Bitmine Adds $40 Million in ETH as Treasury Breaks 4 Million Token Mark

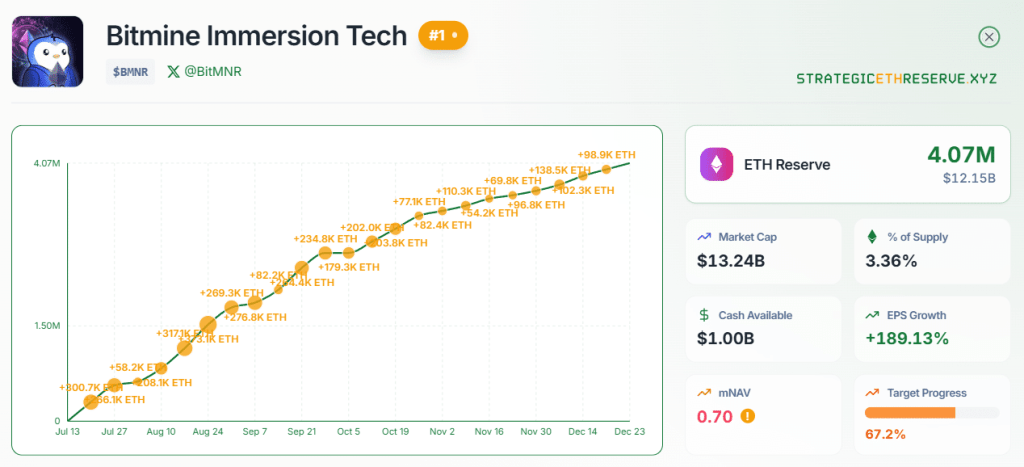

Ethereum treasury company Bitmine has reached a major accumulation milestone after its Ether holdings surpassed 4 million tokens this week, following a fresh $40 million purchase that further cements the firm’s aggressive strategy around Ethereum.

The company said on Monday that it now holds more than 4.06 million Ether. This was after on-chain analytics firm Lookonchain reported earlier in the day that Bitmine had acquired 13,412 ETH, valued at roughly $40.61 million, as part of its latest buying activity.

Rapid Accumulation Over the Past Week

The latest purchase caps off an intense accumulation phase for Bitmine. Over the past seven days alone, the firm has added nearly 100,000 ETH to its balance sheet, an unusually rapid pace even by the standards of large crypto treasury holders.

Bitmine said all of its Ether has been acquired at an average purchase price of $2,991 per token.

That positioning has proven timely, with ETH climbing back toward the $3,000 level over the weekend after spending weeks below that threshold following October’s broader crypto market pullback.

“Bitmine continues to add steadily to its ETH holdings, adding 98,852 ETH in the past week, and Bitmine holdings now exceed the crucial 4 million ETH tokens,” chairman Tom Lee said in a statement. “This is a tremendous milestone achieved after just 5.5 months.”

Treasury Returns to Profit as ETH Rebounds

With Ether reclaiming the $3,000 level, the company’s treasury has tipped back into profit after being underwater for much of the period following the October market downturn. At current prices, the company’s ETH holdings are valued at approximately $12.15 billion, placing Bitmine among the largest known corporate holders of Ethereum globally.

BitMine ETH holdings (Source: StrategicETHReserve)

The firm has consistently framed its accumulation strategy as a long-term conviction trade on Ethereum’s role as core infrastructure for decentralized finance, tokenized assets, and on-chain settlement.

Management has emphasized that short-term price volatility is secondary to the strategic importance of controlling a significant share of the network’s native asset.

The ‘Alchemy of 5%’ Strategy

The company’s ambitions extend well beyond its current milestone. The company has set a stated goal of ultimately owning 5% of Ethereum’s total supply, a target that would represent an unprecedented concentration of ETH under a single corporate balance sheet.

With more than 4 million ETH already accumulated, Bitmine is roughly 67% of the way toward that objective, according to data from Strategic ETH Reserve.

Equity Rally Reflects Ethereum Bet

The market has responded strongly to Bitmine’s Ethereum-focused strategy. Shares of Bitmine (BMNR) are up approximately 606% over the past six months, a period that includes the June launch of its Ether treasury initiative.

BitMine share price (Source: Google Finance)

Investors have increasingly treated the stock as a high-beta proxy for ETH exposure, a dynamic reminiscent of Bitcoin treasury companies whose share prices often amplify moves in the underlying crypto asset. The scale and speed of Bitmine’s accumulation have further fueled interest in the stock as a vehicle for institutional-style Ethereum exposure.

Staking Plans Set for 2026

Looking ahead, Bitmine plans to move beyond passive accumulation and begin actively deploying its Ether holdings. The company has outlined plans to connect staking to its treasury in early 2026, aiming to generate additional yield while supporting Ethereum’s proof-of-stake network.

“We continue to make progress on our staking solution known as The Made in America Validator Network (MAVAN),” Lee said. “This will be the ‘best-in-class’ solution offering secure staking infrastructure and will be deployed in early calendar 2026.”

If executed as planned, the staking initiative would mark the next phase of Bitmine’s Ethereum strategy, transforming its massive ETH treasury into an active, yield-generating asset while deepening its role within the broader Ethereum ecosystem.