Robert Kiyosaki Backs BTC Amid Gold Surge & Mining Record

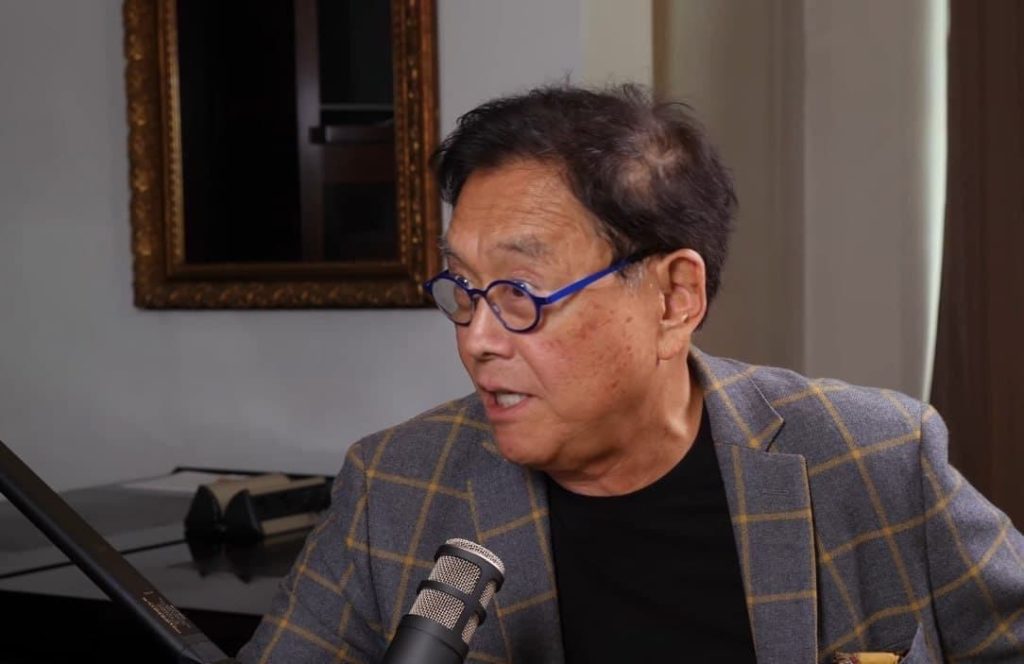

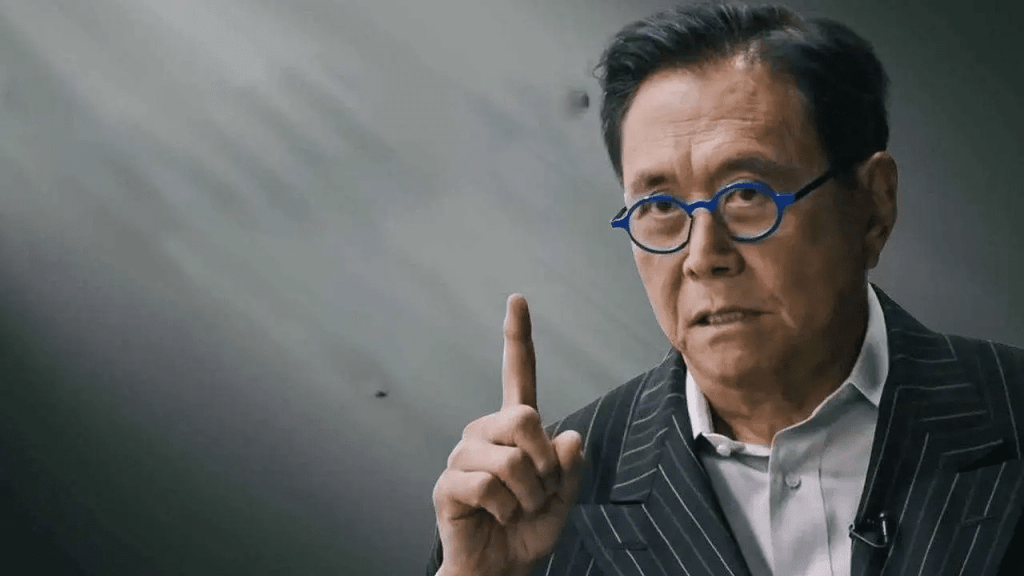

Robert Kiyosaki, the influential author of “Rich Dad Poor Dad,” has recently encouraged his audience to move away from traditional currencies and invest in alternative assets, including gold, silver, and Bitcoin. His advice comes at a time when gold prices have reached a historic high, surpassing $2,000.

In the cryptocurrency sector, Bitcoin (BTC) has achieved a significant milestone. The difficulty of Bitcoin mining has set a new record following an adjustment at block 818496. Alongside this, the average hashrate of the BTC network has soared to a remarkable 504.80 EH/s.

Robert Kiyosaki Shifts Towards Gold, Silver, and BTC

Robert Kiyosaki’s recent statements have focused on moving away from traditional monetary systems and investing in gold, silver, and Bitcoin. His message, driven by the rising prices of gold and his optimistic forecast for Bitcoin’s value, is to invest in these assets sooner rather than later.

Gold prices have seen a significant increase, recently breaking the $2,000 per ounce mark. This surge is attributed to various factors, including a weaker U.S. dollar and the anticipation that the Federal Reserve’s interest rate hikes are reaching their peak.

Kiyosaki has also made a notable prediction about Bitcoin’s value, suggesting it could soar to $135,000. This forecast follows BTC’s recent recovery, where it regained the $38,000 level, fueled by expectations of Bitcoin exchange-traded funds (ETFs) and regulatory clarity.

While Kiyosaki is enthusiastic about gold, silver, and cryptocurrencies, some experts advise caution, pointing to his history of dramatic predictions and a perceived lack of detailed financial knowledge.

Kiyosaki has long advocated for alternative assets like gold, silver, and Bitcoin as hedges against economic uncertainty and inflation, arguing that traditional fiat currencies are vulnerable to devaluation.

Bitcoin Mining Reaches a New Peak

The Bitcoin network has recently marked a significant achievement in mining difficulty, hitting a record high at block 818496. This milestone, along with an impressive average hashrate of 504.80 EH/s, highlights the strength and resilience of the BTC network.

Bitcoin’s mining difficulty has been consistently rising in 2023. These adjustments, which occur roughly every two weeks, aim to maintain a steady block time and balance the rate of Bitcoin creation with the network’s computational power.

The BTC hashrate has reached an all-time high of 491 EH/s. This increase is significant as the Bitcoin community awaits the next halving event, which historically leads to an increase in BTC’s price due to reduced new coin creation and speculative interest.