Solana Price Prediction: Bearish Momentum Dominates Amid Potential Reversal Points

The Solana price plunged more than 7% in the last 24 hours to trade at $171.12 at press time.

The Solana Price Prints Lower Lows

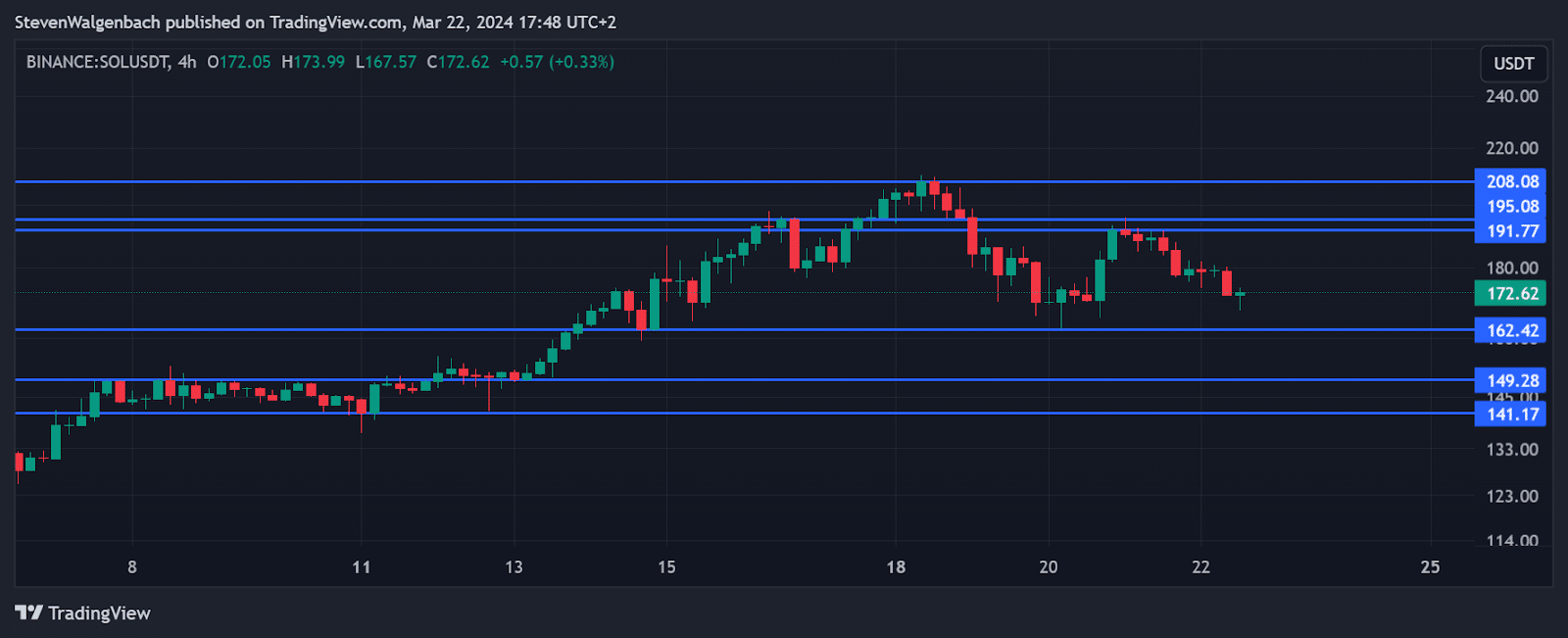

4-hour chart for SOL/USDT (Source: TradingView)

The Solana price presents a fascinating case study on the 4-hour chart, revealing a series of price actions and technical indicators that savvy traders and investors are keen to decipher. With closing prices experiencing a slight downtrend, the market sentiment appears cautious, yet ripe with potential trading strategies for those looking to capitalize on volatility.

The Exponential Moving Averages (EMAs) for the 9 and 20 periods provide a clearer picture of the current market dynamics. The 9 EMA has seen a gradual decrease, while the 20 EMA has also shown a downtrend. This convergence of EMAs suggests a bearish momentum in the short term, as prices have consistently closed below these key indicators, signaling potential resistance on the path to recovery.

The MACD (Moving Average Convergence Divergence) further substantiates this bearish sentiment with values indicating a strengthening downward momentum. The MACD line has moved from -0.340 to -2.359, with the signal line also indicating a bearish trend. Particularly noteworthy is the expanding histogram, which points to an increasing bearish momentum, an insight that could be crucial for traders looking for short opportunities.

Approaching Oversold Territory

Regarding the Relative Strength Index (RSI), readings have dipped from 46.63 to 37.92, moving closer to the oversold territory. This suggests that the asset may be under considerable selling pressure, but it also hints at a potential reversal if the market deems the sell-off to be overextended.

As for potential movements, traders should closely monitor the resistance levels at $191.77, $195.08, and the more formidable $208.08, which could serve as significant barriers in any upward trajectory. On the flip side, support levels at $162.42, followed by $149.28 and $141.17, will be critical in preventing further declines. The proximity of the price to these levels, combined with the technical indicators, suggests a cautious approach might be warranted.

Given the bearish indicators, potential entry points for short trades could be considered around the current levels or on failed attempts to break above the 9 and 20 EMAs. For long positions, waiting for a clear reversal signal, such as an RSI bounce back from the oversold region or a bullish MACD crossover, could provide a more favorable risk-reward ratio.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Ecoinimist is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.