Ethereum in 2026: What Wall Street, Treasury Firms and Developers Are Betting On

Ethereum may be approaching a pivotal moment after a subdued end to 2025, with several prominent industry figures arguing that the network’s fundamentals are aligning for a stronger year ahead.

While Ether’s price has struggled amid a broader crypto market downturn, expanding institutional adoption, accelerating tokenization of real-world assets and major protocol upgrades are reinforcing the case that Ethereum could enter a new growth phase in 2026.

Institutional Adoption Could Lift Ethereum’s TVL

Sharplink Gaming co-CEO Joseph Chalom believes Ethereum’s total value locked (TVL) could rise as much as tenfold in 2026 as capital flows into stablecoins, tokenized assets and onchain financial infrastructure.

Sharplink Gaming is currently the second-largest public Ethereum treasury company, holding 797,704 ETH worth roughly $2.33 billion, according to Ethereum Treasuries data.

Chalom recently forecast that the global stablecoin market will grow to $500 billion by the end of next year, up from roughly $308 billion today.

With more than half of all stablecoin activity already taking place on Ethereum, he argues that a sharp expansion in stablecoin supply could materially increase capital deployed across ETH-based protocols.

Ethereum’s TVL currently stands at about $68 billion, according to DeFiLlama, a level that remains well below previous cycle highs.

Ethereum TVL (Source: DefiLlama)

Supporters say that figure does not fully capture the scale of institutional infrastructure quietly being built on the network.

Tokenized Real-World Assets Gain Momentum

Beyond stablecoins, Chalom expects tokenized real-world assets (RWAs) to become a major growth engine for Ethereum. He predicts the tokenized RWA market will reach $300 billion in assets under management in 2026, representing a tenfold increase as financial institutions move from experimental pilots to full fund complexes onchain.

Interest from traditional finance has accelerated over the past year, with firms such as JPMorgan, Franklin Templeton and BlackRock expanding tokenization initiatives. Most of this activity has gravitated toward Ethereum, which currently hosts the majority of tokenized RWAs across public blockchains.

Data from RWA.xyz shows the total value of tokenized assets has grown to roughly $18.9 billion, up from around $5.6 billion at the start of 2025. US Treasury debt remains the largest category, followed by tokenized commodities, with Ethereum accounting for the lion’s share of onchain issuance.

Sovereign Wealth Funds and Onchain Finance

Chalom also anticipates a significant increase in Ethereum exposure from sovereign wealth funds, estimating that holdings and tokenization activity from this group could rise five- to tenfold in 2026. He said competitive pressures are likely to play a growing role as allocators seek not to fall behind peers exploring blockchain-based finance.

He added that emerging applications such as onchain AI agents and prediction markets could move into the mainstream next year, potentially driving additional transaction volume and value accrual across the Ethereum ecosystem.

Price Weakness Persists Despite Improving Fundamentals

Despite those bullish structural trends, Ether’s price performance has remained under pressure.

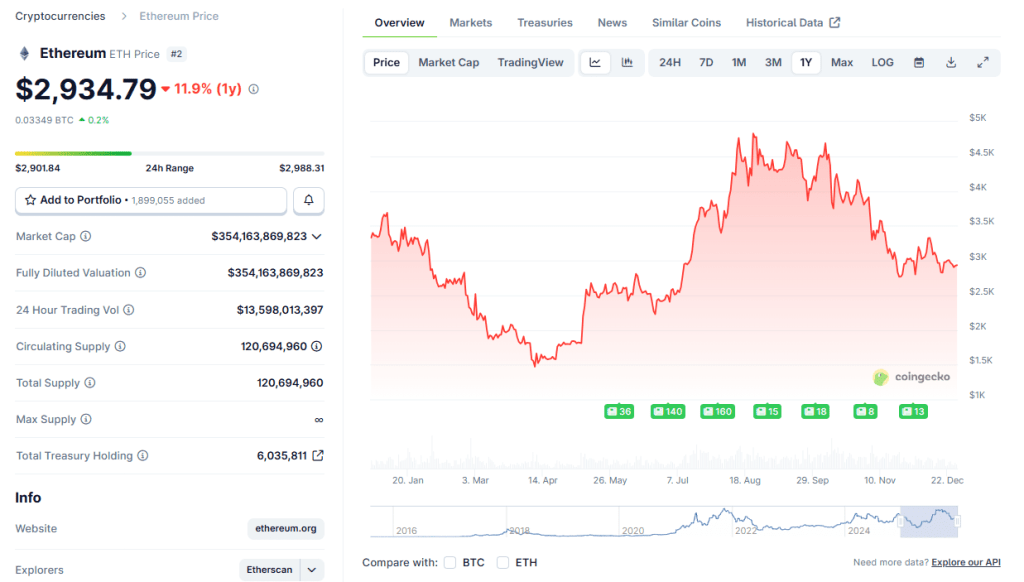

Ether is down nearly 12% over the past year and is trading near $2,900, according to CoinMarketCap.

ETH price (Source: CoinGecko)

Crypto analyst Benjamin Cowen has cautioned that Ethereum may struggle to reach new highs in the near term if Bitcoin continues to face macro headwinds.

Cowen’s view shows the ongoing tension between Ethereum’s improving fundamentals and short-term market sentiment, which remains closely tied to Bitcoin’s trajectory.

Tom Lee Frames Ethereum as Financial Infrastructure

A more optimistic price outlook was presented this week by Tom Lee, co-founder and head of research at Fundstrat Global Advisors.

Speaking on CNBC’s Power Lunch, Lee said Ether could climb to between $7,000 and $9,000 by early 2026 as Wall Street accelerates efforts to tokenize assets and move settlement activity onchain.

Lee argued that Ethereum’s investment case is increasingly rooted in its role as financial infrastructure rather than speculative trading.

“Wall Street wants to tokenize everything,” he said, pointing to initiatives from Robinhood and BlackRock. Over the longer term, Lee suggested Ether could eventually reach $20,000 if adoption deepens.

Lee is also chairman of BitMine Immersion Technologies, the largest Ether-focused treasury company, which has reported holdings of more than 4 million ETH. He was similarly bullish on Bitcoin, calling it a genuine store of value and projecting that a move toward $200,000 would be reasonable if institutional demand continues to grow.

Scaling Upgrades Set the Stage for 2026

Ethereum’s technical roadmap could prove just as important as institutional demand.

In 2026, the Glamsterdam fork is expected to introduce perfect parallel processing, allowing transactions to be executed simultaneously rather than sequentially.

Developers also plan to substantially increase the network’s gas limit, potentially up to 200 million, while transitioning validators toward verifying zero-knowledge proofs instead of re-executing transactions.

Those changes are designed to put Ethereum’s layer-1 chain on a path toward 10,000 transactions per second over time, while enabling layer-2 networks to handle hundreds of thousands of transactions per second through expanded data blobs and improved interoperability.

Additional upgrades, including Enshrined Proposer Builder Separation, aim to reduce centralization pressures tied to maximal extractable value and strengthen censorship resistance. Later in the year, the Heze-Bogota fork is expected to further enhance transaction inclusion guarantees.

Institutions Lay the Groundwork for a Turnaround

Institutional interest in tokenized finance continued to build in December, when the Depository Trust & Clearing Corporation announced plans to tokenize a portion of US Treasury securities on the Canton Network.

DTCC subsidiaries process trillions of dollars in securities transactions annually, underscoring how traditional market infrastructure is beginning to intersect with blockchain-based settlement.

While Ethereum’s price has lagged during the latter part of 2025, proponents argue that the groundwork being laid today could make 2026 a defining year. Between scaling breakthroughs, expanding tokenization and deepening institutional participation, Ethereum may be positioning itself for a rebound driven less by hype and more by real-world financial adoption.