Bitcoin Traders Are Betting Small in 2026 — Even as Analysts Eye $150K and Beyond

Prediction market traders are signaling restraint about Bitcoin’s near-term upside, even as many analysts argue the next leg of the bull market may simply be delayed rather than canceled.

Odds on Polymarket suggest traders are willing to bet on modest gains, but remain cautious about a major breakout before the year is out.

Polymarket Traders Price In Cautious Bitcoin Upside

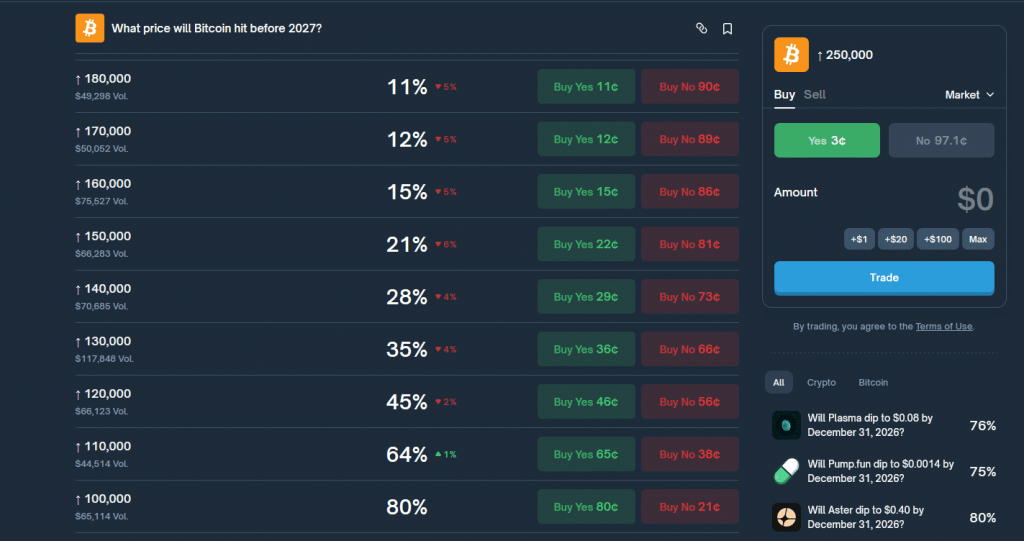

On Polymarket, contracts tracking Bitcoin’s potential price trajectory show subdued confidence in aggressive targets. Traders currently assign just a 21% probability that Bitcoin will reach $150,000 in 2026. The odds improve at lower levels, but even then reflect a restrained outlook.

Polymarket odds on BTC price by year end (Source: Polymarket)

According to the live market asking, “What price will Bitcoin hit before 2027?”, the most confident bet is that Bitcoin reaches $100,000, carrying an 80% probability.

Beyond that threshold, conviction drops sharply.

The odds of Bitcoin hitting $120,000 sit at 45%, while a move to $130,000 is priced at 35%. Traders give a 28% chance to $140,000.

The pricing stands in contrast to the optimism often seen in traditional crypto bull phases, when traders typically crowd into high-upside bets well before major moves materialize.

The End Of The Four-Year Cycle Raises New Questions

One explanation for the cautious tone may lie in Bitcoin’s evolving market structure.

The long-observed four-year cycle, built around Bitcoin halving events, has historically given traders a framework to anticipate major price expansions. This pattern now appears less reliable after Bitcoin closed 2025 in the red, a rare outcome during what was previously considered a post-halving expansion phase.

With the four-year cycle losing predictive power, traders are being forced to rethink familiar playbooks. Rather than leaning on historical analogs, market participants may be waiting for clearer macro or regulatory catalysts before committing to high-conviction bets.

At the same time, the growth of Bitcoin derivatives has altered market dynamics. Options volumes have surged, and some analysts warn that heavy use of yield and hedging strategies could dampen spot-driven rallies, at least in the short term.

Macro And Political Factors Could Shift Sentiment

Despite bearish odds on Polymarket, macroeconomic developments could still reshape Bitcoin’s trajectory.

President Donald Trump is expected to announce a new chair of the US Federal Reserve in the coming weeks, a decision markets believe could influence the pace and depth of future interest rate cuts.

Expectations of easier monetary policy have already fueled strong rallies in traditional safe-haven assets. Gold and silver both set new all-time highs in the fourth quarter of 2025, reflecting investor anticipation of looser financial conditions. Digital assets, by contrast, have remained largely range-bound, potentially leaving room for a delayed response if liquidity conditions improve.

Regulatory clarity may also play a decisive role. Two major US crypto bills — the GENIUS Act and the CLARITY Act — are expected to advance in 2026. Supporters argue that clearer rules around custody, issuance, and market structure could unlock fresh institutional demand by reducing compliance uncertainty.

Analysts See A Bull Market Deferred, Not Dead

While prediction market traders remain hesitant, many analysts continue to outline bullish scenarios beyond the immediate horizon. Research teams at Standard Chartered, Strategy, and Bernstein have all suggested Bitcoin could reach $150,000 in 2026 if monetary easing and institutional inflows converge.

More optimistic forecasts push even higher. Fundstrat strategist Tom Lee has repeatedly argued that Bitcoin could climb into a $200,000 to $250,000 range under a favorable mix of policy support, regulatory clarity, and renewed risk appetite.

For now, Polymarket’s odds suggest traders are content to wait for proof rather than price in aggressive upside early. Whether that caution reflects disciplined risk management or a misreading of longer-term catalysts may only become clear as Bitcoin navigates the shifting macro and regulatory landscape of 2026.