Prenetics Hits Pause on Bitcoin Buying as IM8’s Growth Steals the Spotlight

Prenetics Global Limited, a health-sciences company backed by David Beckham that embraced a Bitcoin treasury strategy earlier this year, has halted further cryptocurrency purchases as prolonged market weakness reshapes corporate enthusiasm for holding digital assets on balance sheets.

The Nasdaq-listed firm said it stopped buying Bitcoin on Dec. 4 and will not allocate additional capital toward new acquisitions, choosing instead to focus exclusively on scaling its consumer health and nutrition brand IM8.

The move marks a notable shift for a company that only months ago positioned itself among a growing cohort of publicly traded firms adopting a Bitcoin-first balance-sheet strategy inspired by Strategy, led by prominent BTC advocate Michael Saylor.

From Bitcoin Accumulation to Operational Focus

Prenetics rolled out its Bitcoin accumulation strategy in June, investing $20 million to acquire roughly 187 Bitcoin at an average price of $106,712 per coin. At the time, the company said it planned to buy one BTC per day, aligning itself with the idea that long-term Bitcoin exposure could enhance shareholder value.

That strategy was reinforced in October when Prenetics announced a $48 million funding round, backed by investors including Kraken, Exodus, GPTX and American Ventures.

Chief executive and co-founder Danny Yeung said at the time that the capital would help scale IM8 globally while building a Bitcoin reserve alongside a long-term target of $1 billion in revenue and BTC holdings within five years.

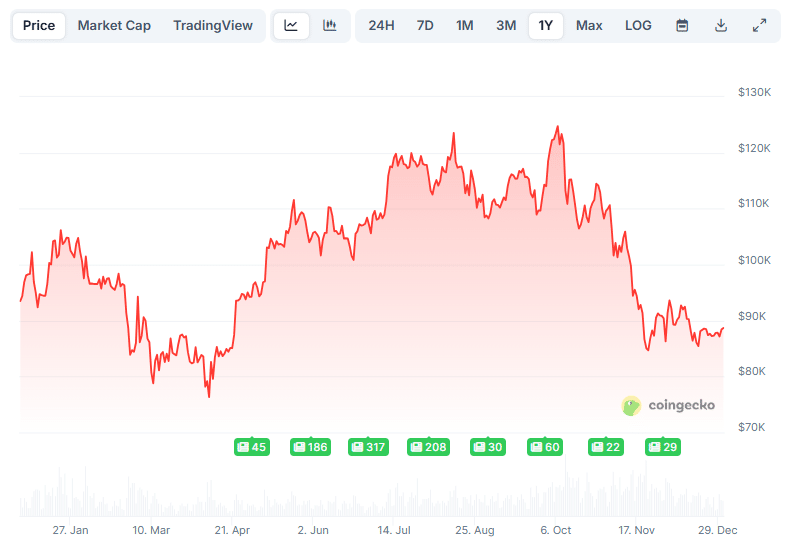

However, the sharp downturn in crypto markets in October — which cooled enthusiasm for corporate Bitcoin strategies more broadly — prompted a reassessment. BTC was trading near $88,000 at the time of writing, leaving Prenetics’ initial purchase sitting on an unrealized loss of about 17%, or roughly $3.4 million.

BTC price (Source: CoinGecko)

IM8’s Rapid Growth Changes the Equation

In a statement released Tuesday, Prenetics said the decision to halt Bitcoin buying was driven by the unexpectedly rapid success of IM8, a daily all-in-one nutrition supplement brand.

According to the company, IM8 has generated more than $100 million in annualized recurring revenue within just 11 months of launch, far exceeding internal expectations.

“The phenomenal success of IM8 has exceeded all expectations and scaled much faster than we originally anticipated,” Yeung said. “Our board and management team unanimously agreed that the most promising path to creating significant, sustainable shareholder value is to devote our undivided attention to this opportunity clearly visible in IM8.”

While Prenetics will no longer pursue additional BTC purchases, it will continue to hold its existing 510 Bitcoin as a reserve asset, alongside more than $70 million in cash and cash equivalents. At current prices, the Bitcoin holdings are valued at just under $45 million.

Market Reaction and Investor Signals

Shares of Prenetics fell 3.32% in Tuesday trading on Nasdaq following the announcement, according to Google Finance data.

Prenetics share price (Source: Google Finance)

Even so, the stock remains up nearly 170% this year, reflecting strong investor confidence driven largely by IM8’s growth rather than its crypto exposure.

By contrast, Strategy — the most prominent corporate Bitcoin holder — has seen its shares fall nearly 48% this year, while BTC itself is down about 5.6% over the same period.

Strategy now holds 672,497 Bitcoin following its latest purchase, accounting for a significant portion of the nearly 1.1 million BTC held collectively by 192 publicly traded companies, according to BitcoinTreasuries.NET.

A Broader Test for Corporate Bitcoin Models

The divergence between Prenetics and Strategy shows a growing split among companies that adopted Bitcoin treasury strategies during bullish market conditions. While some remain committed to long-term accumulation, others are reassessing capital allocation priorities as volatility persists.

Strategy executives have continued to defend their approach. Chief financial officer Andrew Kang said this week that the company expects Bitcoin to rise substantially over time, reinforcing its conviction to keep buying despite near-term price swings.

Not all observers are convinced. Fakhul Miah, managing director at GoMining Institutional, warned earlier this year that “copycat” firms attempting to build Bitcoin-centric balance sheets without robust risk management could expose shareholders to unnecessary downside.