America’s $1 Trillion Interest Bill: The Debt Service Era Has Officially Begun

The United States crossed a historic fiscal threshold in 2025 as interest payments on the national debt exceeded $1 trillion for the first time, overtaking both defense spending and Medicare.

The milestone marks a turning point in American public finance, bringing attention to how debt servicing—rather than public programs or national security—has become the federal government’s single largest expenditure.

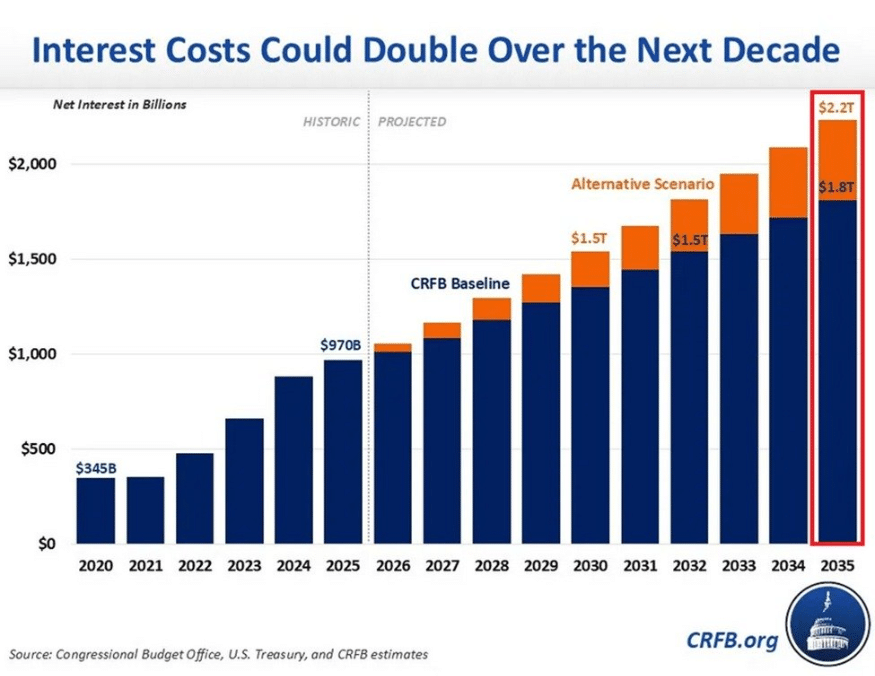

According to data compiled by the US Congressional Budget Office (CBO), net interest payments stood at $345 billion in fiscal year 2020.

US debt interest costs (Source: Kobeissi Letter)

By fiscal year 2025, that figure had nearly tripled to roughly $970 billion, surpassing defense spending by about $100 billion. When accounting for all interest paid on publicly held debt, total costs crossed the $1 trillion mark—an unprecedented event in U.S. history.

America’s Debt Problem Decades in the Making

The CBO projects the situation will worsen.

Over the next decade, cumulative interest payments are expected to total $13.8 trillion—nearly double the inflation-adjusted amount spent on interest over the previous 20 years. Meanwhile, the Committee for a Responsible Federal Budget warns that under less favorable assumptions—such as temporary tax provisions becoming permanent or tariffs being struck down—annual interest costs could surge to $2.2 trillion by 2035, a 127% increase from today.

The broader debt picture is equally stark. The U.S. debt-to-GDP ratio reached 100% in 2025, a level last seen during the immediate aftermath of World War II. By 2029, it is projected to surpass the all-time record of 106% set in 1946, climbing to an estimated 118% by 2035.

Analysts say what makes the current situation particularly dangerous is its self-reinforcing nature. The federal government now borrows roughly $2 trillion annually, with close to half of that amount going solely toward servicing existing debt.

Markets React With Alarm—and Familiar Playbooks

The projections have ignited intense debate across Wall Street and social media. Some commentators invoked “Weimar,” referencing Germany’s hyperinflationary collapse in the 1920s, while others declared the arrival of a permanent “debt service era.” The prevailing retail response has been a call to flee into traditional hard assets such as gold, silver, and real estate.

Notably, Bitcoin was largely absent from early reactions, suggesting that conventional “gold bug” thinking still dominates public sentiment. That may change as the implications of persistent fiscal strain become clearer.

In the near term, heavy Treasury issuance is absorbing market liquidity. With risk-free yields hovering near 5%, equities and cryptocurrencies face structural headwinds. Over the medium term, analysts expect mounting fiscal pressure to drive tighter regulation and potentially higher taxes on digital assets.

Stablecoins Step Into the Spotlight

Yet Washington appears to have identified an unlikely tool to help manage its debt burden: stablecoins.

The GENIUS Act, signed into law in July 2025, requires stablecoin issuers to hold 100% reserves in U.S. dollars or short-term Treasury bills. In practice, this turns stablecoin companies into large, structural buyers of government debt.

America’s Treasury Secretary Scott Bessent has described stablecoins as “a revolution in digital finance” that will drive a surge in demand for Treasuries. Meanwhile, Standard Chartered estimates stablecoin issuers could purchase up to $1.6 trillion in T-bills over the next four years—enough to absorb all new issuance projected during President Donald Trump’s second term.

That would exceed China’s current Treasury holdings of roughly $784 billion, effectively positioning stablecoins as a replacement buyer as foreign central banks reduce exposure to U.S. debt.

A New Era for Finance—and Crypto

The paradox is striking.

While traditional investors rush toward gold, regulated stablecoins are quietly becoming critical infrastructure for U.S. debt markets. At the same time, long-term fiscal instability may ultimately strengthen Bitcoin’s “digital gold” narrative. As confidence in conventional finance erodes, the case for assets outside the system grows stronger.

America has entered the debt service era. In trying to manage it, Washington may have inadvertently accelerated the integration of crypto into the heart of the global financial system—turning a fiscal crisis into an unexpected catalyst for digital assets.