Stablecoins Could Be the Future of Roblox and Web3 Games – Here’s Why

Stablecoins are taking on a transformative new role in the $350-billion global gaming market, according to a new report published by the Blockchain Gaming Alliance (BGA).

Once seen primarily as tools for payments and decentralized finance (DeFi) liquidity, fiat-pegged digital assets like Tether’s USDt and Circle’s USDC are now becoming the invisible financial infrastructure underpinning the gaming economy.

The BGA report highlights that stablecoins provide the predictability and speed necessary for developers to pay creators, price digital items, and retain players across gaming ecosystems. By removing the volatility associated with speculative crypto tokens, stablecoins allow game economies to function more like traditional financial systems—only faster and more transparent.

Developers are beginning to see these tokens as “the monetary operating system” for gaming’s next growth cycle, the report noted.

Gamers Choose Stability Over Speculation

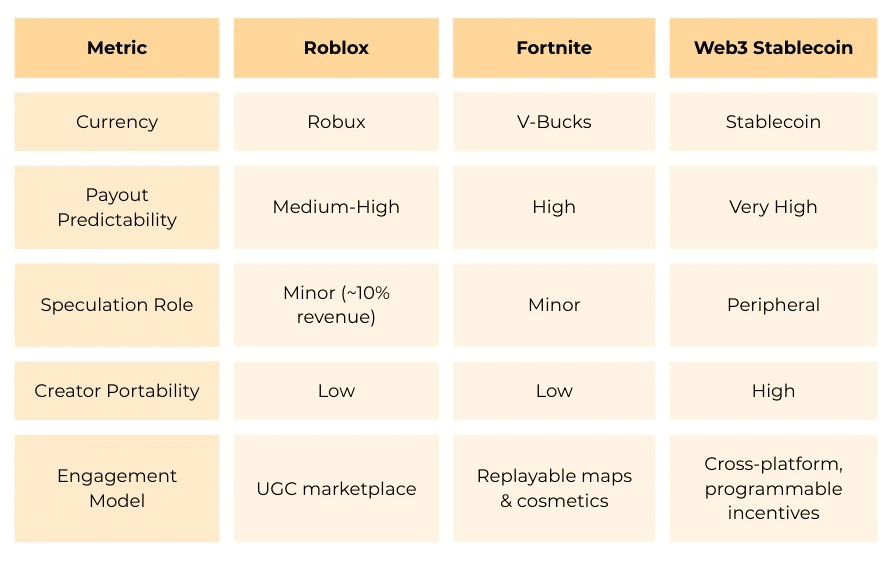

The BGA compared stablecoin integration in gaming to successful closed-loop systems like those in Roblox and Fortnite, where consistent value has been key to sustained user spending and creator engagement.

According to the alliance, the top 10 Roblox creators earn an average of $38 million annually—a feat made possible by fixed exchange rates that protect them from market volatility. Stablecoins, BGA said, could offer this same predictability on a global, interoperable scale.

Amber Cortez, Head of Business Development at Sequence, commented in the report that “stablecoins are transforming fragmented, speculative game economies into scalable, player-first systems.”

BGA report compares stablecoins to other in-game currencies (Source: BGA)

The End of the Play-to-Earn Boom

The BGA also framed the shift toward stablecoins as a direct response to the failures of the play-to-earn (P2E) model.

Games like Axie Infinity suffered massive user losses once their native tokens crashed in value, exposing how financial speculation can undermine long-term engagement.

“The success of gaming’s biggest economies rests on stable value,” the report said. “Stablecoins bring that principle into the open metaverse—turning virtual currencies into real-world financial rails.”

New initiatives are already emerging to bring this concept to life. In May, blockchain network Sui announced “Game Dollar,” a programmable stablecoin designed specifically for gaming transactions and creator payments.

Blockchain Gaming Investment Rebounds in Q3

Despite a subdued year overall, the blockchain gaming sector experienced a notable rebound in venture capital during Q3 2025, recording $129 million in funding—the strongest quarter so far this year, according to DappRadar.

That brought the total for 2025 to nearly $300 million, though the figure remains far below the $1.8 billion seen in 2024. Analysts suggest the shift toward stablecoin-based gaming economies could rekindle investor confidence by grounding blockchain gaming in more sustainable financial models.