USDC Supply Shrinks After $51M Burn on Solana as Circle Rebalances Stablecoin Treasury

Circle’s USDC stablecoin is seeing a renewed contraction in its circulating supply after the USDC Treasury executed a fresh token burn on the Solana blockchain.

According to on-chain transaction tracker Whale Alert, roughly $51 million worth of USDC was permanently removed from circulation, continuing a pattern of recent supply adjustments across multiple networks.

The burn involved 51,168,791 tokens, valued at approximately $51.19 million at the time of execution.

Token burns are a common mechanism used by stablecoin issuers to manage circulation, typically reflecting redemptions, treasury rebalancing, or shifts in demand between blockchains.

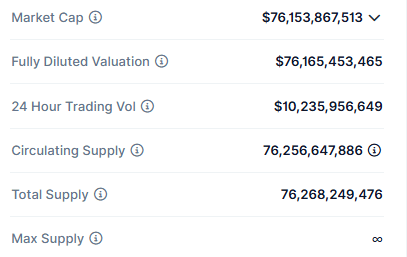

Following the transaction, USDC’s total circulating supply fell to about 76.26 billion tokens.

USDC metrics (Source: CoinGecko)

Recent USDC Burns Signal Active Supply Management

The Solana burn is part of a broader series of treasury actions carried out over the past several days.

Earlier in the week, the USDC Treasury destroyed an additional $50 million worth of tokens on the Ethereum blockchain, highlighting that the supply contraction is not isolated to a single ecosystem.

While token burns can be interpreted as a bullish signal for many cryptocurrencies, their implications for a dollar-pegged stablecoin are different. Because the stablecoin is designed to maintain a one-to-one peg with the U.S. dollar, supply reductions generally have little direct impact on price. Instead, they are often viewed as indicators of on-chain demand trends or user behavior, such as reduced transactional activity or migration to alternative stablecoins.

Solana Burn Follows Visa’s USDC Settlement Expansion

The timing of the Solana-based burn has drawn attention, coming just days after Visa expanded USDC settlement capabilities in the United States. Under the new framework, banks can use USDC on the Solana to settle transactions, a move seen as a milestone for stablecoin-based payments.

Solana’s high throughput and low transaction costs have made it an increasingly attractive network for payments and stablecoin transfers. However, the recent burn suggests that despite growing institutional use cases, near-term on-chain demand for the token on Solana may be softer, or that redemptions have temporarily outpaced issuance on the network.

Minting on Ethereum Offsets Supply Reduction

At the same time, the USDC Treasury has been actively minting new tokens on Ethereum, effectively balancing burns on one chain with issuance on another. On Dec. 27, on-chain data showed that approximately 90 million USDC was minted on Ethereum, following a previous mint of around 60 million tokens.

Circle has not publicly commented on the specific motivations behind the recent minting activity. However, such actions are typical for large stablecoin issuers and often reflect demand from institutional clients, liquidity provisioning for exchanges, or preparation for anticipated transaction volumes.

Market Position And Regulatory Momentum

USDC continues to trade close to its dollar peg, recently changing hands at around $0.998. The stablecoin currently accounts for roughly 2.59% of the total cryptocurrency market capitalization, maintaining its position as one of the largest regulated dollar-backed digital assets.

The recent treasury movements coincide with a period of regulatory progress for Circle. In late 2025, the company secured regulatory approval from Abu Dhabi Global Market, allowing it to operate as a Money Services Provider within Abu Dhabi’s International Financial Centre. The approval strengthens Circle’s presence in the Middle East and supports its strategy of expanding USDC usage in regulated financial environments.

Uneven Demand Across Blockchains

Taken together, the recent burns on Solana and Ethereum, alongside sizable minting on Ethereum, suggest uneven demand across blockchain ecosystems rather than a broad decline in interest.

While the Solana burn may reflect short-term redemptions or reduced activity, the continued issuance on Ethereum points to sustained demand in more established DeFi and institutional markets.

As competition among stablecoins intensifies and real-world payment use cases expand, Circle’s ability to dynamically manage USDC supply across multiple chains is likely to remain a key factor in preserving the stablecoin’s relevance and liquidity in global crypto markets.