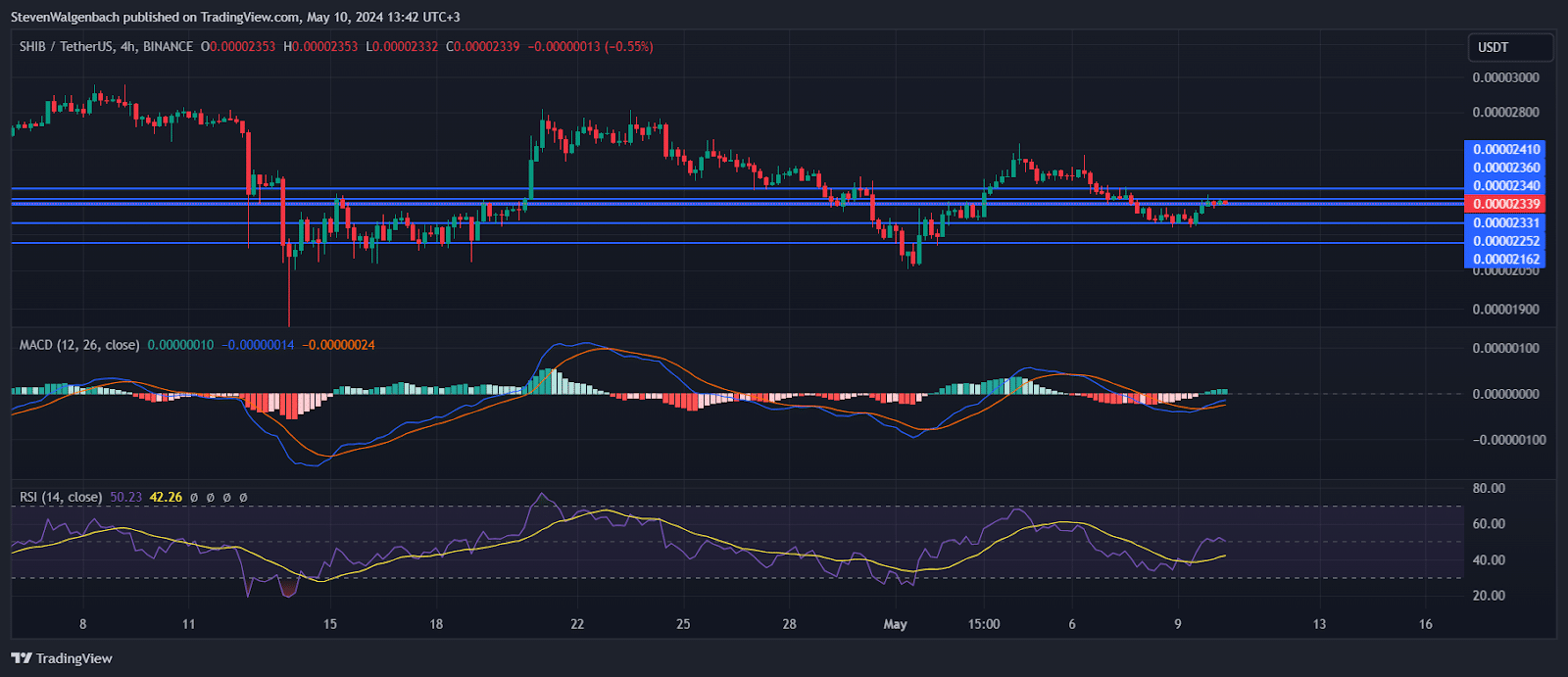

In recent trading sessions, SHIB has demonstrated subtle bullish signals on the 4-hour chart. The crypto’s closing prices have remained relatively stable, fluctuating between $0.0000233 and $0.00002352. The latest closing price hovers around $0.00002338. This suggests a mild consolidation phase near the key resistance level at $0.0000234.

The 9 Exponential Moving Average (EMA) has shown an increasing trend over the last few sessions, moving from $0.00002295 to $0.00002324. This upward movement in the 9 EMA, now positioned above the 20 EMA, indicates a potential bullish crossover. The 20 EMA has also risen slightly from $0.00002322 to $0.00002329, supporting the bullish sentiment in the market.

The Moving Average Convergence Divergence (MACD) analysis reveals increasing bullish momentum. The MACD line has ascended from -0.000000319 to -0.000000142, consistently rising above its signal line over the periods. This upward trajectory is further confirmed by the rising histogram values.

Technicals Leaning Slightly Bullish

The Relative Strength Index (RSI) has oscillated around the mid-line, with readings between 49.23 and 52.31. The recent RSI of 50.08 suggests a balanced but leaning towards bullish sentiment as it edges closer to the 52.31 high.

Volume trends have shown a decrease, which might typically suggest a lack of conviction among traders. However, given the stabilizing prices and improving technical indicators, this might also indicate that a significant sell-off is unlikely at the moment. Traders should watch for a sustained move above the immediate resistance at $0.0000234 to confirm further bullish potential, targeting subsequent resistance levels at $0.0000236 and $0.0000241.

Conversely, if SHIB fails to sustain above $0.0000234, the support levels at $0.00002331 and more critically at $0.00002252 will be areas of interest for potential rebound or further bearish action. A break below these levels could set the stage for testing the lower support at $0.00002162.

Considering the technical setup, potential entry points for long positions could be around the $0.0000234 breakout level. Stop losses just below the nearest support at $0.00002331 could then be considered. For traders considering short positions, a potential setup could be on a failure to break above $0.0000234, targeting the $0.00002331 or lower at $0.00002252, placing stop losses slightly above the $0.0000234 resistance.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Ecoinimist is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.