Ecoinimist Pulse: Ripple Fights Back, Ethereum Whale Sells Off, and Coinbase Challenges CFTC

Breaking Crypto Stories

Welcome to the latest Ecoinimist Pulse newsletter. Here are the top stories today:

- Ripple CEO Brad Garlinghouse Stands Firm Against SEC Appeal

- Ethereum Whale Sells $47.5 Million in ETH Amid Price Drop and Market FUD

- Coinbase Pushes Court to Force CFTC to Release Crypto Communications Amid SEC Lawsuit

Question of the Day

Are you holding XRP?

🧍♂️Ripple CEO Brad Garlinghouse Stands Firm Against SEC Appeal

Ripple CEO Brad Garlinghouse vows to fight the SEC’s appeal over XRP’s classification, reaffirming that XRP is legally considered a non-security.

- Brad Garlinghouse reaffirms Ripple’s commitment to fighting the SEC’s appeal regarding XRP’s status, asserting that XRP is not a security.

- Ripple’s legal team, led by Stuart Alderoty, views the SEC’s lawsuit as misguided and is considering filing a cross-appeal.

- The case is expected to drag on, with the next possible ruling from the Second Circuit appeals court projected for 2026.

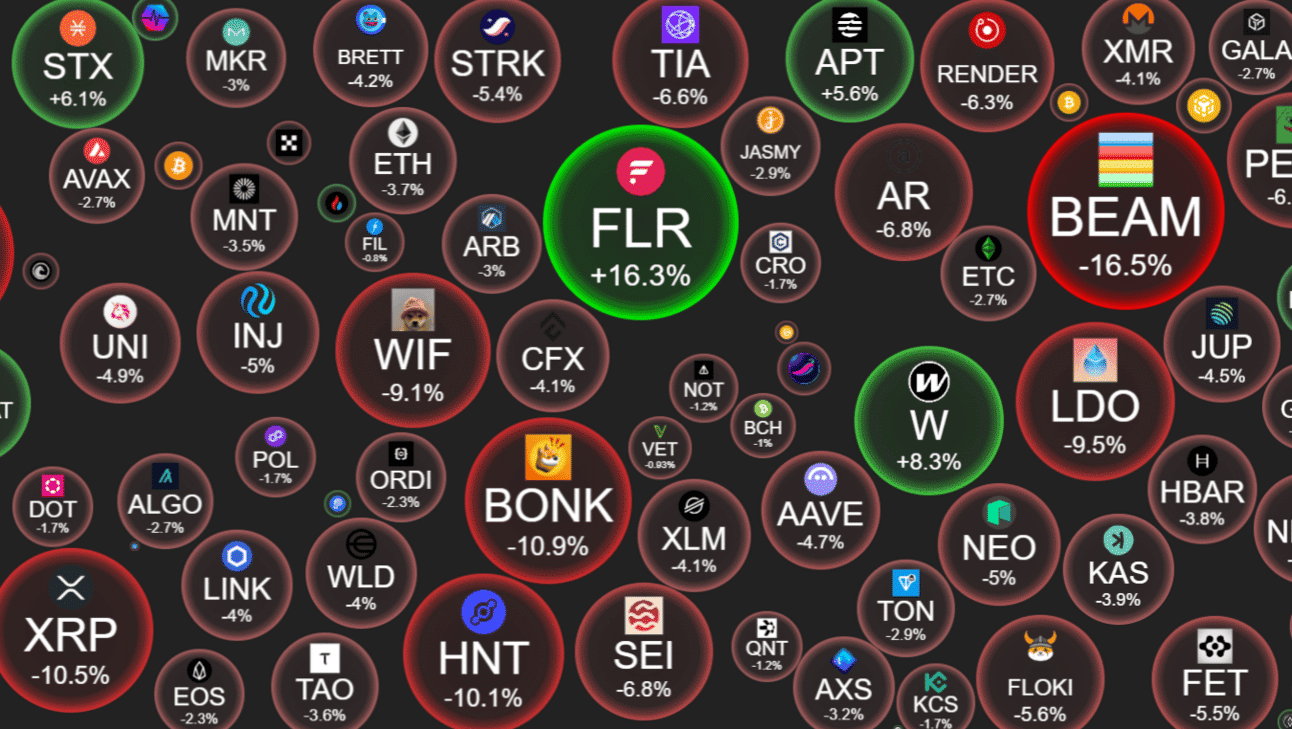

🐋Ethereum Whale Sells $47.5 Million in ETH Amid Price Drop and Market FUD

An Ethereum whale from the 2014 ICO has offloaded significant ETH holdings, contributing to market fear as Ether prices drop.

- A whale from Ethereum’s 2014 ICO sold 19,000 ETH worth $47.5 million, further impacting Ether prices, which have dropped nearly 10% since the start of October.

- Market sentiment around Ethereum has worsened, with critics pointing to the underperformance of ETH this year and further price declines.

- Despite the downturn, Ethereum supporters emphasize the network’s strength, citing institutional interest and future upgrades aimed at onboarding billions of users.

📄Coinbase Pushes Court to Force CFTC to Release Crypto Communications Amid SEC Lawsuit

Coinbase has petitioned a federal court to compel the CFTC to release communications with crypto token issuers to aid in its defense.

- Coinbase is seeking the CFTC’s communications with issuers of 12 cryptocurrencies, which the SEC has labeled unregistered securities, to bolster its defense.

- The crypto exchange argues the information is crucial in determining whether these assets meet the legal definition of securities.

- Despite multiple subpoenas, the CFTC has refused to comply, citing concerns over the scope and burden of the request.

Ecoinimist Pulse: Trade Spotlight

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Ecoinimist is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Quickswap (QUICK)

Quickswap Price Prediction: Are Resistance Levels Holding Back a Breakout?

Price Movements: QUICK has shown a gradual rise in recent closing prices, but mixed signals from technical indicators suggest potential for both bullish and bearish movements.

Key Levels To Watch: Resistance at $0.03604, $0.03713, and $0.04259; support at $0.03438. Breaking these levels will determine the next directional move.

Trade Strategies: Traders could consider long positions around $0.03550–$0.03600 if a bullish breakout occurs, targeting $0.03700 and higher. For short trades, traders might enter near $0.03600–$0.03700, with profit targets around $0.03438.

Aptos (APT)

Aptos Gains Traction with Potential Breakout Above Key Levels

Price Movements: Aptos (APT) has been showing consistent upward momentum, with recent price action pushing from $7.74 to $8.26, suggesting growing bullish sentiment.

Key Levels To Watch: Key resistance levels are at $8.33, $8.34, and $8.38, while support lies at $8.09 and $8.07, which could act as a safety net if the price dips.

Trade Strategies: For long trades, traders might consider entering above $8.33 with targets at $8.34 and $8.38, while short traders may look to enter below $8.09, with stop losses set accordingly to manage risk.

Sui (SUI)

SUI Surges Amid Market Volatility, Key Indicators Signal Further Gains

Price Movements: SUI has been fluctuating, showing moments of consolidation but is exhibiting cautiously bullish momentum based on recent EMA and MACD signals.

Key Levels To Watch: Support levels include $1.8526, $1.8302, and $1.7743. Resistance is likely near $1.9698 and the psychological $2.000 level.

Trade Strategies: For long trades, traders might consider entries near support at $1.8526 with potential exits at $1.9698 or $2.000. Short trades could be considered if support breaks, targeting $1.8302 or $1.7743.

ICYMI:

- EigenLayer Updates Staking Documentation Amid Community Concerns Over Transparency

- Stablecoins Now Dominate Sub-Saharan Africa’s Crypto Transactions Amid Currency Devaluation

- Lamborghini Accelerates Into Web3 Gaming with Fast ForWorld

Start Trading Now!

Looking to get in on the trade opportunities mentioned above? Register on Binance today to start trading crypto on one of the most liquid exchanges in the industry!

Don’t Want to Sit Behind Screens All Day?

Trading the markets is tough, and requires an extreme level of dedication. This is why Binance has made it easy to Dollar cost average into crypto! Find out how to get started here: Dollar Cost Averaging on Binance: A Guide to Investing

To make your crypto work for you, find out how to stake on Coinbase.

Thank you for reading!

Thank you for reading our newsletter! If you liked what you read, please share it with your friends!