The One Big Beautiful Bill: A Detailed Breakdown

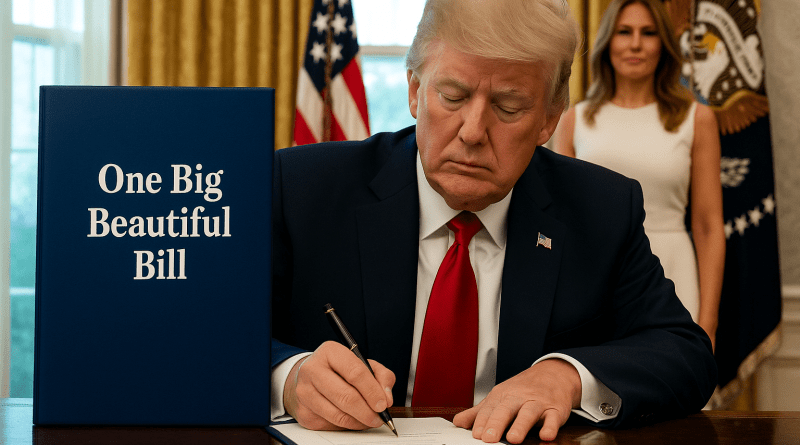

President Donald Trump has officially signed the “One Big Beautiful Bill,” H.R. 1, into law, transforming it from a partisan proposal into a cornerstone of his economic legacy.

The signing took place on July 4 during the White House’s Independence Day celebrations.

The move marks a major milestone in the Trump administration’s second-term agenda, locking in a sweeping set of tax cuts, spending reforms, and border security enhancements.

Overview of the H.R. 1

The One Big Beautiful Bill, introduced by Rep. Jodey C. Arrington (R-TX) as H.R. 1 in the 119th Congress, is now law after passing through budget reconciliation and receiving the President’s signature.

It draws inspiration from the 2017 Tax Cuts and Jobs Act (TCJA), not only extending those tax cuts but expanding them with new relief measures and incentives. The bill supports workers, families, small businesses, and rural economies, while emphasizing national defense and border security.

Now officially law, it combines Republican economic goals with political strategy, aiming to create a short-term stimulus and long-term structural reforms.

Budget Reconciliation in Context

The One Big Beautiful Bill relies on budget reconciliation, a process allowing fiscal legislation to pass the Senate with 51 votes, used for bills like the 1996 Welfare Reform Act and 2001 Bush tax cuts.

With Republicans holding a 53-47 Senate majority, reconciliation was important to overcome Democratic opposition.

The Senate’s July 1 vote-a-rama addressed a series of amendments, culminating in a dramatic 51-50 vote with Vice President JD Vance casting the tie-breaking vote. The House followed up by approving the Senate version on July 2, clearing the way for the president’s signature two days later.

What H.R. 1 Could Mean for America’s Future

Now law, the One Big Beautiful Bill renews provisions from the 2017 TCJA, preventing scheduled tax increases and implementing fresh relief on tips, overtime pay, and auto loan interest. It boosts job creation, enhances rural development, and promotes economic stability for working families.

The bill also aligns closely with Trump’s policy platform, combining economic nationalism with stronger border controls. It represents a legislative triumph as the administration heads into the 2026 midterms.

Objectives of The One Big Beautiful Bill

The bill aims to achieve the following goals:

- Economic Growth: The Council of Economic Advisers projects 5.2% GDP growth over four years and between 6.6 and 7.4 million jobs, though the Congressional Budget Office (CBO) predicts a 0.5% average GDP increase from 2025 to 2034.

- Tax Relief: Prevent family tax increases and provide high cuts, at $1,300 for a family of four.

- Worker and Family Support: Remove taxes on tips and overtime pay. Also expanding the child tax credit to $2,500 through 2028.

- Rural and Small Business Protection: Double the death tax exemption for farmers and support small business jobs.

- Security Improvements: Allocate $150 billion for defense and funding of construction of the border wall with increased immigration restrictions.

- Fiscal Reforms: Eliminate tax subsidies and reduce spending on Medicaid and SNAP programs.

These objectives aim to boost the economy and security while also addressing fiscal policy.

Key Provisions of The One Big Beautiful Bill

The One Big Beautiful Bill main provisions, as detailed by Congress, include

- Tax Policy (Sec. 110001–110004): Permanently extends Tax Cuts and Jobs Act rates at 10% to 37%, increases the standard deduction by $1,000 for single filers and $2,000 for married filers, and raises the child tax credit to $2,500 through 2028.

- Worker Relief: Remove taxes on tips, overtime pay, and auto loan interest.

- Business and Rural Support (Sec. 111001): Increases 100% bonus depreciation and doubles the death tax exemption to $15 million.

- Fiscal and Social Reforms (Sec. 112001–112102): Repeals clean-energy tax credits, increases taxes on university funding, and restricts benefits for illegal immigrants.

- Defense and Border Security: Allocates $150 billion for defense and increased border security.

- Debt Limit (Sec. 113001): Raises the debt limit by $4 trillion.

Economic and Fiscal Implications

The Council of Economic Advisers predicts 5.2% GDP growth and 6.6 to 7.4 million jobs over four years, but the CBO projects a more conservative 0.5% average GDP increase.

Although the CBO estimates the bill will add around $2.4 to $3.1 trillion to debt deficits, potentially increasing $5.0 trillion if temporary provisions are extended.

The $4 trillion debt limit increase supports these measures but threatens increased interest rates and reduced future program spending.

Though tax reductions increase disposable income, critics state the risk of long-term fiscal strain, calling for prudent management to maintain growth and debt.

The One Big Beautiful Bill in Real Life

What does the bill provision mean in the everyday life of Americans?

- Service Workers: Removing taxes on tips could save service workers up to $1,700 annually.

- Laborers: Overtime tax cuts may increase pay by up to an estimated $1,750.

- Families: Increased child tax credits and deductions could save families of four $1,300.

- Farmers and Businesses: Double death tax exemptions and deductions preserve family farms and jobs.

- Security: $150 billion for defense and border security, ultimately improving security.

- Education: Increased 529 accounts support financial planning.

These improvements make the bill’s policies real, though the savings are projections awaiting CBO verification.

Comparison to the 2017 Tax Cuts and Jobs Act

The table below compares the One Big Beautiful Bill to the 2017 Tax Cuts and Jobs Act across several categories:

| Aspect | One Big Beautiful Bill | Tax Cuts and Jobs Act |

| Core Provisions | Replicates the 2017 Tax Cuts and Jobs Act cuts while adding border security and social reforms. | The Tax Cuts and Jobs Act added $1.9 trillion to deficits. |

| Deficit Impact | Estimated debt deficit stands between $2.4 and $3.1 trillion. | Added $1.9 trillion to debt deficits. |

| Unique Features | Includes new provisions like no tax on tips, including service workers. | Focused solely on tax reform, without provisions for border security or social reforms. |

| Legislative Support | Passed with narrow votes—215-214 in the House, 51-50 in the Senate. | The Tax Cuts and Jobs Act was passed with wider Republican support. |

This comparison shows the One Big Beautiful Bill broader scope and higher fiscal impact compared to the 2017 Tax Cuts and Jobs Act, revealing increased political division in the Congress.

Legislative Status and Challenges

Status

As of July 4, 2025, the One Big Beautiful Bill is officially law, following its signing by President Trump during the Independence Day holiday. It had previously passed the House on May 22 (215-214) and the Senate on July 1 (51-50), with the House approving the Senate version on July 2 in a 7-6 Rules Committee vote.

Challenges

The Bill has also been faced with several challenges, which include

- Partisan Opposition: Narrow votes show Democratic resistance to social program cuts.

- Internal Conflicts: Elon Musk’s deficit concerns led to public controversies with Trump.

- Senate Process: The July 1, 2025, vote-a-rama considered several amendments.

- Fiscal Concerns: CBO’s deficit projections raised tension.

The One Big Beautiful Bill passed through budget reconciliation, with Vice President JD Vance’s tie-breaking vote in a 51-50 Senate tally on July 1, 2025, overcoming opposition.

Stakeholder and Public Feedback

The One Big Beautiful Bill has divided stakeholders. The National Federation of Independent Business and cattlemen support its business policies and farm provisions, while Airlines for America backs its plans for infrastructure.

Environmentalists oppose the cancelation of clean-energy credits, citing climate losses. While key stakeholders disagree, some praising tax cuts and others raising concerns over Medicaid/SNAP cuts, which could affect around 10.9 million Americans’ health coverage.

Democrats focus on the effect of the bill on low-income families, while Republicans prioritize economic growth. Elon Musk’s worries about rising debt add more pressure to the debate.

What’s Next for The One Big Beautiful Bill?

Now enacted, the bill will shape U.S. economic and fiscal policy for years. It’s expected to stimulate rural and middle-class economies, redefine immigration and labor dynamics, and increase national debt significantly.

Though praised for tax cuts and pro-business reforms, the law’s long-term success will hinge on whether the projected economic growth can materialize fast enough to offset fiscal risks and social trade-offs.

Frequently Asked Questions

What is the One Big Beautiful Bill?

The One Big Beautiful Bill, officially H.R. 1, is a major U.S. law signed by President Trump on July 4, 2025. It overhauls the tax code, cuts federal spending on certain programs, and increases funding for defense and border security. It’s seen as an extension of the 2017 Tax Cuts and Jobs Act but includes additional reforms related to labor, immigration, and social programs.

How does this law affect my taxes?

The law permanently extends tax cuts from the 2017 TCJA and adds new benefits, including:

- No federal income tax on tips, overtime pay, and auto loan interest

- An expanded child tax credit of $2,500 per child through 2028

- Higher standard deductions for all filers

If you’re a service worker, laborer, or parent, you could see hundreds to thousands of dollars in annual tax savings.

Who benefits the most from the bill?

Groups likely to benefit most include:

- Middle-class families (from child tax credits and deductions)

- Service industry workers (no taxes on tips)

- Small business owners and farmers (larger estate tax exemption)

- Defense contractors (new federal spending)

- Rural communities (investment incentives and economic support)

What are the criticisms of the bill?

Critics argue that:

- It could add $2.4 to $3.1 trillion to the national deficit

- Cuts to Medicaid and SNAP could hurt low-income families

- Environmental tax credits have been repealed, which could slow clean energy innovation

- University endowments are now taxed at higher rates

- It might favor the wealthy and corporations over working-class Americans

Is this bill different from the 2017 Tax Cuts and Jobs Act?

Yes. While it builds on the 2017 TCJA by making many tax cuts permanent, it also:

- Includes border security funding

- Eliminates taxes on tips and overtime

- Introduces major spending cuts to social programs

- Raises the federal debt ceiling by $4 trillion

It’s a broader, more controversial piece of legislation than the TCJA.