Tokenized Stocks Surge Past $1.2B in Early Signal of Blockchain’s Next Phase

Demand for tokenized equities has accelerated sharply since their mainstream debut earlier this year, positioning the emerging asset class as a potential early signal of broader blockchain adoption beyond Bitcoin and stablecoins.

Data from Token Terminal shows that the combined market capitalization of tokenized stocks has climbed to a record $1.2 billion. The increase was driven by particularly strong growth in September and December.

“Tokenized stocks today are like stablecoins in 2020,” Token Terminal said, emphasizing how early the sector remains.

At that time, stablecoins were still a niche experiment, yet they have since grown into a roughly $300 billion market that now underpins much of the global crypto economy.

Tokenized Stocks: From Niche Experiment To Emerging Market

Industry participants increasingly compare tokenized equities to the early decentralized finance boom of 2020, when onchain lending, trading, and yield products first began attracting sustained capital inflows.

The analogy suggests expectations that tokenized stocks could move beyond proof-of-concept use cases and become a foundational layer connecting traditional finance with blockchain infrastructure.

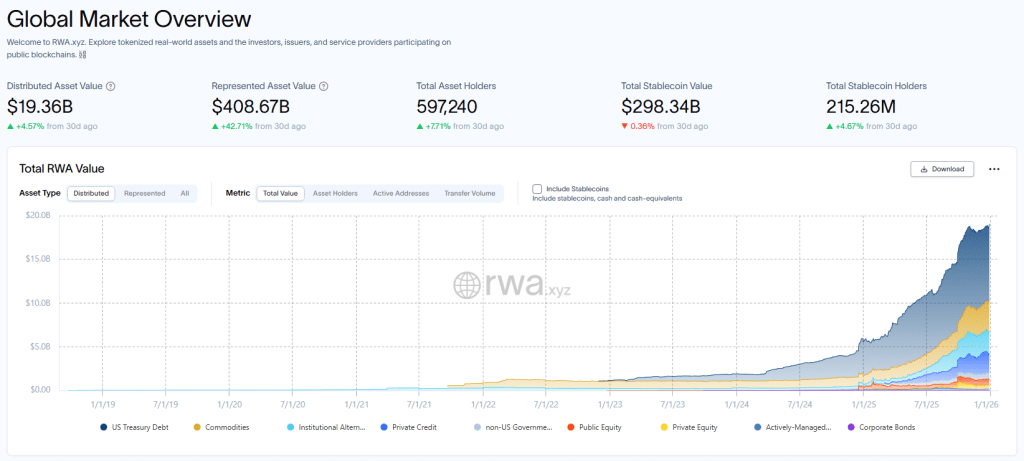

Global tokenized RWA market overview (Source: RWA.xyz)

Supporters argue that putting equities onchain offers several structural advantages. These include faster settlement times compared with legacy clearing systems, around-the-clock trading that is not limited by exchange hours, and fractional ownership that lowers the barrier to entry for global investors.

For users in regions with limited access to U.S. and European stock markets, tokenized equities could offer exposure that was previously difficult or costly to obtain.

Despite those advantages, the market remains small relative to traditional equities, which collectively carry tens of trillions of dollars in value. Still, the speed of growth is drawing increasing attention from both crypto-native firms and established financial institutions.

Institutional Momentum Builds

The sharp rise in tokenized stock activity in September was not accidental.

Around that time, Backed Finance launched its xStocks product suite on Ethereum, debuting roughly 60 tokenized equities. The launch was supported through partnerships with major cryptocurrency exchanges Kraken and Bybit, providing immediate distribution to a broad international user base.

Momentum has continued into the final quarter of the year. Earlier this month, tokenization firm Securitize announced plans to introduce compliant, onchain trading for public equities. The company said the initiative would focus on direct share ownership, an approach aimed at addressing regulatory concerns and reducing reliance on synthetic or derivative-based exposure.

Meanwhile, Ondo Finance has outlined plans to roll out tokenized U.S. stocks and exchange-traded funds on Solana in early 2026. The move signals that competition in tokenized equities is expanding beyond Ethereum-based ecosystems and into high-throughput alternative networks.

Exchanges And Market Infrastructure Follow

Crypto exchanges are also moving to position themselves at the center of this shift.

Coinbase announced this month that it plans to offer stock trading as part of its broader strategy to become an “everything exchange,” combining digital assets, tokenized securities, and traditional financial products within a single platform.

Perhaps the strongest signal of institutional interest came from Nasdaq, which disclosed that it has filed with the U.S. Securities and Exchange Commission to offer tokenized stocks on its platform. The filing marked one of the clearest indications yet that tokenization is moving beyond crypto-native firms and into the core of market infrastructure.

Nasdaq’s head of digital assets strategy, Matt Savarese, described tokenization as a strategic priority rather than a disruptive overhaul. “We’re not looking at upending the system; we want everyone to come along for that ride and bring tokenization more into the mainstream,” he said in an interview with CNBC.

An Early Signal Of Broader Blockchain Adoption

While tokenized equities remain a small market today, their rapid growth and growing institutional backing suggest they could play a meaningful role in the next phase of blockchain adoption.

As regulatory clarity improves and more traditional players experiment with onchain settlement and trading, tokenized stocks may follow a path similar to stablecoins, evolving from a niche product into core financial infrastructure.

For now, the sector stands at an inflection point. Its recent expansion suggests that the next wave of blockchain adoption may be driven less by new cryptocurrencies and more by the migration of familiar financial assets onto blockchain rails.