Polymarket Returns to the US with a Quiet Relaunch and Major New Partners: Report

Decentralized prediction market Polymarket is edging back onto U.S. soil after years of regulatory setbacks, marking one of its most significant milestones since being forced offshore in 2022.

According to comments shared at Cantor Fitzgerald’s crypto conference, the company has quietly launched a beta version of its platform for select American users—its first meaningful domestic presence since resolving a major enforcement case with U.S. regulators.

The relaunch comes as prediction markets rapidly evolve from niche crypto experiments into legitimate financial infrastructure attracting exchanges, data giants and mainstream investors. Polymarket’s U.S. return places it in the center of an industry that is suddenly drawing interest from financial heavyweights, tech platforms and competing crypto firms alike.

A Cautious Re-Entry After Years Offshore

Polymarket’s founder, Shayne Coplan, confirmed that the U.S. platform is already “live and operational” in a limited testing phase. While only a select group currently has access, the beta marks the final stages before a full reopening to a broader American audience.

The company’s re-emergence follows a turbulent regulatory journey. In 2022, the U.S. Commodity Futures Trading Commission hit Polymarket with a $1.4 million penalty and forced the company to shutter its domestic prediction markets, pushing operations offshore.

That enforcement action effectively placed the platform in exile during a period of rapid political and economic volatility that historically drives demand for prediction markets.

But Polymarket spent the last three years restructuring its U.S. footprint. A pivotal step came in July 2025, when the firm acquired QCX, a licensed derivatives exchange and clearinghouse. This acquisition gave Polymarket access to the regulatory permissions it previously lacked, creating a compliant foundation for its American comeback.

Record Growth Abroad Sets the Stage for a U.S. Push

Ironically, Polymarket thrived during the years it operated outside U.S. borders. The 2024–2025 U.S. presidential election cycle fueled explosive demand for forecasting markets. In the last month alone, the platform hit all-time highs in monthly volumes, active traders, and newly listed markets—an indication that global interest in prediction markets is not slowing.

Still, Polymarket faced significant competitive pressure. Its U.S.-regulated rival Kalshi outpaced it in October trading volume.

A major catalyst for user activity is also tied to the upcoming launch of POLY, the platform’s native cryptocurrency. While details of the eventual airdrop remain undisclosed, Polymarket’s Chief Marketing Officer, Matthew Modabber, has confirmed that POLY will roll out after the official U.S. relaunch.

That anticipation has pushed a wave of new traders to the platform as they try to meet any future eligibility requirements.

Strategic Partnerships Bring Prediction Markets Into the Mainstream

Polymarket is not returning alone—it is reentering the U.S. with significant new partnerships across sports, tech and financial media.

On Tuesday, the company announced a partnership with PrizePicks, one of the largest fantasy sports apps in the U.S.

The collaboration pairs two rapidly expanding sectors: fantasy gaming and real-money forecasting. For Polymarket, PrizePicks opens a new demographic of sports-focused users who are already familiar with probabilistic wagering and in-app analytics.

A day later, Polymarket unveiled an even bigger tie-up: Yahoo Finance selected the company as its exclusive prediction market partner.

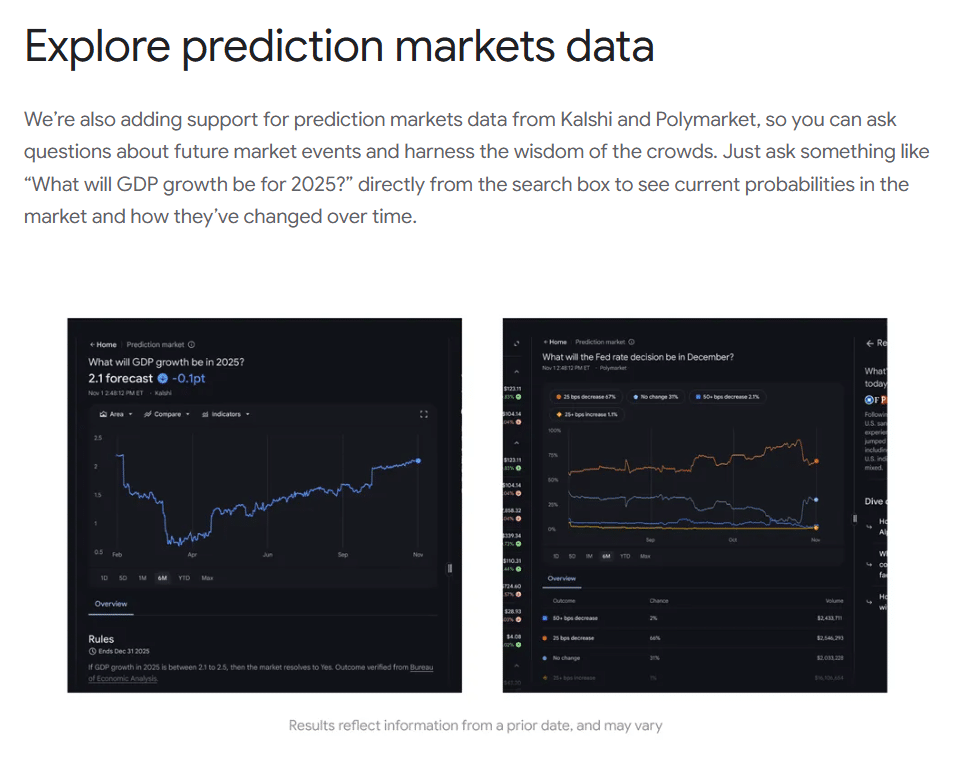

Shortly before that, Google Finance revealed that it would integrate data from both Polymarket and Kalshi into its finance-focused AI tools. These integrations give prediction markets unprecedented visibility across some of the most-visited financial platforms on the internet.

Google announces integration with Kalshi and Polymarket (Source: Google)

The convergence of Polymarket data with mainstream finance ecosystems marks a major step in the normalization of prediction markets. What once lived primarily in crypto-native circles is now positioned to influence financial news, investor dashboards and fintech workflows.

An Industry Entering a New Era

Prediction markets have long been viewed as a hybrid between financial speculation and information aggregation, but 2025 is proving to be a turning point. Traditional finance giants and crypto-native companies are increasingly exploring—or directly building—prediction product lines.

Bloomberg reported earlier this month that Gemini, one of the biggest exchanges in the U.S. crypto sector, is preparing to launch its own set of prediction market contracts.

Meanwhile, derivatives powerhouse CME Group is partnering with FanDuel to launch a new prediction markets platform, signaling a major shift in how institutional players view this category.

Regulatory Lessons Shape the Next Chapter

Polymarket’s cautious U.S. rollout reflects the lingering impact of its earlier conflict with the CFTC. By securing QCX and building a compliant operating framework, the company is attempting to re-enter the market on firmer footing. But prediction markets remain uniquely sensitive to U.S. regulatory scrutiny, given their overlap with derivatives and event-based financial contracts.

The beta launch allows Polymarket to test both technical and compliance systems before a full reopening. For the company, the stakes are high: the U.S. represents the world’s largest market for political and financial forecasting, especially in a year packed with economic uncertainty and policy-driven market shifts.

If Polymarket succeeds, it may set a template for how decentralized prediction markets can operate lawfully within U.S. borders without sacrificing the speed and transparency that make them appealing.