World Liberty Financial Floats $120M Treasury Plan to Boost USD1 Stablecoin

Trump family-backed World Liberty Financial has proposed deploying 5% of its WLFI token treasury to accelerate growth of its U.S. dollar-pegged stablecoin, USD1, as competition in the stablecoin sector intensifies.

The proposal was published Wednesday on the World Liberty Financial governance forum, with the team arguing that increasing USD1’s circulating supply is critical to remaining competitive in what it described as an “increasingly competitive stablecoin landscape.”

According to the proposal, the funds would be used to expand USD1 adoption through a mix of centralized finance (CeFi) and decentralized finance (DeFi) partnerships.

Expanding USD1’s Reach Across CeFi and DeFi

World Liberty Financial said the additional USD1 supply would be used to support integrations with “select high-profile CeFi & DeFi partnerships,” aiming to embed the stablecoin more deeply across exchanges, protocols, and financial platforms.

“As USD1 grows, more users, platforms, institutions, and chains integrate with World Liberty Financial infrastructure,” the team wrote in the proposal. “This increases the scale and influence of the network governed by WLFI holders.”

Also read: WLFI’s USD1 Stablecoin Heads to Canton Network as World Liberty Financial Targets Institutions

The project framed USD1 as a central pillar of its ecosystem, positioning stablecoin adoption as a catalyst for broader network effects. According to the team, higher USD1 circulation would drive demand for WLFI-governed services, including integrations, liquidity incentives, and ecosystem development programs.

“More USD1 in circulation leads to more demand for WLFI-governed services, integrations, liquidity incentives, and ecosystem programs,” the proposal added, outlining what it described as a value capture loop for WLFI holders.

Treasury Size and Proposed Allocation

WLFI began trading on exchanges in September following months of buildup around the Trump-linked project. Prior to the token’s launch, World Liberty Financial disclosed that approximately 19.96 billion WLFI tokens—nearly 20% of total supply—would be allocated to the project’s treasury.

At current market prices, that treasury allocation is valued at nearly $2.4 billion. A 5% deployment would therefore unlock roughly $120 million worth of WLFI to support USD1 growth initiatives.

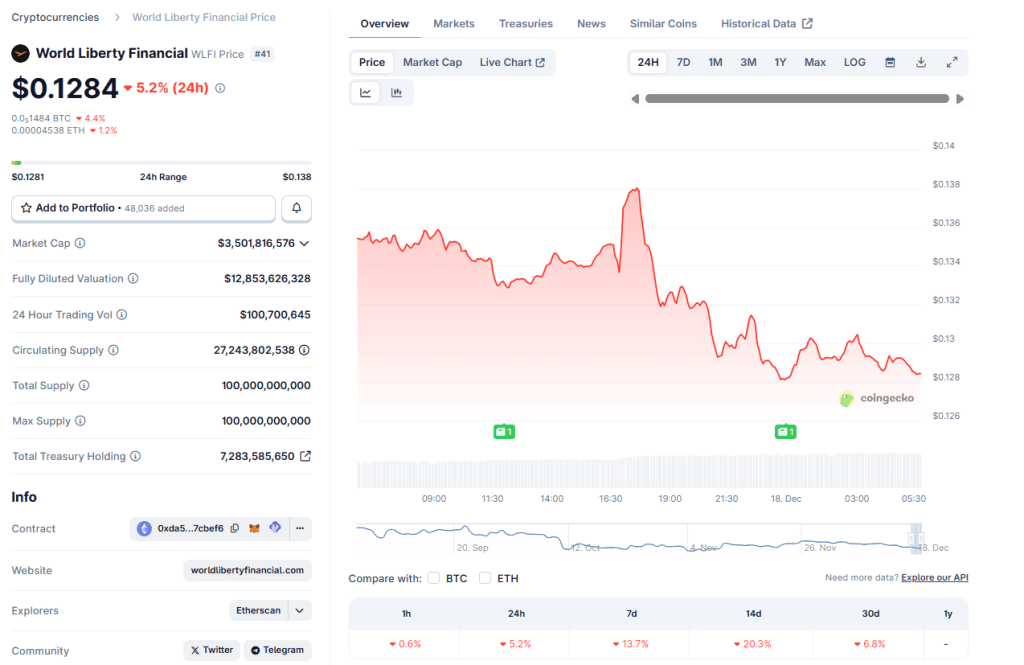

WLFI price (Source: CoinGecko)

The scale of the proposed allocation has drawn attention from both supporters and critics, particularly given the relatively short time since WLFI began trading publicly.

Governance Vote Draws Mixed Reaction

The proposal presents three voting options for WLFI holders: for, against, or abstain. While the vote is now live, the project has not clearly outlined the mechanics of how voting power is calculated or how final outcomes will be determined.

Early feedback suggests a divided community. At the time of writing, responses on the governance forum showed opposition narrowly edging out support. Some community members have expressed concern about unlocking a portion of the treasury so early, citing risks related to dilution, governance clarity, and long-term capital management.

Also read: XRP vs. World Liberty Financial – Supply Discipline vs. Hype?

Others argue that aggressive deployment is necessary to establish USD1 as a serious contender in a crowded stablecoin market, where network effects and early integrations can play an outsized role in determining winners.

USD1’s Position in the Stablecoin Market

USD1 launched in March and has grown rapidly relative to many newer entrants. According to CoinGecko data, the stablecoin currently has a market capitalization of approximately $2.74 billion, ranking it as the seventh-largest USD-pegged stablecoin.

Top stablecoins by market cap (Source: CoinGecko)

Despite that growth, USD1 remains well behind several competitors. PayPal’s PYUSD, which sits just one rank higher, has a market capitalization roughly $1.1 billion larger.

Market leaders such as Tether’s USDT and Circle’s USDC continue to dominate the sector with significantly deeper liquidity, broader exchange support, and longer operating histories.

A Test of Strategy and Confidence

If approved, the 5% treasury deployment could provide World Liberty Financial with significant resources to accelerate USD1 adoption and compete more aggressively with established stablecoins.

At the same time, the vote represents an early test of governance participation and confidence in the project’s long-term strategy.

The outcome may offer insight into how WLFI holders balance caution against growth ambitions—and how World Liberty Financial plans to position itself in an increasingly crowded and competitive stablecoin market.