XRP Price Eyes Bullish Breakout: Poised to Challenge Key Resistance Levels?

The XRP price surged more than 5% in the last 24 hours to trade at $0.5207 at press time

The XRP Price Breaks Resistance.

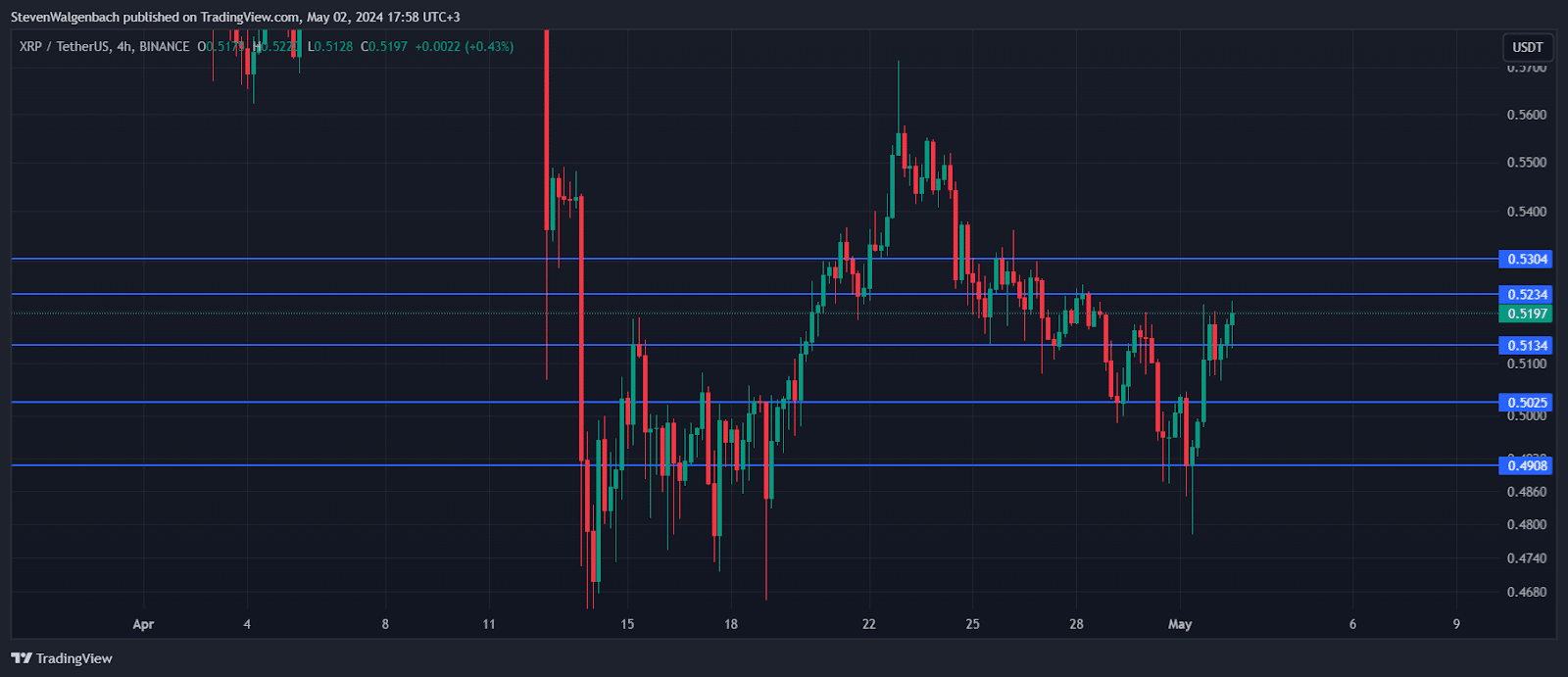

4-hour chart for XRP/USDT (Source: TradingView)

The XRP price has shown a subtle yet noticeable fluctuation in price movements, with closing prices oscillating between $0.5108 and $0.5175. As we delve into the technical analysis, we note that the price has been testing the 9 Exponential Moving Average (EMA), which currently stands at $0.5104, suggesting a potential turning point in market sentiment.

XRP has recently shown signs of stabilization around the $0.5136 to $0.5175 range, closely tracking the 9 EMA and slightly above the 20 EMA, which is currently at $0.5093. This positioning above both EMAs is generally perceived as a bullish indicator in the short term. However, the proximity of the EMAs also points to a potentially tight market without strong bullish momentum at this stage.

– MACD: The Moving Average Convergence Divergence (MACD) presents an interesting narrative with its values inching closer to the zero line. The latest readings show the MACD line at -0.0007 with a signal line of -0.0031, and a histogram value of 0.0024, indicating a decrease in bearish momentum and a possible shift towards a bullish crossover.

– RSI: The Relative Strength Index (RSI) is currently at 52.67, which is relatively neutral but leans towards bullish territory. This suggests that while there isn’t overwhelming buying pressure, there is certainly enough to prevent significant downturns.

Key Levels to Watch

– Resistance Levels: Short-term resistance for XRP is observed at $0.5234 and $0.5304. A breakout above these levels could be triggered by increased buying momentum, potentially turning these resistance levels into new supports.

– Support Levels: On the downside, support for XRP has formed around $0.5134, followed by more substantial levels at $0.5025 and $0.4908. These levels could serve as strategic points for placing stop-loss orders for those in long positions.

For traders considering entry and exit points:

– Long Positions: Entering a long position near the $0.5134 support with a stop-loss order just below $0.5025 might be advisable, targeting exits around the $0.5234 or $0.5304 resistance levels.

– Short Positions: Should the price break below $0.5134, initiating a short position with a target near the $0.5025 support level could be considered, placing a stop-loss slightly above the entry point to mitigate potential losses.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Ecoinimist is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.