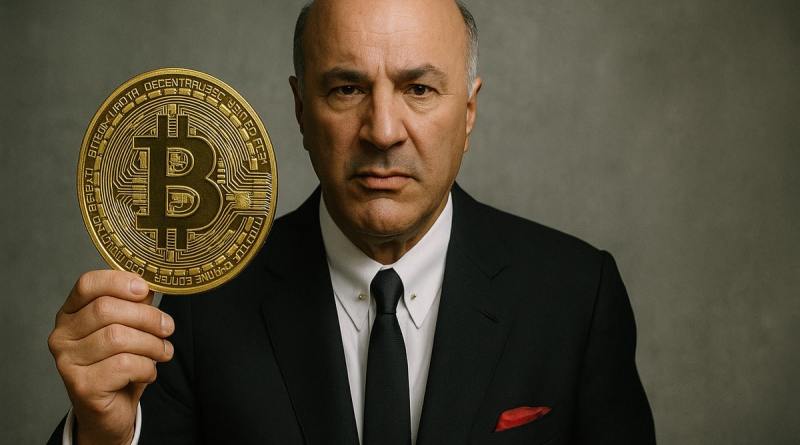

Kevin O’Leary Bets Big on Crypto as Bitcoin Eyes $100K and Regulation Looms

As Bitcoin eyes the six-figure mark once again, celebrity investor Kevin O’Leary, famously known as “Mr. Wonderful,” is doubling down on digital assets and calling for the next phase of crypto adoption to be led by institutional capital — but only once clear regulation is in place.

In a wide-ranging interview ahead of his keynote at Consensus 2025 in Toronto on May 15, O’Leary framed crypto as the next foundational pillar of the global economy. “I consider crypto to be the 12th sector of the economy within five years,” said the O’Leary Ventures chairman, emphasizing the long-term potential of blockchain-based assets in institutional portfolios.

19% Allocation, Exchange Exposure, and USDC for Yield

O’Leary revealed that nearly a fifth of his portfolio — 19% — is allocated to crypto and crypto-adjacent equities, including holdings in exchanges like Coinbase, Robinhood, and WonderFi. He sees volatility not as a risk but as a revenue driver.

“Volatility is good for an exchange,” he noted. “No matter what crypto is doing, up or down, the exchange is making money because it’s the infrastructure.”

Also read: Japan’s Bitcoin Giant Metaplanet Takes on the U.S. Bitcoin Market

When it comes to yield, O’Leary prefers stablecoins over traditional bank deposits. Specifically, he holds USDC — a product of Circle, in which he is a shareholder — citing a current yield of 3.822%. Still, he remains disciplined with risk: no more than 5% in any single position and no more than 20% in any sector, including crypto.

O’Leary Says No to ETFs, No to Strategy

Though bullish on Bitcoin, O’Leary distances himself from Bitcoin ETFs and high-profile plays like MicroStrategy’s leveraged BTC strategy. “I never understood why anybody would buy bitcoin in an ETF and pay fees. That’s insane,” he said. “If I want vol on crypto, just buy bitcoin.”

Bitcoin ETF flows (Source: Farside Investors)

He also acknowledged MicroStrategy CEO Michael Saylor as “a great strategist,” but questioned the need for intermediaries: “Why don’t I just own bitcoin outright?”

Also read: Strategy Q1 2025: Massive Bitcoin Gains, Mounting Paper Losses

Regulation: The Last Barrier to Institutional Capital

O’Leary’s core thesis hinges on one word: regulation. “There are trillions of dollars waiting on the sidelines. But they can’t move until it’s regulated and the compliance infrastructure is there,” he said. He believes that institutional money — pension funds, sovereign wealth funds, and asset managers — will pour in once crypto assets can be treated like traditional holdings within regulated frameworks.

That optimism is particularly tied to the stablecoin market. O’Leary expressed confidence that stablecoin legislation will pass in the U.S. soon, and when it does, he urges investors to “own the exchanges” that will underpin the new regulated economy.

Also read: Bitcoin for the Rich? Institutions May Price Out Retail Investors

The End of the Crypto Wild West

For O’Leary, the era of unregulated innovation in crypto has run its course. “The era of the crypto cowboy is over,” he stated. “They’re all in jail or felons. What we need now is compliance.”

As Bitcoin’s price eyes $100,000 and the political winds shift toward regulatory clarity, O’Leary is placing his bets — not just on coins, but on infrastructure, yield strategies, and the looming flood of institutional capital ready to reshape the industry.