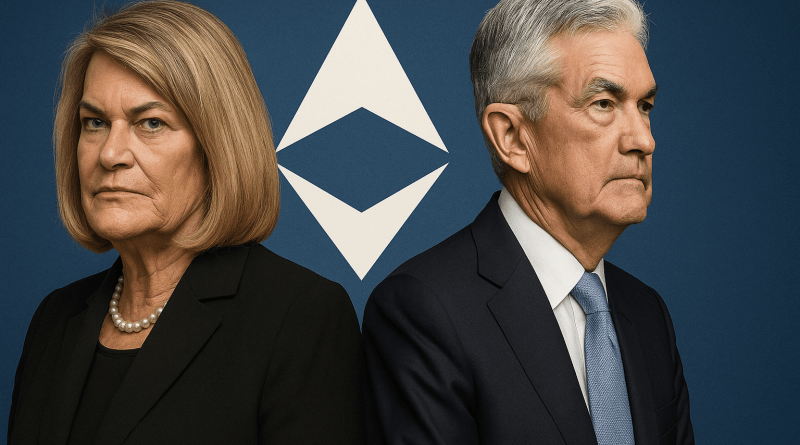

Ethereum Tests $2.6K as Political Heat Rises on Fed Chair Powell

Ethereum (ETH) is showing renewed signs of life on the daily chart just as political pressure intensifies on the U.S. Federal Reserve.

A sharp post-weekend recovery has lifted ETH into the mid-$2.5 K range, while Senator Cynthia Lummis’s fiery comments about Fed Chair Jerome Powell add a new layer to crypto’s macro backdrop.

Lummis accused Powell of acting like a “modern-day Versailles” monarch and failing to prioritize sound monetary policy over bias—an implicit reference to what some in the industry call Operation Chokepoint 2.0, the alleged crackdown on crypto-friendly banks.

As the Fed faces scrutiny from Capitol Hill, ETH’s market structure is simultaneously shifting in favor of the bulls. Traders now find themselves at a technical and political crossroads.

Ethereum Chart Structure Tilting Bullish

Technically, ETH has carved out a series of higher closes, with the most recent session stabilizing just under the $2,600 mark. The price action is now consistently holding above both the 9-day and 20-day exponential moving averages. That crossover signals building short-term strength, with momentum starting to mirror it.

Daily chart for ETH/USD (Source: GeckoTerminal)

The MACD, a key momentum gauge, has flipped from bearish to bullish, with an expanding histogram suggesting increased buy-side volume. Meanwhile, the RSI has edged into the mid-50s, which confirms bullish control without signaling overbought conditions. This alignment of indicators typically points toward continuation—unless derailed by macro or regulatory shocks.

Also read: Will Ethereum Hit 10K? Examining ETH’s Potential

Ethereum Support and Resistance Summary

| Level Type | Price Zone (USDT) | Significance |

| Resistance | 2,607.68 | Near-term breakout trigger |

| Resistance | 2,659.19 | Major hurdle to continuation |

| Resistance | 2,664.82 | Extension target if breakout succeeds |

| Support | 2,528.06 | First zone of bullish defense |

| Support | 2,475.08 | Key level to maintain bullish bias |

| Support | 2,457.33 | Last line before trend reversal risk |

Price Scenarios: Breakout or Fade?

Ethereum’s immediate hurdle lies at $2,608. A breakout above this level could trigger momentum-driven buying toward the next resistance band between $2,659 and $2,665. A decisive daily close above that area would validate the current uptrend and could attract even broader market participation, especially with institutional flows favoring crypto amid rising distrust of central banks.

Conversely, failure to clear resistance on the first attempt might force ETH to regroup at $2,528. A deeper pullback could see support at $2,475 or even $2,457 tested—but holding those levels would preserve the bullish structure.

Trade Considerations

For bulls, the ideal play is either a clean breakout above $2,608 or a retest of the $2,528–$2,475 zone that confirms strong demand. Momentum traders could target a breakout toward the $2,660–$2,750 area, placing stop-losses just below $2,457.

For bears, a visible rejection candle near $2,659 might justify a short-term fade, aiming for a drop back toward the mid-$2.4 K region. That trade only makes sense if bullish momentum stalls and volume dries up.

Also read: Is Ethereum the Next Amazon?

Macro Factors Reinforce the Narrative

Senator Lummis’s post adds a macro-political angle that reinforces the long-standing crypto narrative: decentralization as a hedge against institutional overreach. Her statement that Powell “is supposed to run the Federal Reserve, not build a modern-day Versailles,” echoes frustrations shared by crypto advocates who view Operation Chokepoint 2.0 as an existential threat to digital finance.

While the Federal Reserve’s policy path remains uncertain, the political will to challenge its power is rising. If the current administration acts on Lummis’s call for accountability, it could create further volatility across both traditional and crypto markets.

Looking to diversify beyond Ethereum?

Check out our expert-curated list of the Top Altcoins to Buy in 2025 — packed with promising picks, market trends, and strategic insights to help you stay ahead in the next crypto cycle.

Key Ethereum Takeaways and Market Guidance

Why is ETH showing bullish momentum right now?

ETH recently formed a bullish crossover between the 9-day and 20-day exponential moving averages. Momentum indicators like MACD and RSI also flipped to bullish, suggesting rising buying pressure.

What are the most important resistance levels for ETH right now?

The main resistance levels are at $2,608, followed by $2,659 and $2,665. A breakout above this zone could trigger a strong upward move.

Where should traders look for support if ETH pulls back?

Key support levels lie at $2,528, $2,475, and $2,457. These levels could attract dip buyers if the uptrend stays intact.

How does Senator Lummis’s criticism of Jerome Powell affect Ethereum?

Lummis’s comments highlight growing political resistance to the Fed’s stance on crypto. This boosts Ethereum’s narrative as an asset outside the traditional financial system, potentially supporting long-term bullish sentiment.

Is now a good time to go long on ETH?

A breakout above $2,608 on strong volume could present a good long opportunity. However, conservative traders might wait for confirmation above $2,665. Stop-loss levels should be considered below $2,475 for risk control.

What could invalidate the bullish setup?

A breakdown below $2,457 could negate recent bullish signals and shift the market structure back to bearish.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Ecoinimist is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.