China’s Digital Yuan Is About to Pay Interest as PBOC Unveils Major 2026 Overhaul

The People’s Bank of China (PBOC) will allow commercial banks to pay interest on digital yuan holdings under a new framework that takes effect on Jan. 1, 2026.

The move represents a fundamental redesign of the central bank digital currency (CBDC), known as the e-CNY, shifting it away from its current role as a cash-like instrument toward something closer to a traditional bank deposit.

In an article published by the state-backed newspaper Financial News, PBOC deputy governor Lu Lei said the digital yuan will begin operating as a “digital deposit currency.” Under the new framework, verified e-CNY wallets will be eligible to receive interest payments from commercial banks, in line with existing self-regulatory agreements governing deposit pricing.

Digital yuan balances will also receive the same protection as conventional deposits under China’s deposit insurance system. The policy further grants banks greater flexibility to incorporate digital yuan balances into their broader asset-liability management, an important step toward normalizing the CBDC within the banking sector.

From Digital Cash To Digital Deposit Money

Lei described the changes as part of a broader “action plan” to modernize the digital yuan’s role within the financial system. Under the plan, the e-CNY will function as a digital payment and circulation tool issued and supervised by the central bank, while possessing the attributes of commercial bank liabilities.

According to Lei, the digital yuan will be account-based, compatible with distributed ledger technology, and capable of fulfilling core monetary functions such as a unit of account, store of value, and medium for cross-border payments.

Allowing interest payments is seen as a key incentive that could make holding digital yuan balances more attractive relative to both physical cash and non-interest-bearing digital wallets.

A Decade Of Research And Pilot Programs

The updated framework follows more than a decade of research and experimentation. Lei said the PBOC began theoretical research and closed testing for a legal digital currency around 2014, under the unified deployment of China’s central leadership.

By 2016, the central bank had proposed a formal theoretical framework for a sovereign digital currency and began piloting management systems and operational mechanisms. Over subsequent years, a series of demonstrations and open pilots helped establish what Lei described as a “preliminary ecosystem” for the digital yuan.

He said the process has forged a development path for digital currency “with Chinese characteristics,” led by the PBOC, supported by commercial financial institutions, and integrated with existing payment systems while incorporating newer technologies.

Competition From Dominant Mobile Payment Platforms

Despite being regarded as one of the most advanced CBDCs globally, adoption of the digital yuan has been slower than authorities initially hoped. A major challenge has been competition from entrenched mobile payment platforms, particularly WeChat Pay and Alipay, which dominate China’s cashless economy.

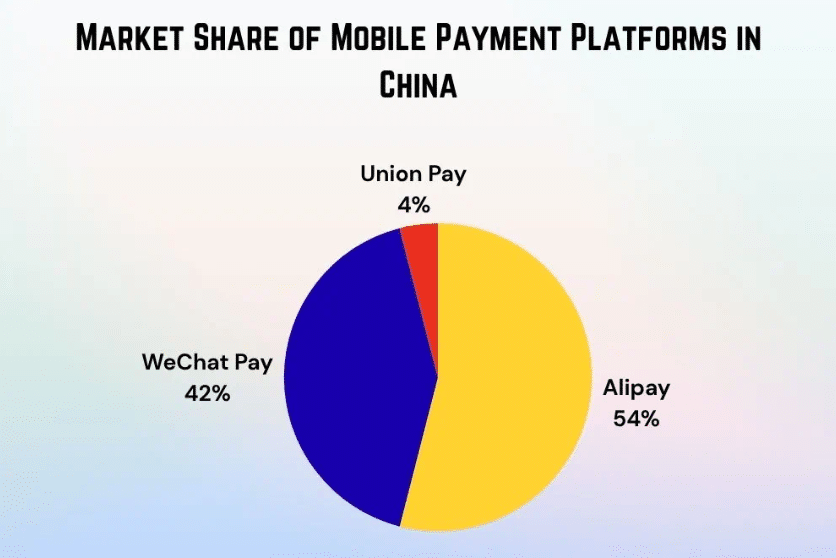

As of early August, Alipay accounted for roughly 54% of China’s mobile payments market, while WeChat Pay held about 42%, according to data cited by CoinLaw.

Market share of mobile payment platforms in China (Source: CoinLaw)

Those platforms are deeply embedded in everyday transactions, leaving limited room for the e-CNY to displace existing habits.

Usage Growth And Cross-Border Ambitions

Even with those challenges, digital yuan usage has continued to expand.

As of November 2025, the e-CNY had processed 3.48 billion transactions with a cumulative value of 16.7 trillion yuan, or about $2.38 trillion, according to Lei. Around 230 million personal wallets and approximately 18 million corporate wallets have been opened through the official digital yuan app.

China has also pushed the e-CNY into cross-border payment trials. Lei said 4,047 cross-border transactions, totaling the equivalent of 387.2 billion yuan, have been processed through a multilateral central bank digital currency bridge. The digital yuan accounted for about 95.3% of the total transaction value across all participating currencies.

As part of the new action plan, the PBOC also intends to establish an international digital yuan operations center in Shanghai, reinforcing its ambition to position the e-CNY as both a domestic payment tool and a competitive player in future cross-border settlement systems.