Theta Price Prediction: THETA Set for a Rally with Strong EMA and RSI Signals

This Theta price prediction comes amid a dynamic interplay of price actions and technical indicators. The altcoin is now presenting a noteworthy case study in its recent 4-hour trading charts. As the digital asset fluctuates, several critical levels and technical metrics offer insights into its potential future movements.

Theta Technical Overview

The Theta price dropped more than 1% in the past 24 hours to trade at $2.48 at press time.

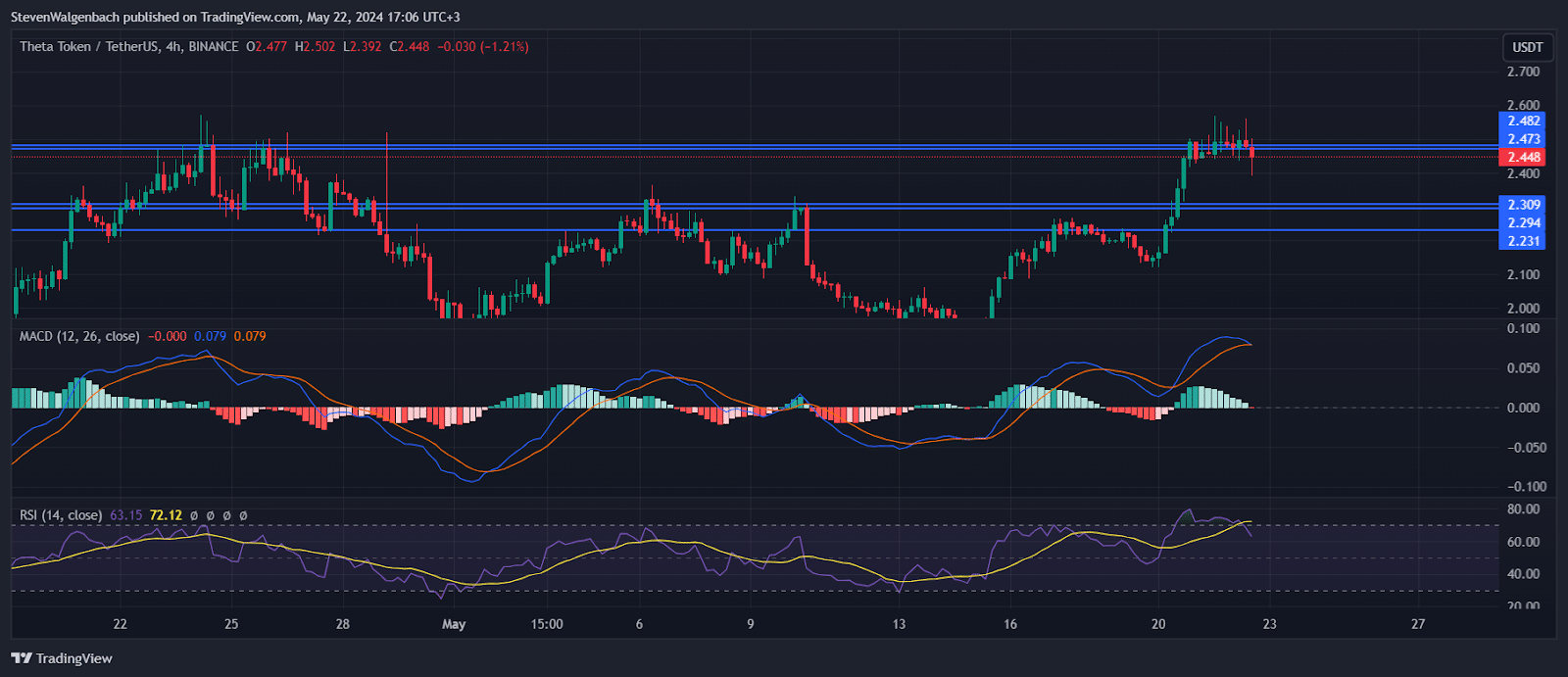

The Theta price has shown a mix of upward and downward movements in its recent sessions, with closing prices ranging from a low of $2.42 to a high of $2.498. This volatility underscores the importance of key resistance and support levels that traders are closely monitoring. The 9 Exponential Moving Average (EMA) indicates a slight downward trajectory from $2.460 to $2.452, suggesting a potential cooling off after recent price gains. The 20 EMA, on the other hand, gradually climbed from $2.353 to $2.390, providing a broader view of a possible underlying bullish sentiment.

Related: Kaspa Crypto: Unveiling the Fastest BlockDAG Network

In terms of technical resistance and support, THETA encounters immediate resistance at $2.482 and a stronger ceiling at $2.473. Should the price push past these points, it could signal a continuation of the bullish trend. Conversely, support levels at $2.309 and $2.294 are crucial for holding the price in case of a downturn, preventing further slides towards the more substantial floor at $2.231.

The Moving Average Convergence Divergence (MACD) reveals a mixed signal with the MACD line crossing below the signal line recently, suggesting a potential shift towards bearish momentum as indicated by a negative histogram value in the latest period. However, the proximity of these lines suggests a cautious market sentiment. The Relative Strength Index (RSI) peaked at 73.56, indicating overbought conditions, but has since moderated to 58.85, aligning closer to neutral levels and offering room for potential price increases without immediate overbought pressures.

Theta Price Prediction: Potential Trade Strategies

For traders looking to capitalize on THETA’s volatility, potential entry points could be considered around the current support levels if signs of price stabilization appear. Conversely, setting up short positions may be advisable near resistance levels if the price fails to break through, especially if accompanied by bearish MACD crossovers or declining RSI figures.

While the current analysis provides a robust framework for understanding THETA’s potential paths, traders should approach with caution. The cryptocurrency market’s inherent volatility requires constant vigilance and readiness to adapt strategies as new data emerges.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Ecoinimist is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.