Pepe Price Prediction: PEPE Showing Mixed Signals on 4H Chart

The Pepe price slid slightly in the last 24 hours to trade at $0.000006884 at press time.

The Pepe Price Resting On Support

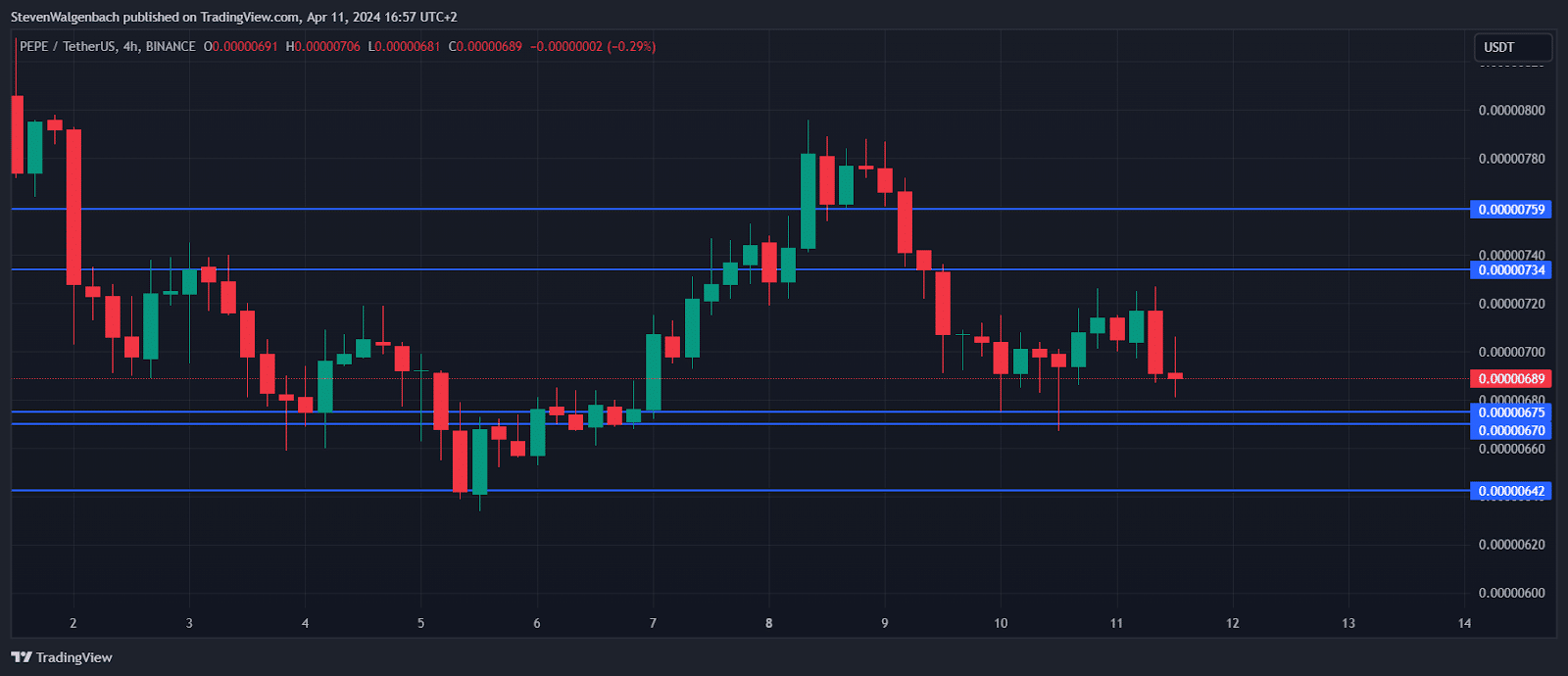

4-hour chart for PEPE/USDT (Source: TradingView)

In the world of cryptocurrency trading, the 4-hour chart for PEPE has recently exhibited a mixed bag of signals, leaving traders grappling with uncertainty regarding potential movements. Over the past few trading sessions, the closing prices have been oscillating, reflecting the indecisiveness prevalent in the market.

The Exponential Moving Averages (EMAs) provide a glimpse into the short-term trend. The 9 EMA has been hovering around $0.0000071, while the 20 EMA has been slightly higher, at approximately $0.00000716. This indicates a slight bearish sentiment in the short term, as the 9 EMA is below the 20 EMA.

The Moving Average Convergence Divergence (MACD) oscillator, however, paints a different picture. Despite minor fluctuations, the MACD remains negative, with the histogram showing a consistent bearish divergence. This suggests that selling pressure may persist in the near term.

Relative Strength Index (RSI), standing at around 48.94, indicates a neutral stance, neither oversold nor overbought. However, the recent downward trend in RSI values hints at weakening buying momentum.

Levels to Watch

In analyzing resistance and support levels for the Pepe price, several key thresholds emerge. Two barriers for the meme coin are identified at $0.00000734 and $0.00000759. These points suggest significant barriers to surpassing higher valuations, potentially signaling a shift in market sentiment or increased selling activity.

On the other hand, multiple support levels emerge for PEPE, indicating various points of potential price stability. These include $0.00000675, $0.0000067, and $0.00000642. Each of these levels represents a threshold where demand for the asset increases, potentially leading to a reversal in its downward trajectory or a consolidation phase.

For long trades, cautious entry points could be identified near the support levels, particularly around $0.0000067 and $0.00000642, with targets set at the resistance levels of $0.00000734 and $0.00000759. However, traders should remain vigilant for potential breakdowns below support levels, which could signify a further bearish trend.

On the flip side, short trades could be considered if the price approaches resistance levels with confirmation from other indicators such as the MACD and RSI. Short entry points could be established near $0.00000734 or $0.00000759, with stop-loss orders placed above these levels to mitigate risk.

Disclaimer: The information presented in this article is for informational and educational purposes only. It does not constitute financial advice or advice of any kind. Ecoinimist is not liable for any losses incurred as a result of utilizing content, products, or services mentioned. Readers are urged to exercise caution and conduct their own research before making any financial decisions.