Ethereum Price Analysis: ETH Posts a Slight Gain but Struggles to Break Out

The Ethereum price rose more than 1% over the past 24 hours to trade at $2,555.39 at press time as investors take a bet on the potential launch of an Ether ETF.

The Ethereum Price Continues to Trade in a Positive Channel

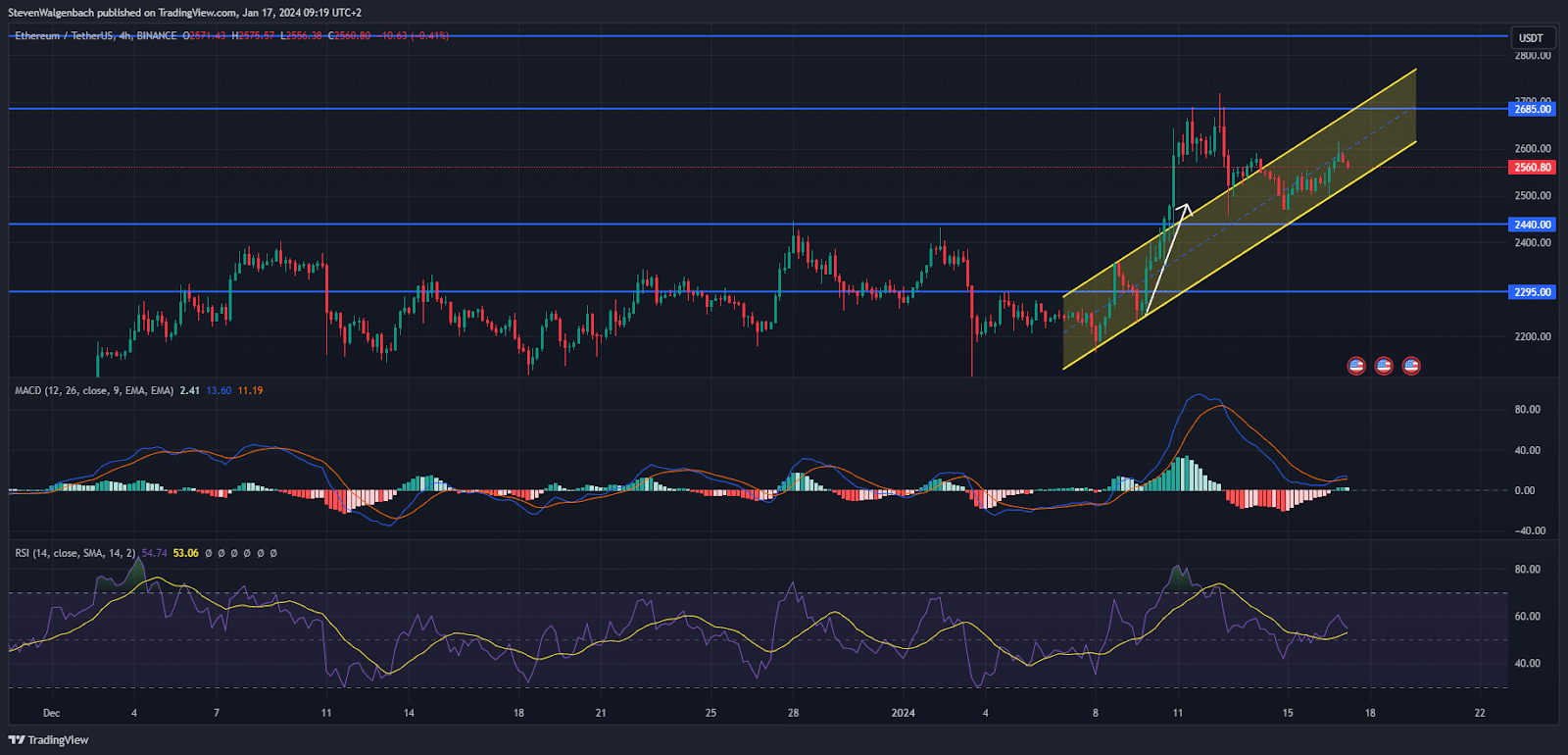

4-hour chart for ETH/USDT (Source: TradingView)

The Ethereum price printed a new higher low over the past 24 hours. This was after it retested the lower boundary of a medium-term price channel that has formed on its charts in the last couple of days. The previous time ETH rebounded from this level was on Jan. 9, and was followed by a strong bullish move.

However, the latest retest of the price channel’s lower barrier was somewhat anticlimactic. Although the Ethereum price rebounded off of the mark, it was only able to rise to just above the middle level of the bullish price channel, as traders quickly realized their profits. This may be linked to the bankrupt crypto lender Celsius as it tries to pay off its debts.

ETH Could Retest the Channel Boundary Soon

As a result of the failed bullish breakout, the Ethereum price corrected and is currently on track to retest the price channel’s lower limit in the next few hours. Technical indicators on ETH’s 4-hour chart also suggested that the Ethereum price may continue to drop in the next 24 hours. Both the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) are flagging bearish.

The MACD line was closing in on the MACD Signal line, and may cross below the Signal line in the next 24 hours. Should this happen, it will trigger a significant bearish technical flag that will signal that ETH has entered into a bearish cycle. In addition to this, the RSI is looking to cross below its Simple Moving Average (SMA) line. Should these two lines intersect, it may suggest that sellers have gained the upper hand against buyers on ETH’s 4-hour chart.

If these bearish technical flags are confirmed and validated, the Ethereum price may fall to the immediate support level at $2,440. Continued sell pressure could even drag the altcoin’s value down to as low as $2,295 in the short term.

This bearish thesis may be invalidated if ETH closes a 4-hour candle above the middle level of the price channel. In this alternative scenario, ETH could overcome $2,685 before rising to $2,840.

The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Ecoinimist is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.