From Bitcoin to SEI: 21Shares Expands Its ETF Ambitions

21Shares has filed with the U.S. Securities and Exchange Commission (SEC) to launch a spot SEI exchange-traded fund (ETF), heating up the competition with Canary Capital to see who will bring the first ETF focused on the altcoin to market.

The filing, submitted on Aug. 28, 2025, follows a similar application by Canary Capital in April 2025, a testament to the growing institutional interest in the native token of the Sei Network, a layer-1 blockchain launched in August 2023.

21Shares Sets Sights on SEI’s Rising Star

The 21Shares SEI ETF plans to track the price of SEI, which powers gas fees, governance, and network security on the Sei Network, a blockchain designed for optimized decentralized trading infrastructure.

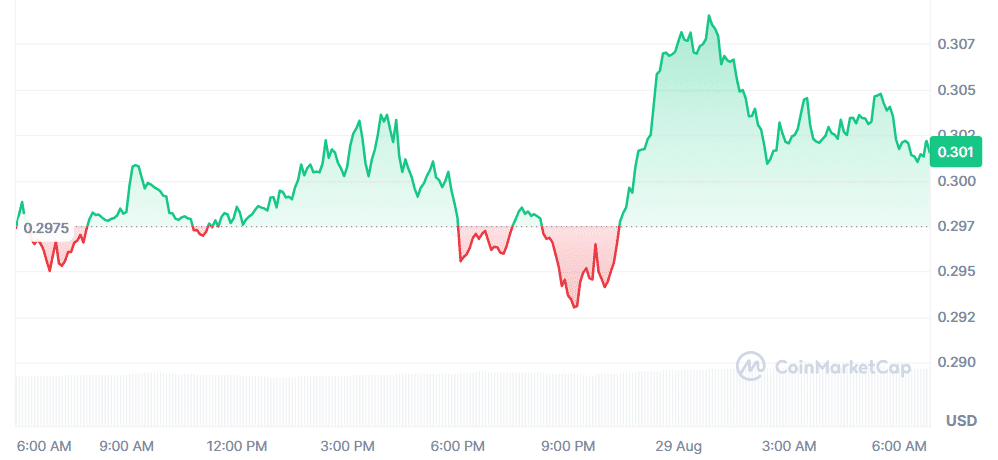

SEI, which is currently trading between the prices of $0.2978 and $0.3028 and is ranked 53 by market capitalization, is currently at $1.81 billion as of Aug. 29, 2025, according to CoinMarketCap.

SEI Price Chart (Source: CoinMarketCap)

The filing positions 21Shares, a veteran in the crypto ETF space with products like the ARK 21Shares Bitcoin ETF and pending applications for SUI, XRP, and Ondo funds, to step in to capitalize on SEI’s growing relevance in the market

In a statement shared on X, 21Shares referred to the filing as a “key milestone” in expanding access to the Sei Network for traditional investors.

The Sei Development Foundation’s Justin Barlow agreed with this view, stating that ETFs could act as a “gateway for broader adoption” by bridging crypto and conventional finance. The filing is in line with a general push to integrate altcoins into mainstream markets, though regulatory policies remain a major challenge.

How 21Shares’ SEI ETF Plans to Work—and Win

The proposed fund will use CF Benchmarks’ SEI-Dollar Reference Rate to track SEI’s spot price, pulling data from multiple crypto exchanges. While the Coinbase Custody Trust Company will serve as the custodian for the underlying assets.

A potential staking feature is presently under consideration, which could allow investors to earn passive income through staking rewards.

However, 21Shares is also assessing legal, regulatory, and tax risks associated with staking at the moment, given the recent SEC scrutiny of staking programs.

Canary Capital’s earlier filing also considers direct exposure to staked SEI and passive income, making staking a key differentiator in the competitive ETF landscape.

The SEC has so far approved spot ETFs only for Bitcoin and Ethereum, with approvals in January and May 2024, respectively. Applications for other cryptocurrencies, including SUI, XRP, and Solana, remain under review.

Sources reveal that the SEC is presently considering a streamlined and expedited approval process that could automatically list ETFs after 75 days without objections, potentially speeding up SEI ETF timelines.

Still, there are regulatory uncertainties around staking, given that the SEC is still deciding whether certain crypto assets are securities.

SEI ETF Filing Stirs Hope and Challenges in Crypto Community

The 21Shares filing is a testament to the recent increase in institutional demand for altcoin ETFs.

Asset managers and companies like VanEck, Bitwise, and Grayscale have filed for ETFs tracking SUI, XRP, Solana, Cardano, and Dogecoin.

The trend is proof of the growing popularity of layer-1 blockchains like the Sei Network, which has become a favorite since its launch in 2023 for its trade-focused infrastructure.

The announcement was followed with discussion in cryptocurrency communities across social media, especially X, with 21shares confirming the filing: “We’re excited to announce that we’ve filed with the SEC for a SEI ETF in the U.S. – a key milestone in our vision to expand exchange-traded access to @Seinetwork.”

Major crypto advocates also shared the news, with some sharing links to the SEC filing for transparency. Sentiment on X is positive regarding the potential of SEI, although there are still worries about regulatory delays caused by staking and classification problems.