Japan’s $90B Stimulus Could Send Bitcoin to $1 Million, Says Arthur Hayes

Bitcoin is once again at the center of global macro conversations after Japan’s new Prime Minister, Sanae Takaichi, unveiled a sweeping economic stimulus package designed to counter rising inflation.

The announcement — which includes subsidies for electricity and gas costs as well as regional grants for small and medium-sized businesses — is being interpreted by many crypto observers as a potential catalyst for renewed Bitcoin strength.

Yet, beyond Japan’s borders, the decision is being viewed as a sign that the world’s third-largest economy may be edging back toward aggressive monetary easing — a backdrop that has historically benefited Bitcoin.

Arthur Hayes Sees “Money Printing” on the Horizon

BitMEX co-founder Arthur Hayes was among the first to comment on Takaichi’s move, calling it a clear sign of impending monetary expansion by Japan’s central bank.

In a post on X, Hayes said the stimulus translates to “printing money to hand out to folks to help with food and energy costs,” a dynamic he believes could send Bitcoin soaring to $1 million.

Hayes, known for his macro-driven crypto outlook, has long argued that renewed quantitative easing (QE) in major economies could be the next major catalyst for Bitcoin and risk assets. His interpretation of Japan’s new fiscal direction aligns with that thesis — suggesting that as more yen floods the market, investors may increasingly seek refuge in decentralized assets like Bitcoin.

Yen Weakens as Markets React to Takaichi’s Leadership

Following Takaichi’s swearing-in as Japan’s first female prime minister, the yen slipped to a one-week low on Tuesday.

According to Reuters, investors viewed her “pro-stimulus” stance as a mixed signal for the country’s monetary outlook ahead of the Bank of Japan’s (BOJ) next interest rate decision.

While the BOJ remains in a phase of quantitative tightening, it has yet to achieve its 2% inflation target, leaving the door open for a potential policy reversal. Analysts currently expect a 0.75% rate hike by early 2026, but with no clear consensus on when the central bank might change course.

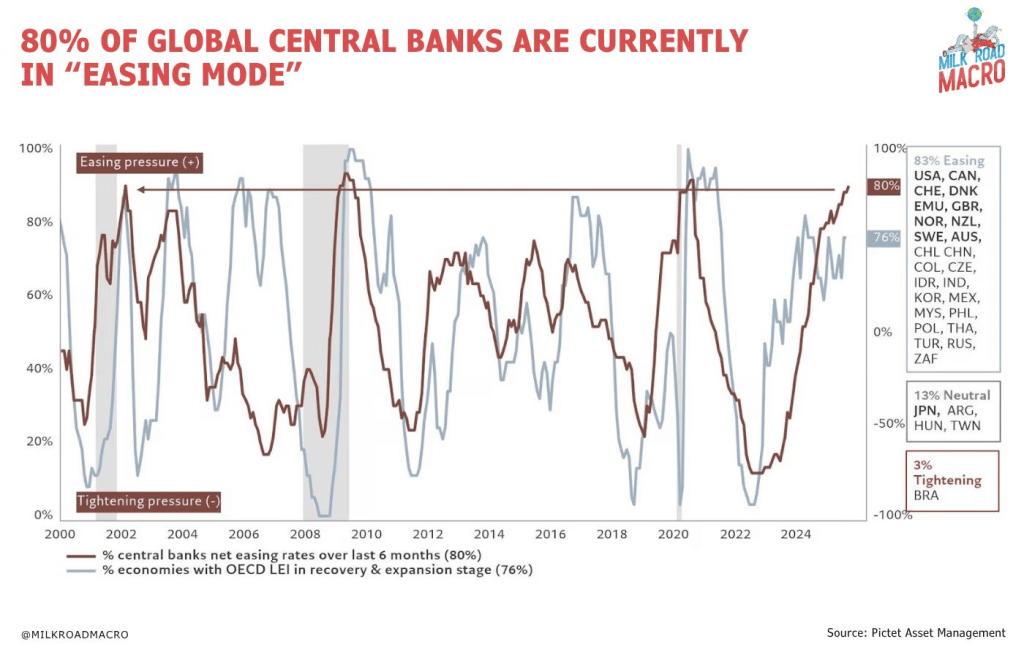

Macro analysts at Milk Road Macro noted in a recent post that with over 80% of global central banks already pursuing some form of quantitative easing, Japan may soon join them once again under Takaichi’s leadership.

80% of central banks pursuing QE (Source: Milk Road Macro)

Bitcoin Whales Re-Enter the Market

As Japan’s stimulus plans made headlines, large Bitcoin holders — known as whales — appeared to take bullish positions in anticipation of renewed liquidity conditions.

According to blockchain data shared by Lookonchain, three major whales returned to decentralized exchange Hyperliquid on Wednesday, depositing tens of millions of dollars to open leveraged long positions on Bitcoin.

One whale wallet, identified as “0x3fce,” increased its Bitcoin long position to nearly $49.7 million, while another, “0x89AB,” initiated a 6x leveraged long worth $14 million. The activity followed a sharp “flush” that sent Bitcoin to a four-month low of $104,000 last Friday, before prices began to recover.

The surge in whale activity suggests renewed optimism that macroeconomic conditions — particularly in Japan — could provide the next leg of support for Bitcoin’s price recovery.

The Bigger Picture: A Global Shift Toward Easing

Takaichi’s pro-stimulus stance represents more than just a domestic economic policy; it signals a potential pivot in global monetary sentiment. If Japan moves toward renewed easing, it could add to a worldwide wave of liquidity injections that tend to favor hard and digital assets.

For Bitcoin, which thrives in environments of fiat currency debasement, the message from Tokyo may be bullish. As governments grapple with inflation through fiscal relief rather than austerity, crypto advocates like Hayes see a future where Bitcoin becomes not just an alternative asset — but a necessary one.