How Ethereum Could React to Bitcoin ETF Approval

As the U.S. Securities and Exchange Commission (SEC) nears its decision deadline on January 10 for the Bitcoin (BTC) ETF, the crypto market, including Ethereum (ETH), the second-largest cryptocurrency, is bracing for potential impacts.

Ethereum ETF Prospects

The approval of a Bitcoin ETF could pave the way for other crypto-based ETFs, including Ethereum. In December 2023, the SEC delayed decisions on several Ethereum ETF applications in the U.S. to May 2024. These include applications from Hashdex Nasdaq, Grayscale, VanEck, and a joint application from ARK Invest and 21Shares. The delay is part of the SEC’s process of gathering public input before making a decision. Notably, Ethereum has not been classified as a security in the SEC’s recent lawsuits against crypto exchanges, nor has the SEC challenged the leading altcoin’s classification through the ETF registration process with the Commodity Futures Trading Commission (CFTC).

Ethereum-Bitcoin Correlation

Ethereum’s price is closely correlated with Bitcoin’s price. A Bitcoin ETF approval could lead to increased crypto exposure among traditional investors, potentially resulting in a surge in the altcoin’s price. Conversely, a delay or denial of the Bitcoin ETF could exert short-term bearish pressure on the market.

ETH Price Technical Analysis

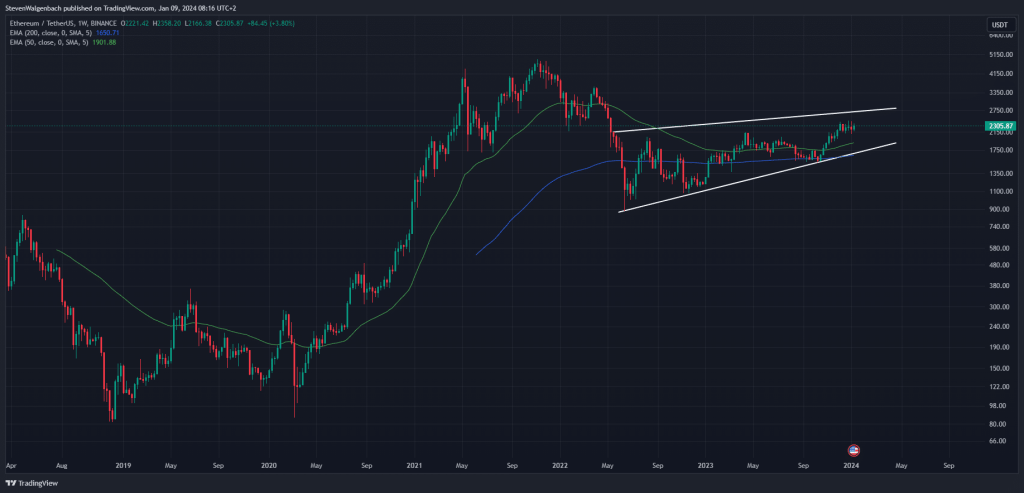

Weekly chart for ETH/USDT (Source: TradingView)

Technically, ETH’s price is near the resistance trendline of a rising wedge pattern. A delay or denial of the Bitcoin ETF could lead to a price correction toward the wedge’s lower trendline near $1,865 by February.

On the other hand, approval of the ETF may lead Ethereum to invalidate its rising wedge setup in favor of an ascending triangle reversal pattern. The upside target of this pattern is near $3,870 by March, a 75% increase from current levels, coinciding with the 0.786 Fibonacci line.

As the crypto community awaits the SEC’s decision, Ethereum’s price reaction will be a key indicator of the market’s sentiment and the potential for broader acceptance of cryptocurrencies in traditional investment portfolios.

The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Ecoinimist is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.